Rachael Lee

Rachael Lee

Jason Chi

Jason Chi

Krunal Billimoria

Krunal Billimoria

Executive Summary

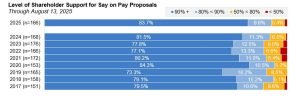

Say on Pay vote outcomes at S&P/TSX Composite companies remain strong this year, continuing the positive trend from 2024. Key highlights from this proxy season include:

- The highest number of companies receiving 90%+ support, and the lowest failure rate since 2021

- Strategic shareholder engagement is increasingly important as institutional investors apply voting policies that diverge from proxy advisor guidance

- Glass Lewis announced changes to its quantitative pay-for-performance assessment for 2026

Recap of Say on Pay Results at the TSX Composite

- Based on 166 ballots so-far this year, 84% of TSX Composite companies received at least 90% support

- Overall average level of support is 93%, and 7% of companies received less than 80% support.

These outcomes reflect shareholder confidence in executive compensation practices, despite the backdrop of economic uncertainty. Looking ahead, if market volatility persists, we may see increased dispersion in Say on Pay outcomes, particularly for companies undergoing strategic shifts or making significant changes to compensation plans (including designs that deviate from market norms, such as front-loaded awards).

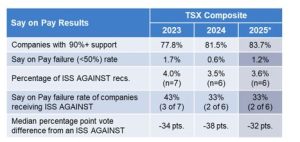

ISS recommended “AGAINST” Say on Pay at 6 companies in the Composite (vote results in brackets): Aya Gold & Silver (46%), Colliers International Group (65%), First Majestic Silver (41%), GFL Environmental (67%), NovaGold Resources (71%), and Shopify (62%).

In addition to a pay-for-performance misalignment, key problematic pay practices cited include egregious absolute pay quantum, single trigger change in control, excessive severance and perquisites, and tax gross-ups.

A continuing theme in 2025 was the criticism of companies with a history of low Say on Pay support and insufficient shareholder engagement to address investor concerns. Notably, half of ISS AGAINST recommendations included commentary on poor shareholder engagement, particularly among companies with multiple years of low vote outcomes. We suggest developing a Say on Pay action plan, actively engaging with shareholders to demonstrate responsiveness, and having a robust disclosure of shareholder engagement to address proxy advisor concerns.

Influence of Proxy Advisors

ISS

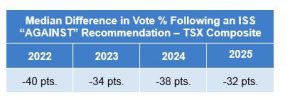

ISS had recommended AGAINST Say on Pay at more than half of the companies that failed or scored in the “yellow card zone” (50%-80% support). The impact of an ISS AGAINST recommendation on vote results has been between -30 to -40 percentage points since 2022, and ISS’s influence on Say on Pay vote results remains stronger than Glass Lewis.

Glass Lewis

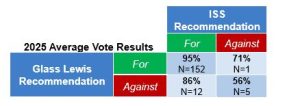

Glass Lewis had also recommended AGAINST Say on Pay at more than half of the companies that failed or scored in the “yellow card zone” (7 of the 11), and 3 companies that received 90%+ support. Like last year, Glass Lewis was much more likely than ISS to recommend AGAINST Say on Pay, at roughly 3x the rate of ISS. A negative recommendation resulted in a median -13 pt. lower vote, less than half the impact of ISS.

Combined Influence

The following table sets out the median vote results where one or both of the proxy advisors have recommended FOR or AGAINST Say on Pay. The impact of a negative recommendation from ISS is more pronounced than Glass Lewis, independent of Glass Lewis’ recommendation.

Impact on Compensation Committee Chair Vote Outcomes

We also considered the impact of a negative Say on Pay recommendation from ISS vote outcomes for the election of the Chair of the Compensation Committee. Since 2021, median Say on Pay votes for companies with a negative ISS recommendation remained fairly constant between 58% to 66%, while support for Compensation Committee Chairs has seen significant decline, from 93% in 2021 to 77% in 2025. This trend likely reflects ISS’s policy, under which repeated negative Say on Pay outcomes—typically two consecutive years—can trigger an AGAINST recommendation on the re-election of the Compensation Committee Chair. As a result, investor scrutiny has increasingly shifted from Say on Pay alone to broader accountability of the Compensation Committee Chair.

Proxy Advisor Policy Updates

A continuing trend in 2025 is the divergence of proxy advisor policies from those of institutional shareholders. This underscores the importance of strategic shareholder engagement, as companies seek to understand and align with the priorities of their specific investor base.

Proxy advisors are evolving their service models to offer specialty policies to clients. ISS offers a range of specialty voting policies, tailored to address the priorities of specific investor groups. Glass Lewis is expected to offer custom policies for its institutional clients starting in 2026.

The complexity of shareholder engagement is increasing, as asset managers like BlackRock, Vanguard, and State Street split their stewardship teams into two groups with separate voting policies and perspectives. This shift reflects a broader move toward investor-driven stewardship, reinforcing the need for companies to actively engage and tailor messaging to their unique shareholder base.

Glass Lewis Pay-for-Performance Methodology Update

Glass Lewis announced changes to its quantitative pay-for-performance assessment methodology applicable to North American companies for the 2026 proxy season. Key updates previewed include:

- The replacement of the current A – F letter grade system with a new numerical (0 – 100) scorecard accompanied by a concern level (Negligible, Low, Medium, High, Severe) based on five quantitative tests

- Two new charts will be introduced: 1) annual bonus payouts vs. annual TSR ranking, and 2) CEO pay percentile vs. TSR percentile over a five-year period

- A longer evaluation period, from three to five years to measure pay-for-performance alignment

- New qualitative elements, which evaluate additional aspects of the pay program

* * * * *

This Client Alert is prepared by Meridian Compensation Partners, LLC, provides general information for reference purposes only and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.