Ed Hauder

Ed Hauder

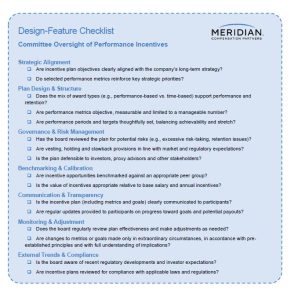

Performance incentives are critical tools companies need to drive strategic outcomes, retain top talent and align executive interests with shareholders. This Meridian Beacon outlines best practices and common pitfalls in incentive design. We include a checklist of key questions for Compensation Committees to ask to ensure incentive plans are set up to deliver sustainable value.

Design Best Practices

Directors should regularly review incentive plans to ensure they reflect evolving business priorities, regulatory requirements and market practices. Active oversight helps mitigate risks of misalignment and unintended outcomes.

Three best practices should be kept in mind when designing performance incentives:

1. Choose Appropriate Performance Metrics

Corporate strategy ultimately is designed to support long-term value creation. Although companies have non-financial strategic goals, these should advance the financial outcomes that drive value creation for shareholders.

Creating value is a function of three primary activities:

• Generating profitability/returns in excess of the cost of capital;

• Adding business that has returns above cost of capital;

• Eliminating business which has returns persistently below cost of capital.

Metrics need to have the right blend and degree of emphasis on advancing profitability/efficiency vs. growth. This depends on where a company is along the profitability continuum.

For High Return Companies:

High profit companies (i.e., returns above cost of capital) should focus ____on growth. For these companies, the key to increasing value is growth (even at lower margins than the current business).

Growth metrics include revenue, market share and/or investment growth, often balanced with a profitability metric to ensure that returns remain above the cost of capital.

For Average Return Companies:

Companies with returns close to the cost of capital generally focus primarily on profitable growth. These companies add value by growing selectively, only at current or higher levels of profitability.

Profitable growth metrics include operating profit, EBITDA, EPS and cash flow metrics. If growth metrics like revenue are included, their weight is typically low relative to profit metrics.

For Lower Return Companies:

Companies that do not (on a sustained basis) generate returns above ___the cost of capital focus on returning to profitability. This may range from cost cutting to more fundamental change: review of strategic alternatives, sale of unprofitable businesses and other significant shifts. For an unprofitable company, shrinking the enterprise can actually create value.

Return to profitability metrics include cash flow, margin improvement, cost reduction and debt reduction.

Other Metric-Specific Considerations

Profit metrics are the most common annual incentive metric and come in many forms (operating income, EBITDA, EBIT, net income, EPS, etc.). Although they all share some characteristics, each has particular strengths and limitations and it is important to choose the metric which best matches with the operations of the business.

Return metrics (ROIC, ROCE etc.) are not typically included in an annual incentive plan for three reasons:

• Fewer people can impact return measures and it can be difficult to communicate how employees can impact returns.

• Return metrics are complex.

• Changes in levels of investment (i.e., the balance sheet) tend to take time to show results and are therefore better suited for long-term incentives.

Return metrics can be a valuable for long-term incentives, particularly for capital intensive businesses (manufacturing, financial services etc.), but are less relevant to companies that are significantly impacted by commodity price (mining and energy) and companies that are not capital intensive (retail and services). Return metrics can be challenging for companies that are making significant investments for future growth.

2. Set Appropriate Performance Goals

Performance goals – whether for short- or long-term performance incentives, generally require both quantitative and qualitative assessments. It is important to consider not just “target” but the performance range around target (threshold and maximum). There are five perspectives that, in combination, should lead to sound performance goals.

1. Operating Plan/Budget: This is the most common goal setting starting point and is management’s assessment of what they expect to achieve in the upcoming fiscal year. This needs to be reflected on a realistic assessment of both the risks and opportunities of the business to ensure that goals have reasonable stretch.

2. Performance of a Relevant Group of Peers: Goals should consider how other firms in the same industry perform over time. As this is necessary a backward-looking metric, it needs to be informed by a nuanced assessment of where the company is in its value-creation journey and a realistic assessment of expected market and economic conditions.

