Linking value creation, business strategy and underlying goal setting is arguably the linchpin of executive compensation, where the pay-and-performance “rubber” meets the road. For compensation committees, focusing on the basics can help cut through to the heart of the matter, and lead to better incentive goals.

The Basics

Value creation is about two things—return on investment or ROI (profitability) and growth. This principle holds no matter what type of business is being considered. Balancing and appropriately emphasizing one versus the other is the key managerial judgment and insight.

Investors are taking risks with any enterprise. In exchange for that risk, they expect a certain minimum ROI over time. This minimum expected return is known as the “cost of capital.”

Entire text books have been written about the cost of capital but its importance is simple. If a business is not generating ROI in excess of its cost of capital, then it is not likely to be creating value over time because it is not covering its costs. Correspondingly, if a business is not generating satisfactory ROI, then it does not make sense to make substantial additional investments in that business (i.e., it should not grow) until it does surpass its cost of capital. Alternatively, if a business is generating ROI above its cost of capital, greater emphasis on growth is warranted. Following is a summary.

| ROI < Cost of Capital | ROI ≈ Cost of Capital | ROI > Cost of Capital |

| Don’t grow; improve profitability | Strengthen profitability with modest emphasis on growth | Sustain profitability and grow! |

Making it Operational

For most established enterprises within a fairly standard range of capital intensity and ongoing business risks, the cost of capital does not vary that greatly. Currently, the long-run weighted average cost of capital for many (if not most) companies is likely in the 7% to 9% range. Running a business always involves time lags, and long-run strategies cannot be started or stopped every time ROI slides over or dips under the cost of capital. Consequently, the following decision tool is a reliable guidepost of when to emphasize ROI versus growth both as a business decision and as it relates to compensation structure. This should be based on results over several years, not just one year.

| ROI < 5%–6% | ROI ≈ 7%–9% | ROI > 10% |

| Don’t grow; improve profitability | Strengthen profitability with modest emphasis on growth | Sustain profitability and grow! |

Framework for Goal Setting

For most long-term incentive plans, goal-setting is the most difficult aspect. It can be helpful, however, to reference the decision tree above, and the basic strategic objectives of the company.

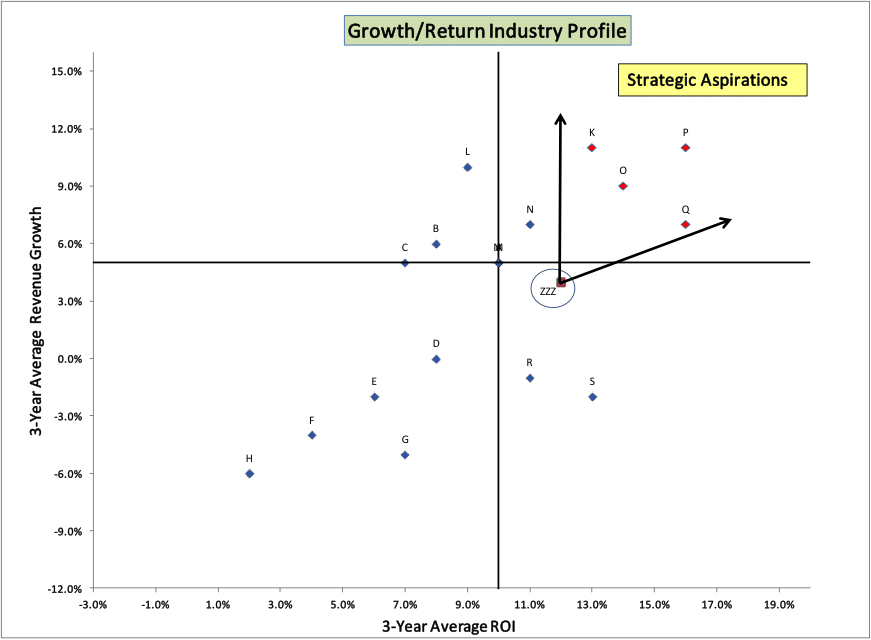

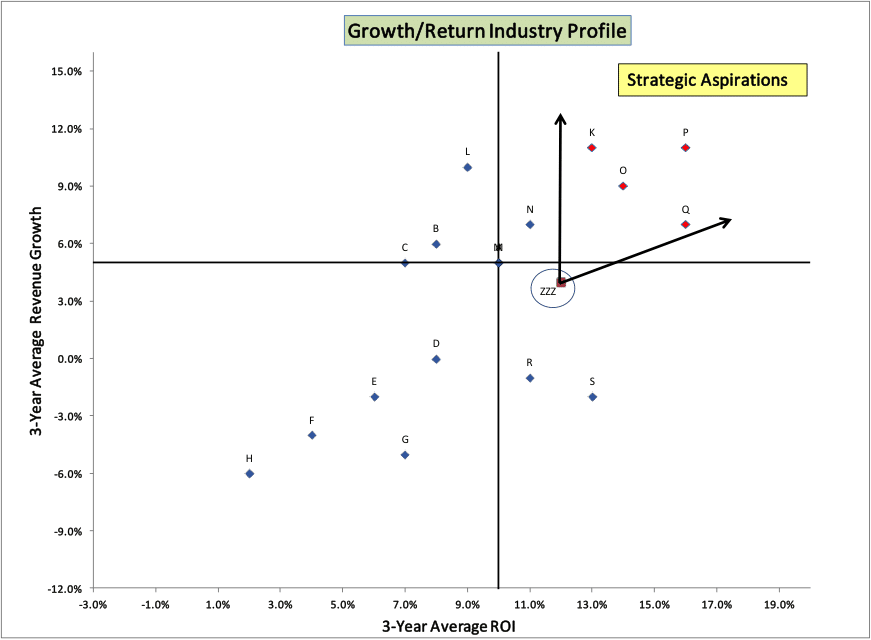

It is also useful to look at the current levels of ROI and growth for a cross-section of broadly relevant companies as this can have implications of where a company should be vis-à-vis a set of competitors.

For example, consider a recent client (coded as ZZZ) whose three-year average ROI and revenue growth profile is as shown below. The three-year average ROI and growth of a set of competitors is similarly plotted. The company’s ROI (12%) is above its cost of capital so an emphasis on growth clearly is warranted. The precise range of attainable growth and ROI figures need to be worked out, but this analysis narrows the plausible range of goals.

Most compensation committees would expect to see growth rates that make notable movements toward those in the “Strategic Aspiration” quadrant (red plot points) while at the same time sustaining and even improving current levels of profitability.

Summary

Mastering the basics is the key to success in most complex efforts. To link value creation, strategy and goal setting, means (1) balancing growth and profitability (ROI), and (2) knowing when to emphasize one versus the other and adopting some basic decision rules. Then (3), a solid perspective on where a relevant set of competitors lies in terms of ROI and growth can often provide a strong set of guiding parameters of where goals should be set. Company-specific considerations and factors can and should be incorporated, but the playing field will often have been largely established or at least substantially narrowed.