Donald Kalfen

Donald Kalfen

On August 16, 2022, President Biden signed into law the Inflation Reduction Act of 2022 (“IRA”).

IRA is a substantially scaled back version of the President’s failed Build Back Better (“BBB”) legislation. BBB called for new expenditures of up to $3.0 trillion and significant tax increases on individuals and corporations to fund these expenditures. In comparison, IRA calls for new expenditures of $437 billion and $737 billion of additional taxes.

These new expenditures focus on health care and climate change.

This Client Update will focus exclusively on tax changes under IRA, except for those related to prescription drug pricing reform.

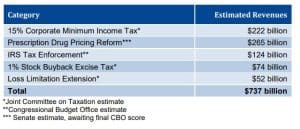

Estimated Tax Revenues Raised by Category under IRA

The table below shows estimated tax revenues raised over a ten-year period by indicated category.

15% Minimum Corporate Income Tax on Profits in Excess of $1 Billion

IRA imposes a corporate minimum income tax (Minimum Tax) rate of 15% on the adjusted financial statement income (“AFSI”) for corporations with profits over $1 billion, effective for tax years beginning after December 31, 2022. Excluded from the Minimum Tax rate are S corporations, regulated investment companies and real estate investment trusts.

The illustration below shows the determination of whether a corporation is subject to the Minimum Tax and, if so, the calculation of the Minimum Tax:

Once a corporation becomes subject to the Minimum Tax it will continue to be subject to the Minimum Tax in future taxable years (even if the AFSI Test is not met) unless the corporation:

■ Experiences a change in ownership or

■ Does not satisfy the AFSI test for a certain number of consecutive years and it would no longer be appropriate to subject such corporation to the Minimum Tax, in each case as determined by the Secretary of the Treasury.

A modified version of the AFSI test applies to foreign-owned domestic corporations.

Generally, AFSI is a corporation’s “book income” that is reported on its financial statement for a tax year, as adjusted for certain items. Notably, a corporation generally may deduct from its AFSI:

■ Net operating losses and

■ Tax depreciation deductions allowed under Section 167 of the Internal Revenue Code (rather than financial statement depreciation).

1% Tax on Share Buybacks

IRA imposes a new 1% excise tax on a domestic corporation’s repurchase of its shares during a taxable year, effective for share repurchases occurring after December 31, 2022. Domestic corporations includes any U.S. corporation whose stock is traded on an established securities market (e.g., NYSE, NASDAQ or similar stock exchanges or trading markets).

The excise tax is equal to 1% of the market value of shares repurchased less the market value of certain share issuances throughout the year, including shares issued or provided to employees.

The 1% excise tax does not apply to share repurchases:

■ Related to a tax-free reorganization in which no gain or loss is recognized on the repurchase by the shareholder,

■ That total less than $1 million during the taxable year,

■ That are contributed to an employee pension, employee stock purchase plan or similar type plan,

■ By a dealer in securities in the ordinary course of business,

■ By regulated investment companies or real estate investment trusts and

■ That are treated as dividend for U.S. federal income tax purposes.

$80 Billion Funding for IRS Tax Enforcement

The IRA provides approximately $80 billion to fund the following IRS Revenue Service initiatives over the next ten years:

■ Enforcement: Approximately $46 billion will fund enhanced tax enforcement activities, such as legal and litigation support, conducting criminal investigations, providing digital asset monitoring and compliance activities and enforcing criminal statutes related to violations of internal revenue laws and other financial crimes.

■ Operations Support: Approximately $25 billion will fund taxpayer services and enforcement programs.

■ Business Systems Modernization: Approximately $5 billion will fund business systems modernization programs.

■ Taxpayer Services: Approximately $3 billion will fund taxpayer services.

Limitation on Excess Business Losses

The “Limitation on Excess Business Losses” provides that non-corporate taxpayers may not deduct excess business loss if the loss is in excess of $250,000 ($500,000 in the case of a joint return), indexed for inflation. The excess business loss would become a net operating loss in subsequent years and could offset up to 80% of taxable income each year. The 2017 Tax Cuts and Jobs Act imposed this limitation, which was set to expire at the beginning of 2027. The IRA extends this limitation on non-corporate taxpayers’ excess business losses until January 1, 2029 (i.e., a two-year extension).

IRA Does Not Impose New Direct Taxes on Individual Taxpayers

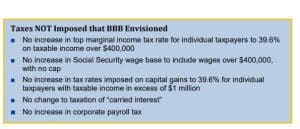

The IRA does not impose any new direct taxes on individual taxpayers or the more far-reaching corporate taxes that BBB had envisioned.

Meridian comment. The Joint Committee on Taxation projects that the Minimum Tax will affect approximately 150 public companies. In turn, the Minimum Tax may affect certain outstanding incentive awards granted by these public companies. For example, with respect to outstanding performance-vested awards that include 2023 and future years in the performance period, the increase in corporate taxes may have an adverse impact on actual results for companies that use an after-tax financial metric to determine vesting and payout of such awards (e.g., net income, earnings per share).

Many incentive arrangements include language in award agreements that require an adjustment to actual results to reflect changes to applicable tax laws. For those companies, the mandatory adjustment to actual results should not create accounting or disclosure issues. However, absent such language (or if the language permits a discretionary adjustment), then such a discretionary adjustment to actual results could create significant accounting and disclosure issues. Prior to making a discretionary adjustment to actual results, we suggest companies quantify the impact of the Minimum Tax on pay outcomes and then evaluate whether a discretionary adjustment is appropriate.

The claimed purpose of the 1% tax on share repurchases is to encourage companies to invest available cash in their operations and employees, in lieu of using such cash for share repurchases. However, one purpose of share repurchases is to return excess capital to shareholders, namely capital that companies deem cannot be prudently invested in operations. Thus, one potential unintended consequence of the tax would be for companies to shift excess cash to boost dividends – whether ordinary or special. In the event companies decide to reduce the volume of share repurchases in favor of increases in dividend payouts, such increases in dividends would benefit employees who hold equity awards, which often include the right to dividends or dividend equivalents.

* * * * *

The Client Update is prepared by Meridian Compensation Partners’ Governance and Regulatory Team led by Donald Kalfen. Questions regarding this Client Update or executive compensation technical issues may be directed to Donald Kalfen at 847-235-3605 or dkalfen@meridiancp.com.

This report is a publication of Meridian Compensation Partners, LLC, provides general information for reference purposes only, and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.

www.meridiancp.com