Banking Industry Incentive Practices

Posted by Daniel Rodda, Jinyoon Chung, and Niki Nolan on August 26, 2020 in Thought Leadership

For the last seven years, Meridian has compiled a database on banking industry compensation practices for all public banks with assets greater than $10 billion. Our database provides insight on trends and emerging practices, including annual and long-term incentive plan practices. This document provides insight from the 2020 proxy database and perspectives based on our consulting work across the industry on how plan designs may evolve in 2021 given the challenges of the current environment.

Annual Incentives

Plan Structure

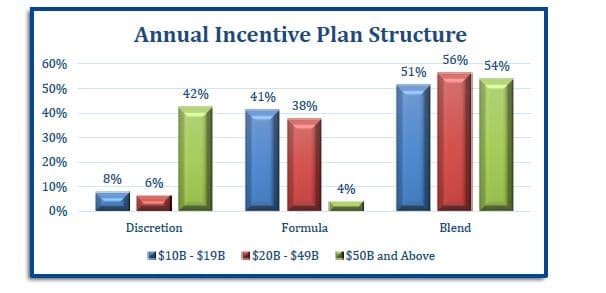

Similar to previous years, a majority of annual incentive plan designs continue to use a blend of formulaic and discretionary/qualitative components:

■ Purely formulaic plans are rare among banks with assets above $50B, as over 90% use discretionary plans or a blend of formula and discretion.

■ Formulaic plans are much more common among banks with assets between $10B and $49B, where we also see plans with a blend of formula and discretion. Fewer than 10% of banks below $50B use a fully discretionary approach.

Methods of Discretion in “Blended” Plan Structures

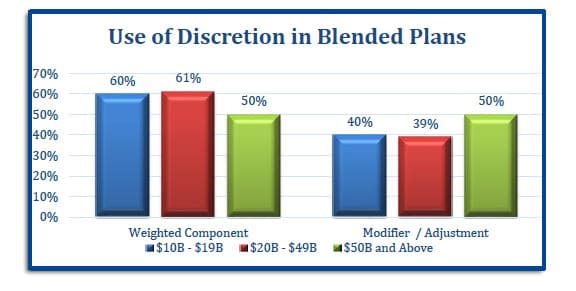

Among banks using a “blended” plan structure, there are two primary approaches to incorporating discretion within the annual incentive plan:

■ Weighted Component: A weighted portion of the formula is allocated to discretionary/qualitative goals, such as strategic objectives and/or individual performance.

■ Modifier / Adjustment: The plan structure provides that the formulaic result (typically driven by financial goals) can be modified based on a qualitative assessment of additional corporate, line of business or individual performance factors. Examples of this approach include establishing additional factors which may be used to modify the formulaic result within a specified range (such as +/-15%), and providing for the corporate funding to be determined formulaically with individual allocations done on a qualitative basis.

The majority of banks with a blended plan structure use a weighted discretionary component, with modifiers most common among banks with assets above $50B.

Performance Measures

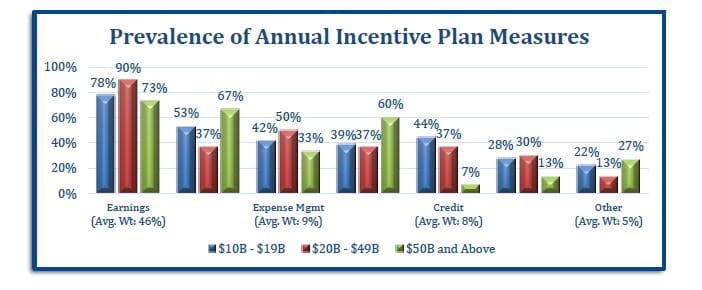

Earnings measures (e.g., earnings per share (EPS), net income) continue to be the most prevalent and highest weighted performance measure in annual incentive plans across all asset sizes. Other prevalent measures vary by asset size. The most common measures in formulaic and blended plans are (in order of prevalence):

■ Assets over $50B: earnings, returns and strategic/individual measures.

■ Assets between $20B and $49B: earnings, expense management, and, with equal prevalence, returns, credit, and individual/strategic measures.

■ Assets between $10B and $19B: earnings, returns and credit.

The chart below illustrates the most common metrics used by banks of different asset sizes.

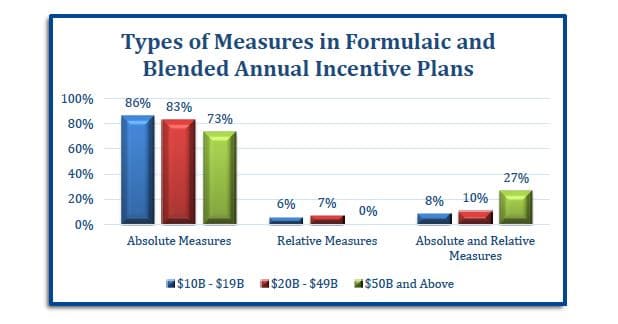

As shown in the graph below, the majority of banks with formulaic or blended plans use absolute measures that align with the annual business plan. The use of relative measures (typically in combination with absolute measures) is more common among the largest banks. The largest banks are also more likely to use fully discretionary plans that assess both absolute and relative results as part of a broad review of performance to determine payouts.