3. Strategic Aspirations: Goals should be consistent with the strategic aspirations of the company, either the same as or a meaningful progression toward desired long-run results.

4. Investor Expectations: Goals should be consistent with what investors expect for the company in the near and long-term and, at a minimum, should not reward performance which is below any guidance provided to the market.

5. Sustainable Sharing: Goals should be stress tested to ensure that the sharing of profit and value creation between employees and shareholders is both reasonable and sustainable.

These perspectives need not – and rarely will – all yield the same answers. However, there should be an overlap of outcomes that suggests an appropriate set of performance objectives. Judgment, of course, is critical to achieving that delicate balance of stretch versus attainable goals.

3. Maintain Good Governance and Oversight Process

There are four sound design processes that, over time, ensure the appropriateness of performance-based incentives:

• Benchmark and calibrate: Benchmark the long-term incentive opportunity values to an appropriate peer group to confirm that total award values are reasonable. Regularly assess the realizable value of equity awards (relative to grant date value, shareholder experience and peers) to confirm alignment between long term incentive outcomes, value created for shareholders and peer company outcomes.

• Implement ownership, vesting and clawback features: Maintaining proper alignment of interests with shareholders requires that:

― Management have a meaningful and enduring stake in the company.

― Some performance incentives be earned over extended periods.

― Value earned be based on properly computed results and adherence to company codes of conduct.

• Communicate clearly and often: An incentive is only effective if the participants understand what they need to achieve to be rewarded. Clearly communicating the incentive opportunity, applicable performance metrics and goals to participants ensures they know what is expected of them. Clear communication of performance results and incentive outcomes supports confidence in the incentive program.

• Review, monitor and adjust: Sound incentive arrangements have some consistency and should not change every year. However, incentive designs need to be reviewed regularly to reflect changes in strategy, business conditions and priorities. Significant changes in the business should be supported by appropriate changes to incentive design.

Common Pitfalls to Avoid

• Overcomplicating things by using too many metrics or weightings: “Get it 80% right and declare victory.” Identify the most important 2-3 metrics and focus on these. Having too many metrics increases complexity, diffuses focus and decreases the importance of performance on each metric. This can lead to incentives not achieving their intended purposes.

• Confusing values and performance incentives: Not everything that is important to an organization should be in the incentive plan. Values and culture play a crucial role in many organizations. Incentive plans are not the only or even necessarily the most effective way to highlight and sustain these values.

• Setting unachievable or ambiguous goals: Goals set at levels that executives believe are not attainable, are unlikely to motivate executives. Similarly, ambiguous goals make it difficult for executives to understand what performance they need to be driving towards.

• Neglecting relative performance or external benchmarking: Whether relative performance measures are used in an incentive plan or not, understanding the performance of a relevant group of peers is key context for both plan design and goal setting.

• Poor communication: When communication falters, even well-structured incentives may fail to motivate executives to achieve target performance.

Conclusion

Taking a thoughtful approach to performance incentives will help ensure they are effective to drive value creation and company strategy. Given the many moving pieces, performance incentives should focus on the priorities that are most critical to the company’s strategic goals and objectives.

Be sure to check out Meridian’s podcasts for additional insights on these topics:

• Are Your Long-Term Incentives Working? – Meridian Compensation Partners

• Uncertainty-Proofing Pay Practices – Meridian Compensation Partners

• Effective Goal Setting for Incentive Plans – Meridian Compensation Partners

• Evaluating Executive Pay Relative to Company Performance – Meridian Compensation Partners

• Setting Performance Goals for Long-Term Incentive Plans – Meridian Compensation Partners

* * * * *

The Meridian Beacon is prepared by Meridian Compensation Partners. Questions regarding this Meridian Beacon may be directed to Ed Hauder at 224-775-4852 or ehauder@meridiancp.com.

This report is a publication of Meridian Compensation Partners, LLC, provides general information for reference purposes only and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.