Donald Kalfen

Donald Kalfen

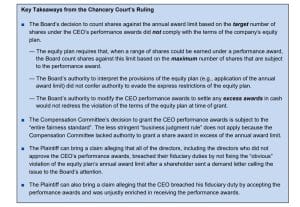

On May 24, 2022, the Delaware Chancery Court denied a motion to dismiss a shareholder lawsuit that alleges a company’s Compensation Committee breached their fiduciary duties by granting the CEO performance awards that could exceed the individual annual award limit under the company’s equity plan.

The Chancery Court did not decide the lawsuit on its merits.

Nonetheless, to avoid potential litigation, companies should monitor compliance of share grants with any applicable annual award limits, other applicable plan terms and underlying award agreements.

Background

The ODP Corporation (“Company”) maintains a shareholder approved equity plan (“Equity Plan”) under which the Company’s board of directors may grant certain types of equity awards to employees, non-employee directors and consultants. The Equity Plan limits the maximum number of shares of common stock that may be subject to performance awards granted in any one fiscal year to any one Equity Plan participant to 3.5 million shares (“Annual Award Limit”).

In March 2020, the Compensation Committee made two grants of performance awards to the Company’s Chief Executive Officer, Gerry Smith (“Challenged Awards”). The Challenged Awards entitle Mr. Smith to receive a variable number of shares based on achieved performance against two performance goals over a three-year performance period. Each of the Challenged Awards specify the number of shares that would be earned for achieving threshold, target and maximum performance levels.

Under certain payout scenarios, the Challenged Awards would give Mr. Smith the right to receive shares in excess of the Annual Award Limit.

Shareholder Demand Letter

Robert Garfield, a shareholder of the Company, sent a demand letter dated March 18, 2021 to the Company’s Board of Directors under which Mr. Garfield asked the Board to “[m]odify the performance awards granted to Mr. Smith by lowering the maximum potential payout to conform with the [Annual Award Limit].” The demand letter also asked the Board to “[i]nvestigate whether there are additional violations of the Company’s equity plans” and to “[a]dopt and implement internal controls and systems at the Company . . . to prohibit and prevent a recurrence of the [Equity] Plan violation . . . and ensure compliance with NASDAQ rules and regulations.”

By letter dated April 9, 2021, the Company informed Mr. Garfield that it had refused to take any action in response to the demand letter. The Company represented that the Board had adopted a policy to determine compliance with the Annual Award Limit based on the target number of shares subject to a performance award. Applying this policy, the Company asserted that the Challenged Awards would not exceed the Annual Award Limit. The Company further claimed that the Board had the authority to adopt this policy “pursuant to the broad interpretative authority found in [the Equity] Plan.”

Shareholder Lawsuit

In May 2021, Mr. Garfield (“Plaintiff”) filed a complaint in the Delaware Chancery Court that alleged:

■ Breach of contract by (i) the four members of the Company’s Compensation Committee who approved the Challenged Awards because the awards violated the terms of the 2019 Plan and (ii) by all of the directors serving on the Board who rejected the Demand Letter by allowing Mr. Smith to retain his rights under the Challenged Awards.

■ Breach of fiduciary duty by (i) the four members of the Company’s Compensation Committee who approved the Challenged Awards, (ii) all of the directors serving on the Board by failing to fix the Challenged Awards in response to the demand letter and (iii) Mr. Smith in accepting the Challenged Awards.

■ Unjust enrichment by Mr. Smith for the personal benefit he received under the Challenged Awards.

The defendant directors and CEO moved to dismiss the complaint alleging that it failed to state a claim on which relief may be granted. On May 24, 2022, the Delaware Chancery Court denied defendants’ motion to dismiss and allowed the lawsuit to proceed. The Chancery Court did not decide the lawsuit on its merits.

Meridian comment. In response to the Chancery Court’s ruling, companies should review:

■ Their equity plans’ individual annual award limits (many companies no longer include such limits in their equity plans since Section 162(m) of the Internal Revenue Code was modified by the Tax Cuts and Jobs Act of 2017).

■ Any large outstanding performance awards (alone or in combination with other grants) to determine whether such grants may exceed a stated individual award limit in the equity plan across a range of potential payout scenarios.

■ Share-counting methodology used to determine compliance with individual annual award limits. A prescribed share counting methodology may be included in any equity plan. However, plans are often silent on this matter, in which case the plan administrator should review existing share counting policy or practice.

■ Adequacy of internal controls to ensure share grants comply with individual annual award limits.

* * * * *

The Client Update is prepared by Meridian Compensation Partners’ Governance and Regulatory Team led by Donald Kalfen. Questions regarding this Client Update or executive compensation technical issues may be directed to Donald Kalfen at 847-235-3605 or dkalfen@meridiancp.com.

This report is a publication of Meridian Compensation Partners, LLC, provides general information for reference purposes only, and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.

www.meridiancp.com