Tina Murphy

Tina Murphy

Meridian’s 2023 Retail Incentive Trends Report summarizes the current retail environment and trends, highlighting the direction companies are taking regarding incentive design. Overall, results are consistent with the prior year’s study, indicating that most retailers are in a more stable state after dealing with post-COVID turmoil.

This study represents 110 retail and restaurant companies within the Consumer Discretionary and Consumer Staples GICS industry sectors.

Highlights

Annual Incentive Plan Design Practices

• Almost 50% of companies used two financial metrics, while another 41% used just one

• All companies used at least one profit metric (e.g., EBIT(DA), operating income, operating margin, EPS, or net income), often paired with a revenue/sales metric

• 55% of companies also included at least one non-financial metric

• The most prevalent payout range was 50% at threshold and 200% at maximum

Long-Term Incentive Plan Design and Vehicle Mix Practices

19% of companies made changes to the LTI mix in 2022 or 2023 (if disclosed). The most prevalent changes were to increase PSU and RSU weightings, typically in conjunction with a decrease to stock option weightings.

• 86% of respondents used a performance-based vehicle, while 80% used RSUs and 32% used stock options

• The average mix of LTI awards for CEOs was 50% PSUs, 37% RSUs, and 13% stock options

• Relative Total Shareholder Return (rTSR) was the most prevalent metric used in performance-based plans (47%), followed by EBIT(DA)/operating income (43%) and revenue (34%)

― Of those that used rTSR, 66% used it as a standalone metric and 34% used it as a modifier

― 65% of companies that used rTSR used either an Index or an Index Subset (e.g., S&P Retail Select Index) for the comparator group with the remaining 35% using the compensation peer group or a custom performance group

― Likely in response to proxy advisor preferences, practices were evenly split on two rTSR design elements:

• 52% of companies required median performance for target payout, while 48% required above median performance (e.g., 55th percentile)

• 52% of companies included a payout cap for negative absolute performance (i.e., if absolute TSR over the performance period is negative, payouts are capped at target)

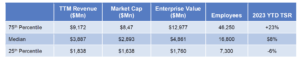

The financial highlights of the 110 companies represented in this study are shown below. All figures shown are as of August 1, 2023.