Potential Changes for 2021

While historical peer trends can serve as a helpful reference of current practices, given the global pandemic and likely continued uncertainty going forward we expect banks will reassess plan designs in light of emerging business strategies and needs. Some of the potential changes we anticipate will be considered include, but is not limited to, the following:

■ Reviewing and updating (as appropriate) performance metrics and weightings to reflect new strategic and financial priorities.

■ Ensuring the plan provides an appropriate level of discretion and broader qualitative performance considerations, potentially including ESG priorities.

■ Incorporating relative performance.

■ Reviewing and testing incentive plan gate(s) and/or threshold performance criteria to ensure they account for potential continued volatility.

Long-Term Incentive Practices

Mix of Vehicles

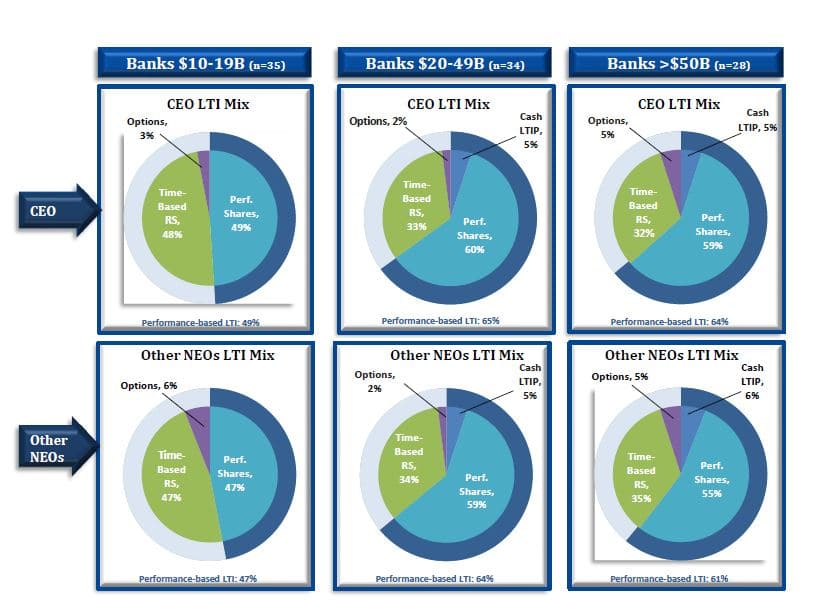

As shown in the graphs on the following page, long-term incentive vehicle mixes vary slightly by bank size. Larger banks (i.e., assets above $20B) allocate on average approximately 65% of LTI as performance-based awards (including both long-term cash plans and performance-based equity), and banks with assets between $10B and $20B allocating approximately 50% in performance-based awards. Time-based restricted stock remains a meaningful part of the long-term incentive program for most banks, while fewer than 5% of banks grant stock options. Most banks provide the same mix of vehicles to the CEO as other Named Executive Officers, though banks with assets above $50B are slightly more likely to provide a higher percentage of performance-based awards to the CEO.

Performance Measures

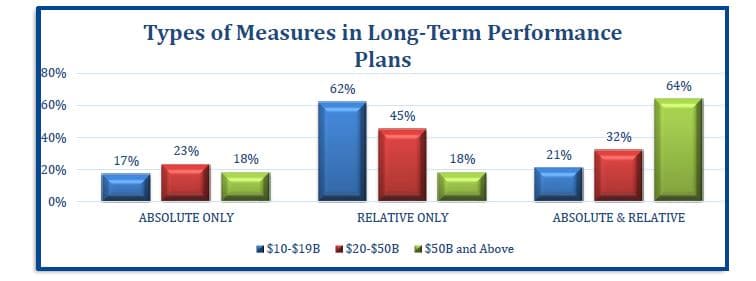

Relative metrics are common in LTI plans, reflecting the challenges banks face in setting long-term goals as well as a desire to align with shareholders who consider relative performance. Banks below $20B are more likely to use relative metrics only, while larger banks are more likely to use both absolute and relative metrics.

