David Bixby

David Bixby

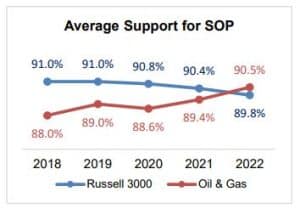

Based upon results published through the end of June 2022, average support for oil & gas company Say on Pay (SOP) proposals has increased for the second straight year. For the first time in the past six years, average oil & gas support also narrowly exceeded the average outcome for the Russell 3000.

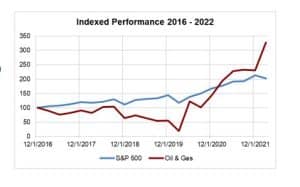

Improved financial and shareholder returns for oil & gas companies have doubtless played a role in increased support for pay across the industry. As demonstrated in the chart below, total shareholder return

for the oil & gas industry (represented by the XOP index) has significantly outperformed the S&P 500 since hitting an historic low point in early 2020.

However, as we noted last year, increased support for SOP is probably also a reflection of evolving pay practices within the oil & gas sector, including:

- Less complex short-term incentive plans, with heavier weight on quantitative or formulaic elements

- More emphasis in short-term incentive plans on free cash flow generation and ESG, and less on production growth

- Larger role for absolute metrics (either financial or total shareholder return) in performance unit plans

Increasing Portion of Oil & Gas Companies Achieving Strong Support

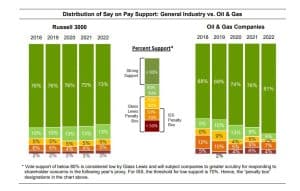

The portion of oil & gas companies with “strong” support (≥ 90%) increased for the third straight year, rising to 81% – as compared to 73% in our general industry sample. However, the portion of oil & gas companies receiving support in excess of 80% this year was consistent with our general industry sample; roughly 86% of companies in both groups were able to exceed that important threshold.

Companies with support below 80% may be, and those below 70% will be, subject to additional advisory firm scrutiny in the following year’s vote. As a result, companies that pass their vote but fall below 80% may still feel compelled to make material changes to existing programs in order to demonstrate responsiveness.

In our general industry sample, the portion of companies falling in the range of 70% to 90% support – where support was not necessarily “strong” but was also not “low” – was consistent year-over year at 18%. In contrast, only 7% of companies in our oil & gas sample fell within that gray area, implying that there has been less middle ground in terms of shareholder sentiment on pay when compared to general industry.

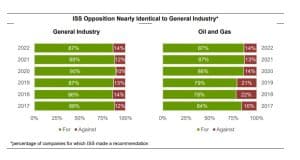

Opposition from ISS Nearly Identical to General Industry

The prevalence of ISS opposition to SOP proposals among oil & gas companies has remained largely unchanged from 2021 (13.5% YTD in 2022 vs. 13.1% in 2021). Meanwhile, the prevalence of ISS opposition among general industry companies increased for the third year in a row. As a result, for the first time in the past six years, the likelihood of an ISS “Against” was nearly identical in our oil & gas and general industry samples.

ISS Opposition Continues to Have a Significant Impact

Regardless of industry affiliation, ISS opposition to SOP continues to create significant headwinds for shareholder support. Within our general industry sample, ISS opposition correlated with a roughly 28 percentage point decline in support vs. the overall average. Within our oil & gas sample, the average impact was closer to 27 percentage points. However, once we exclude results for two closely held oil & gas companies that received “Against” recommendations, the average impact increases to an impressive 37 percentage points – implying again that SOP within oil & gas this year may have been more of an “all or nothing” proposition than in general industry.

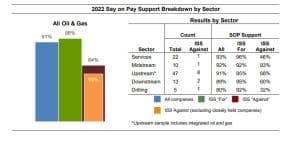

The table below provides a breakdown of overall support, and ISS impact, by sector within oil & gas.

Rationale for Negative Recommendations Remain Consistent with Prior Years

A pay-for-performance disconnect in one of three primary ISS quantitative tests remains by far the most common trigger, but qualitative concerns are typically cited as the ultimate rationale for any negative recommendation.

Qualitative concerns expressed in 2022 followed common themes:

- Large one-time or “special” awards particularly without forward-looking performance criteria

- Termination-related payments for apparently voluntary terminations like retirement

- Insufficient disclosure of incentive plan goals (forward-looking and backward-looking)

- Incentive plan complexity with a large number of discrete measures limiting transparency

- Lack of sufficiently rigorous goals, particularly target payouts for median performance and/or lack of a cap if absolute TSR is negative

- Significant pay increases without “clearly disclosed” rationale

For companies who had a challenging vote in 2022, proxy advisory firm concerns such as those listed above can provide helpful insights into potential hot buttons for investors. However, advisory firm guidelines are no substitute for robust shareholder outreach to determine the most effective response…and as demonstrated by 2022 results, improved financial and stock price performance certainly doesn’t hurt.

Archived copies of previous Energy Insights can be found by going to www.meridiancp.com/insights and selecting Oil & Gas from the dropdown list.

To have your name removed from our Energy Insights email list, please contact ckellner@meridiancp.com.