Andrew McElheran

Andrew McElheran

Christina Medland

Christina Medland

While initially the EVA material will be provided purely for information, it seems inevitable that ISS will continue to push to include EVA as a formal part of its pay for performance analysis.

There are general concerns about ISS using EVA – a complicated analytical framework that uses highly adjusted financial data – to make SOP voting recommendations, exacerbated by ISS’ standardized, imprecise approach to choosing peer companies for pay and performance comparison purposes. However, E&P companies will face some particular challenges with EVA. We think EVA will say more about the differences between gas and oil commodity price movements, type of drilling (onshore or offshore), and particularly timing and leverage of capital investments, than about company performance.

Basics of EVA

The intuition behind EVA is straightforward, and well-grounded in financial theory: capital is not free, and companies that earn positive economic profits after deducting a charge for capital employed are the only ones creating value. See Meridian’s client update on EVA for a detailed look at the EVA definition, and the specific EVA-based measures that ISS will use.

However, the implementation of EVA is complicated because: 1) the calculation incorporates multiple layers of adjustments, assumptions, and estimates; 2) EVA has a built-in bias toward short-run profitability. For E&P companies, the biggest challenges with EVA relate to:

- ISS’ practice of comparing results to peers that it chooses, which often include some poor matches

- Commodity price movement and its cyclical effect on earnings

- The long-term, capital-intensive nature of E&P businesses

ISS Peer Group Selection for E&P Companies

There are three flaws with ISS’ approach to selecting peers for relative pay and performance comparisons—all of which will have an impact on relative EVA:

- ISS does not align peer groups to specific commodity price exposure—so will include gassy peers in an oily company peer group and vice versa. When oil and gas prices diverge, the effect of commodity price movement is no longer muted by the use of a relative measure.

- ISS does not distinguish between companies with onshore versus offshore drilling operations. The two company types have different cost structures and timing from investment to returns.

- In the energy sector, ISS selects peers based on industry category and sized by market cap only. This can result in poor performing or higher leveraged companies having a group of smaller peer companies than better performing or lower leveraged companies.

Commodity Price Movement

EVA starts with operating profit, which, for E&P companies, is substantially affected by cyclical and volatile oil and gas prices. A company’s absolute EVA results may move from positive or negative just based on commodity price changes. A positive EVA result, “buoyed” by rising commodity prices, could signal that the company should increase capital investments, when the business fundamentals otherwise suggest prudence/conservatism.

As EVA is measured relative to peers, the impact of cyclicality in the results could be muted, but only if the ISS peer group is strongly aligned to specific commodity price exposure. In the absence of this peer group alignment, relative EVA measures will suggest that gassy companies are performing better, when gas prices increase.

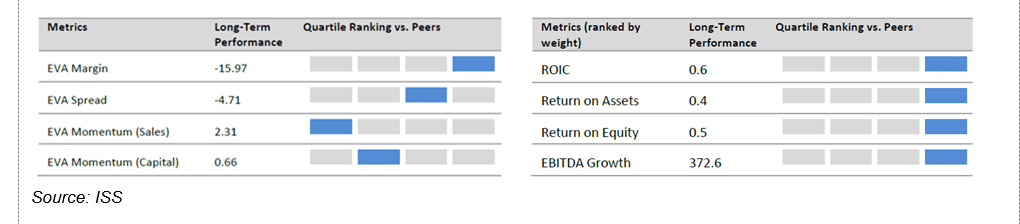

Also, interpretation is difficult when absolute EVA results are poor but relative results are good (or vice-versa), particularly when results are compared to more conventional GAAP metrics that tell yet one more different story. Consider the following findings for an E&P company in 2019:

What to make of these findings? Measured using GAAP metrics, the company has performed relatively very well on all dimensions. In EVA terms, the company is not generating any value (negative EVA Margin and Spread), but less negative than peers. It is growing EVA from current levels (positive EVA Momentum) but not as fast as peers. The lessons from these findings are not necessarily straightforward.

Long Term Capital Intensive Businesses

For capital-intensive businesses, a long lead time between investment, and return on that investment, makes measurement using capital-based measures (including cost of capital) particularly challenging. While this is mitigated somewhat by measuring EVA over a 3 year period (as preliminary indications from ISS suggest), that period is still very short by many E&P companies’ timescales. Measurement at any point in time is assessing performance of a series of investments, some made significantly in the past. Ramping up investment for the future, in fact, generates worse near term returns.

EVA is one of the best (worst) examples of this problem – companies that make positive NPV investments for the future may still see a near-term dip in their EVA results. And, measuring this on a relative basis, at least in an ISS context, is likely only to exacerbate the non-performance based differences between companies with different capital expenditure profiles.

EVA is Coming

There is little doubt that ISS will eventually use EVA in its analysis of company performance. In interpreting EVA results and potentially making proactive disclosure to counter the ISS interpretation, energy companies may focus on how EVA does not tell the whole story based on their investment profile and commodity price exposure.