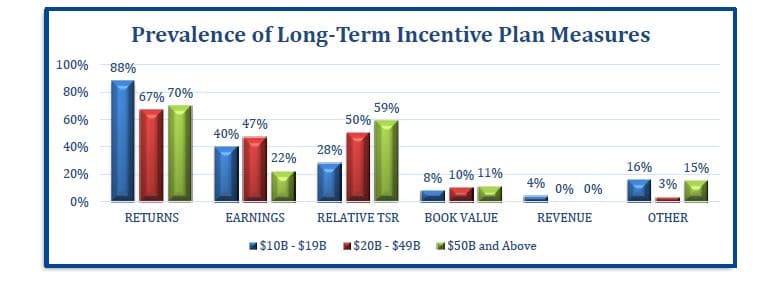

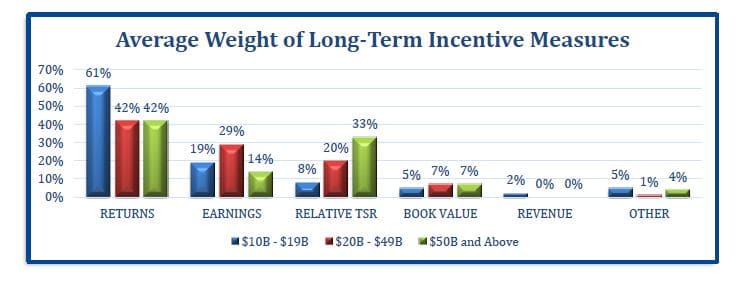

Returns, earnings and relative TSR are the most prevalent measures used by banks, regardless of size. Return on Equity (and variants including Return on Tangible Common Equity) is the most common return measure. Earnings measures are more common at banks below $50B in assets while relative TSR is more common at the larger banks. Other measures include: Efficiency Ratio, Net Charge Offs, Non-Performing Assets, Deposit Growth, and Strategic/Discretionary measures.

As the most prevalent measure, return measures are also the most heavily weighted measure across banks of all asset sizes. On average, relative TSR is the second most heavily weighted measure at banks with assets above $20B, while earnings is the second most weighted measure at banks with assets below $20B. Other measures are not heavily weighted, on average, as they are generally paired with one or more of the highly prevalent/highly weighted measures.

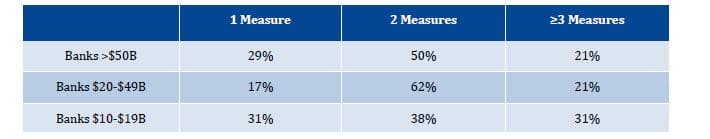

The majority of banks use two or more measures in the long-term incentive plan.

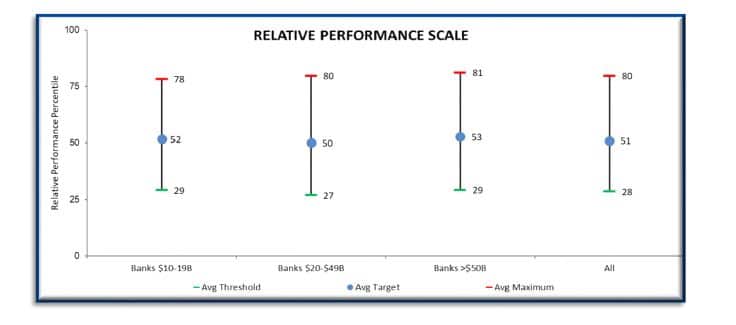

Of the banks using relative performance measures, the most common scale approximates 25th, 50th, and 75th percentile for payout at threshold, target, and maximum. The average range illustrated below illustrates slightly higher percentiles at each payout level, likely a response to proxy advisory firm and shareholder feedback. While still a minority practice, we are starting to see more banks setting target performance above median: 26% of banks with assets above $50B and 10% of banks with assets between $10 and $19B with relative measures have targets above median, though there were no instances in the $20-49B group.

Potential Changes for 2021

As with annual incentive plan design, we anticipate banks will reassess their long-term incentive plans for 2021. Potential changes considered may include, but not be limited to, the following:

■ Adjusting performance measures to align with new strategic goals and priorities.

■ Increasing the weight of time-based equity within the long-term incentive program, particularly for those banks who currently provide more than 75% of long-term incentives through performance-based awards.

■ Increasing the use of relative performance measures.

■ Lowering threshold performance criteria (potentially with lower threshold payouts) to reduce the probability of zero payouts.

■ Introducing qualitative measures in the LTI program (which is less problematic now that the performance- based exemption under 162(m) is no longer available).

■ Shorten performance measurement periods due to difficulties with long term goal setting.

With all the uncertainty brought on by the global pandemic, one thing is certain: determining executive pay outcomes and future program designs is going to be challenging in 2020 and 2021. While it is important for banks to understand the industry landscape, it will be even more critical to consider each bank’s unique situation and needs when assessing the appropriateness and effectiveness of current and future program designs.

Compiled by Meridian’s Financial Services Team, including Susan O’Donnell, Daniel Rodda, Jinyoon Chung and Nicole Nolan.

Performance Alignment, Program Design