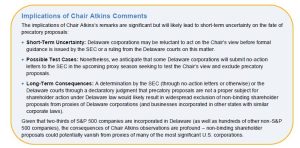

In a recent address, SEC Chair, Paul Atkins, questioned whether Delaware law actually requires companies to include non-binding shareholder proposals in their corporate proxy statements.

His remarks suggest that there is a sound basis under which these proposals may be excluded from proxy statements of Delaware corporations – a position that, if adopted, could upend historical shareholder engagement practices related to shareholder proposals.

While the Chairman’s view remains untested, its ultimate resolution may rest with Delaware’s courts before exclusion of such shareholder proposals becomes settled practice.

Background on Non-Binding Shareholder Proposals

SEC Rule 14a-8 requires publicly traded companies to include qualifying shareholder proposals – including non-binding or “precatory” ones – in their proxy materials. The rule is designed to promote shareholder participation by allowing investors to present issues for consideration and advisory vote at annual shareholder meetings.

A company may seek to exclude a shareholder proposal from its proxy materials only if it meets one of the thirteen substantive bases for exclusion under Rule 14a-8. To do so, companies typically file no-action requests with the SEC, asking the staff to confirm that the requested exclusion is permissible.

For example, Rule 14a-8(i)(1) allows a company to exclude a precatory proposal from its proxy statement “(i)f the proposal is not a proper subject for action by shareholders under the laws of the jurisdiction of the company’s organization.”

The Central Question: What is a “Proper Subject” under Delaware Law?

Historically, SEC guidance has presumed that a precatory proposal is a “proper subject” for shareholder action and, thus, should be included in a corporation’s proxy. However, in his remarks delivered on October 9, 2025, at the John L. Weinberg Center for Corporate Governance’s 25th Anniversary Gala, Chair Atkins directly challenged this longstanding presumption as applied to Delaware corporations.

Chair Atkins argued that Delaware law does not affirmatively grant shareholders the right to have their precatory proposals included in a Delaware corporation’s proxy, provided the company has not created that right through its governing documents.

Chair Atkins suggested that Delaware corporations could successfully exclude precatory proposals from their proxies by undertaking the following:

• The corporation submits a no-action letter to the SEC in which the corporation seeks to exclude a precatory proposal on the following basis:

― Delaware law does not grant shareholders the right to vote on precatory proposals.

― The company has not created such right through its governing documents.

― Therefore, the precatory shareholder proposal is excludable under Rule 14a-8(i)(1).

• The corporation obtains an opinion of counsel that the precatory proposal is not a “proper subject” for shareholder action under Delaware law

Chair Atkins unequivocally stated that the foregoing basis for excluding a precatory proposal should “prevail” and that he had “high confidence that the SEC staff will honor this position.”

* * * * *

The Client Alert is prepared by Meridian Compensation Partners’ Governance and Regulatory Team led by Donald Kalfen. Questions regarding this Client Update or executive compensation technical issues may be directed to Donald Kalfen at 847-347-2524 or dkalfen@meridiancp.com.

This report is a publication of Meridian Compensation Partners, LLC, which provides general information for reference purposes only, and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific facts or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.