Last week, Institutional Shareholder Services (ISS) issued proposed policy updates for 2026, which include significant revisions to the Pay-for-Performance evaluation placing greater emphasis on longer-term time horizons.

These proposed updates address the following compensation-related topics:

• ISS quantitative Pay-for-Performance assessment

• Proportion of time-based and performance-based equity awards

• Board responsiveness to a prior year low Say on Pay vote

• High non-executive director pay

• Equity plan/share request proposals

Issuers and investors may submit comments via e-mail (policy@issgovernance.com) on the proposed policy updates to ISS no later than November 11, 2025. ISS will release final 2026 policies later this month and will generally be applicable for shareholder meetings taking place on or after February 1, 2026.

ISS Quantitative Pay-for-Performance Assessment

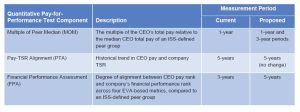

Currently, ISS’s quantitative Pay-for-Performance evaluation generally applicable to most companies includes a comparative analysis of CEO total pay and company performance, as measured in both absolute and relative terms, over a one-, three- and five-year period depending on the test.

Proposed Policy

As shown in the following table, ISS proposes to modify its quantitative evaluation to assess Pay-for-Performance alignment over longer-term time horizons for three of the four tests.

ISS notes that the proposed policy update “is intended to better align with how investors assess a company’s long-term performance when evaluating compensation relative to peers” and “emphasizes the assessment of sustained value creation and better smooths out short- to mid-term fluctuations, unusual one-time events, or external factors.”

Meridian Comment: The proposed change to the ISS quantitative Pay-for-Performance assessment may be criticized for emphasizing long-term outcomes at the expense of more recent performance, which may be more relevant to current pay decisions and business strategy.

ISS Pay-for-Performance test result is typically a screening mechanism for their investor clients. Many large institutional investors have their own Pay-for-Performance models, which directly impact their voting patterns.

Proportion of Time-Based and Performance-Based Equity Awards

In its assessment of Pay-for-Performance alignment, ISS evaluates a company’s executive compensation practices against a variety of qualitative factors to determine whether they promote (or undermine) sustainable value creation and alignment with shareholder interests.

Proposed Policy

ISS proposes to revise the list of qualitative factors to include “vesting and/or retention requirements for equity awards that demonstrate a long-term focus.” ISS notes that this proposed change “reflects the importance of long-term time horizons for time-based equity awards and provides a more flexible approach in evaluating the equity pay mix.”

In addition, ISS clarifies that realized pay outcomes may be considered alongside realizable and granted pay as part of the qualitative assessment.

Meridian Comment: If the proposed update is adopted, companies may have more flexibility to heavily emphasize time-based equity awards in the total award mix, as long as time-based equity awards include an extended vesting period (e.g., 5-years) and/or a post vesting holding requirement.

Board Responsiveness to a Prior Year Low Say on Pay vote

If a company receives less than 70% shareholder support for a prior year Say on Pay proposal, ISS will issue adverse vote recommendations on Say on Pay and/or compensation committee members if the board fails to demonstrate responsiveness to the prior year Say on Pay vote. ISS assesses board responsiveness by considering various factors, including disclosure of shareholder engagement efforts, concerns noted and actions taken to address concerns.

Proposed Policy

ISS proposes to revise its framework used for evaluating board responsiveness by considering (i) a company’s actions taken in response to a Say on Pay vote and (ii) a company’s explanation as to why such actions are beneficial to shareholders, even in the absence of disclosed shareholder feedback (the latter of which is required under ISS current policy).

Meridian Comment: Under the proposed policy, a company can demonstrate board responsiveness through positive compensation program changes, even if such changes are not linked to specific shareholder feedback. A company should nonetheless disclose that it engaged shareholders after the prior Say on Pay vote, but it was unable to obtain specific feedback.

High Non-employee Director (NED) Pay

Currently, ISS generally recommends voting against board committee members responsible for approving or setting NED compensation if such compensation is excessive for two or more consecutive years without a compelling rationale. ISS measures NED pay levels relative to companies in a subject company’s four-digit GICS.

Proposed Policy

ISS proposes revisions to its framework for evaluating NED pay. Under the proposed framework, ISS may issue adverse vote recommendations in any year in which NED pay is (i) excessive in magnitude (even across non-consecutive years) or (ii) includes problematic perquisites, performance awards, stock options or retirement benefits.

Meridian Comment: Historically, ISS identified excessive NED pay based on companies in the top 2% of the comparison group for two consecutive years, which impacted few companies. The proposed policy will result in more companies receiving ISS adverse vote recommendations due to excessive NED pay levels.

Equity Plan/Share Request Proposals

ISS evaluates equity plan proposals under its Equity Plan Scorecard (EPSC) model. The EPSC includes three evaluation components – plan cost, plan features and grant practices – and weights each factor under the three categories. A company’s equity plan must receive a passing score to receive a positive ISS recommendation.

Proposed Policy

ISS proposes to revise its policy on evaluating equity plan proposals in the following respects:

• Adds a new scoring factor under the Plan Features category to assess whether an equity plan includes a cash-denominated NED award limit

• Introduces a new negative overriding factor for equity plans found to be lacking sufficient positive features under the Plan Features category, despite an overall passing score

Meridian Comment: When submitting an equity plan for shareholder approval, companies should consider including NED award limits on total compensation (rather than solely equity awards) and assess its plan provisions against the full list of Plan Feature criteria. Typically, a company will adopt some, but not all, of the ISS-preferred plan features in balancing ISS preferences against flexibility in plan administration and grant practices.

* * * * *

The Client Alert is prepared by Meridian Compensation Partners’ Governance and Regulatory Team led by Donald Kalfen. Questions regarding this Client Update or executive compensation technical issues may be directed to Donald Kalfen at 847-347-2524 or dkalfen@meridiancp.com.

This report is a publication of Meridian Compensation Partners, LLC, which provides general information for reference purposes only, and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific facts or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.