Ed Hauder

Ed Hauder

In January 2026, GameStop Corp.’s Board of Directors approved a performance-based stock option award for its Chairman and Chief Executive Officer, Ryan Cohen, subject to shareholder approval at a forthcoming special meeting. The award replaces traditional CEO compensation: Mr. Cohen will not receive base salary, annual cash incentives or time-based equity during the performance period. His only compensation opportunity is this option award and vesting occurs solely upon achievement of rigorous long-term performance goals.

The award is intended to align Mr. Cohen’s pay opportunity directly with the creation of significant shareholder value and requires substantial increases in both market cap and cumulative EBITDA to vest.

Award Structure

• Total Options Granted: 171,537,327 stock options to purchase GameStop common shares.

• Exercise Price: The exercise price is set at $20.66, closing stock price on January 6, 2026.

• Term: The options have a maximum term of 10 years.

• Vesting: Each tranche of options vests only upon achievement of two separate performance goals.

• No Partial Vesting: Performance is assessed on a tranche-by-tranche basis; failure to meet both conditions would result in no vesting for that tranche.

• No Guaranteed Compensation: No salary, bonus or other equity will be provided for the applicable period outside this performance award.

Performance Conditions

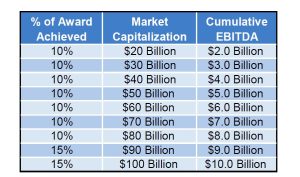

The award is divided into nine performance tranches.

Each tranche has two independent requirements:

• Market Capitalization Hurdle

• Cumulative EBITDA Hurdle

Both must be met for a tranche to vest.

The table below details the goals that must be met for each tranche to vest. There is no interpolation between tranches; partial performance does not result in partial vesting.

Market Performance Context

As of January 16, 2025:

• GameStop’s market capitalization was approximately $9.3 billion.

• Most recently disclosed cumulative EBITDA levels were approximately $241 million.

The performance requirements, therefore, represent substantial increases relative to current performance levels.

Since Mr. Cohen joined the Board in 2021, GameStop’s market capitalization has increased from approximately $1.3 billion to approximately $9.3 billion, reflecting significant value creation over that period. The structure of this award places all future compensation on the achievement of similarly transformational results.

Governance, Approval and Safeguards

• Shareholder Approval: The award is subject to approval at a special shareholder meeting, expected to be held in March or April 2026. During this vote, the CEO will recuse himself, allowing other shareholders to determine the outcome.

• Performance Only Vesting: Vesting is strictly tied to meeting both market capitalization and cumulative EBITDA goals; no discretionary adjustments are permitted.

• No Interpolation: Results below a tranche threshold do not result in partial vesting.

• Alignment With Shareholders: The size, structure and all-at-risk design features emphasize long-term shareholder value creation.