Chris Havey

Chris Havey

Stock ownership guidelines are nearly universal among public companies, including those in oil & gas. Investors use these guidelines to assess how well management’s financial interests align with shareholders and to understand the degree of “skin in the game.” Because executive compensation in this industry is heavily equity-based, ownership requirements help ensure leaders retain a meaningful portion of the shares they receive.

However, ownership guidelines that are set too low may be ineffective – and guidelines that are set too high may limit diversification and unintentionally encourage executives to leave to monetize equity. Getting the balance right is essential.

Current Practices

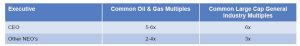

Most companies set stock ownership requirements as a multiple of salary. As shown below, oil & gas practices are generally consistent with the broader large-cap market:

To measure compliance, most companies count:

• Shares owned outright

• Unvested restricted stock/RSUs

• Shares held in retirement accounts

They typically exclude:

• Stock options (vested or unvested)

• Unearned performance shares

Many companies pair these requirements with a “hold-until-met” policy. Penalties for non-compliance usually focus on restricting share sales rather than imposing more punitive measures and typically some allowance is provided if there is a significant share price reduction.

Stock ownership guidelines rarely influence Say-on-Pay outcomes. Most oil & gas companies already score well under ISS standards, which include an expectation of 6× salary for CEOs, strict counting rules (no unvested performance shares or unexercised options), and transparent disclosure.

Nevertheless, we question whether “typical” market practice, particularly for oil & gas CEOs, is meaningful given current LTI grant sizes and current ownership levels.

Typical LTI Values Suggest Guidelines Are Easily Met

Oil & gas companies tend to deliver higher LTI values than other industries due to the sector’s emphasis on shareholder alignment. While LTI values vary by company size and other factors:

• Most CEOs receive LTI of at least 4x salary annually

• Most other NEOs receive LTI of at least 2x salary annually

As a result, executives can typically meet existing ownership requirements with fewer than two years of equity grants, assuming reasonable performance outcomes and no major stock price decline.

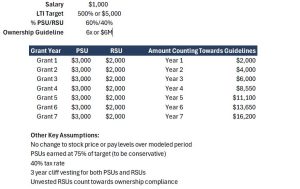

The table below illustrates the ownership growth, for an example CEO.

In this example, the CEO has achieved over 10x salary by year 5 and 15x salary by year 7, even without considering any new hire awards or prior accumulated equity.

Actual CEO Ownership Levels Confirm This

Looking at CEO ownership in S&P 500 oil & gas companies:

• Every CEO met a 6× salary guideline, even those recently promoted to the role

• 90%+ held more than double that amount

• The median CEO held ~50× salary

Given current LTI grant values, these ownership levels are unsurprising – and they highlight how low a typical ownership guideline appears relative to real-world ownership.

A More Meaningful Standard

The longstanding 5-6× salary guideline for CEOs likely once served as a meaningful signal of alignment. Today, it does not. A CEO can easily exceed this level without any commitment to long-term ownership.

We believe a minimum CEO guideline of 10× salary – with corresponding increases for other top executives – would better reflect actual ownership and send a stronger message to investors.

Only about 10% of S&P 500 companies currently use a 10× guideline, so adopting a higher standard is still differentiated but not unprecedented. Before increasing guidelines, companies should confirm that current executives already meet the levels to avoid unintended retention or diversification pressures.

Better Marketing of Ownership Can Strengthen Say on Pay

A frequent investor critique of executive pay programs is weak pay-for-performance alignment. However, large personal ownership stakes can mitigate these concerns, as they create a powerful economic incentive tied directly to shareholder outcomes.

When a CEO holds 50× salary in stock, that fact alone meaningfully enhances alignment, particularly when compared to an annual compensation package that is a fraction of that amount – yet it is often under-emphasized in proxy materials.

In our view, oil & gas companies could benefit from:

• More rigorous ownership guidelines that reflect real behavior

• Clearer disclosure of actual ownership levels and their reinforcement of shareholder alignment

Highlighting substantial ownership can help counterbalance perceived compensation issues and strengthen the overall Say-on-Pay narrative.