Donald Kalfen

Donald Kalfen

Beginning in 2022, BlackRock is taking the first in a series of steps to expand the opportunity for their institutional clients to participate in proxy voting decisions.

In a letter issued in early October, BlackRock announced that institutional clients invested in index funds will have the opportunity to directly participate in proxy voting decisions. BlackRock’s announcement is in response to its institutional clients’ increased interest in investment stewardship, including participation in proxy voting.

Beginning January 1, 2022, BlackRock will be expanding the voting choice options available to institutional clients invested in certain index strategies – within institutional separate accounts globally and certain pooled funds managed by BlackRock in the U.S. and UK.¹

Specifically, certain institutional clients will have the opportunity to vote eligible proxies in eligible markets for the companies in which they are invested. Additionally, investors in participating pooled funds who meet the eligibility criteria will have the opportunity to direct voting on eligible proxies in eligible markets for companies held by the funds. According to BlackRock, approximately 40% of the $4.8 trillion invested in its index equity assets will be eligible for these new voting options, including $750 billion of pooled fund assets.

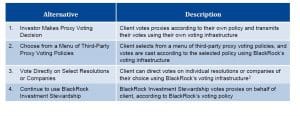

Voting choice alternatives for such clients include:

Clients can choose to opt-in on a rolling basis. If a client does not elect to opt-in, BlackRock Investment Stewardship will continue to vote proxies in line with BlackRock’s voting policy.

BlackRock has indicated that, over time, it will seek to continue to develop its capabilities to increase proxy voting choice across more of its investment products.

Meridian Comment. The impact of BlackRock’s announcement hinges on the answers to two questions: (i) what percentage of institutional investors will choose to make their own proxy voting decisions and (ii) whether, and to what extent, those proxy voting decisions will differ from BlackRock’s proxy voting decisions? Unfortunately, the answers to those questions are not knowable unless BlackRock chooses to publish information relating to those questions.

BlackRock’s new policy on proxy voting could complicate companies’ shareholder engagement efforts. If a meaningful percentage of shares held by BlackRock equity index funds are voted directly by underlying institutional investors, companies may find it difficult to identify and engage with the investors responsible for voting those shares.

So far, no other major asset manager has announced a proxy voting choice policy similar to BlackRock’s.

¹ We understand such accounts are often held by large institutional investors, such as large public pension funds.

² This is an option for clients in institutional separate accounts only.

* * * * *

The Client Update is prepared by Meridian Compensation Partners’ Governance and Regulatory Team led by Donald Kalfen. Questions regarding this Client Update or executive compensation technical issues may be directed to Donald Kalfen at 847-235- 3605 or dkalfen@meridiancp.com.

This report is a publication of Meridian Compensation Partners, LLC, provides general information for reference purposes only, and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.

www.meridiancp.com