Over 75% of Telsa’s shareholders approved Elon Musk’s 2025 performance equity grant.

The grant would be worth nearly $1 trillion if Tesla attains a market value of $8.5 trillion and meets aggressive operational milestones.

Any shareholder derivative lawsuit challenging the grant would be decided under Texas corporate law due to Tesla’s reincorporation in Texas in 2024.

Rationale for and Approval of 2025 CEO Performance Award Grant

Mr. Musk has publicly stated that if he were to remain at Tesla, it was critical he hold at least a 25% voting interest in Tesla and that he receive assurances that he would be compensated for his past services in accordance with his 2018 mega option grant, which was struck down by a Delaware court. Mr. Musk also raised the possibility that he may pursue other interests that may afford him greater influence if he did not receive such assurances.

To address Mr. Musk’s concerns, on January 8, 2025, the Board of Directors of Tesla formed a Special Committee of disinterested directors to consider whether it would be in the best interests of Tesla to retain and incentivize Mr. Musk, and if so, the manner in which to do so. Unsurprisingly, the Special Committee determined it is in the best interests of Tesla to retain Mr. Musk and separately determined the best approach to do so is through a mega-grant of performance-based restricted shares (“CEO Performance Award”). Based on the Special Committee’s recommendation, on September 3, 2025 the Tesla Board of Directors authorized the grant of the 2025 CEO Performance Award, subject to shareholder approval.

Both Institutional Shareholder Services and Glass Lewis recommended that shareholders vote AGAINST the CEO Performance Award.

Nonetheless, at the November 6, 2025 shareholder meeting, over 75% of shares cast voted to approve the CEO Performance Award.

Overview of Key Terms of the CEO Performance Award

The CEO Performance award provides Mr. Musk the opportunity to earn up to 12% of Tesla’s voting shares over a 10-year performance period if Tesla achieves “stratospheric growth” over that period, as characterized in Tesla’s proxy. For Mr. Musk to receive the maximum payout under the award, Tesla would need to achieve the following extraordinary goals:

• Increase market cap from about $1 trillion to $8.5 trillion (which would significantly exceed the current aggregate market capitalization of the entire S&P 600 index)

• Increase EBITDA from $13 billion to $400 billion

• From scratch deliver 1 million robots and 1 million robot taxis

• From scratch sign-up 10 million active FSD subscriptions (i.e., advanced driving system)

Interestingly, the CEO Performance Award is structured to mimic the economics of a stock appreciation right but without providing Mr. Musk with the discretion to exercise the award upon vesting. The CEO Performance Award requires Mr. Musk to pay an “offset amount” upon the settlement of the award (which may be paid in shares deducted from the award or cash). The maximum offset amount is equal to the grant date fair market value of the shares underlying the CEO Performance Award, or approximately $141.5 billion. Therefore, at the time of grant the CEO Performance Award has no intrinsic value and will only have value to the extent Tesla’s share price increases.

Additional details on the CEO Performance Award are set forth below this Client Update.

Meridian Comment

So-called moon-shot awards are unlikely to become a staple practice in executive compensation, particularly of the magnitude of Mr. Musk’s award. However, although not common, some companies have implemented relatively “modest” moon-shot awards to drive extraordinary operational results and total shareholder return. With the ongoing race to develop the preeminent AI model, moon-shot type awards may become a necessary incentive and retention tool among leading high-tech companies.

* * * * *

The Client Alert is prepared by Meridian Compensation Partners’ Governance and Regulatory Team led by Donald Kalfen. Questions regarding this Client Update or executive compensation technical issues may be directed to Donald Kalfen at 847-347-2524 or dkalfen@meridiancp.com.

This report is a publication of Meridian Compensation Partners, LLC, which provides general information for reference purposes only, and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific facts or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.

Terms of 2025 CEO Performance Award

The 2025 CEO Performance Award represents a grant of 423,743,904 restricted shares of Tesla common stock (equal to approximately 12% of Tesla’s outstanding shares) and is composed of 12 equal tranches (each representing 1% of Tesla’s outstanding shares). On the date of grant, the shares were worth approximately $141.5 billion (Tesla pegged the preliminary fair value of the award for accounting purposes at $87.75 billion).

Performance Goals

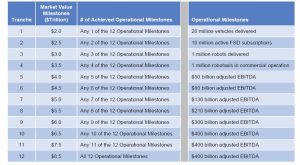

The shares underlying each tranche are earned upon the achievement of a market value milestone when paired with an operational milestone as set forth in the table below.

For example, Mr. Musk would earn the first tranche of the CEO Performance Award if Tesla met the $2 trillion market value milestone when paired with the achievement of the delivery of 1 million robots. The $400 billion adjusted EBITDA goal may be paired with three separate market value milestones which would result in Mr. Musk earning three tranches of the CEO Performance Award.

In addition to meeting market value and operational milestones, Mr. Musk is required to have developed a succession plan to earn shares underlying the 11th and 12th tranches.

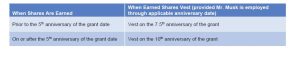

Vesting of Earned Shares

Earned shares will vest in accordance with the following schedule:

Earned/Vested Shares Subject to Offset

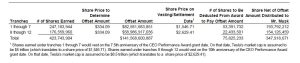

Mr. Musk will be required to pay to Tesla an “offset amount” upon the vesting of earned shares. To pay this amount, Tesla shares with a fair market value equal to this offset amount will be deducted from Mr. Musk’s earned shares (with the fair market value of such shares based on share price on the applicable vesting anniversary date). The offset amount is equal to the product of $334.09 per share and the number of shares earned. Mr. Musk may choose to pay the offset amount in cash.

The following illustrates the determination and share payment of the offset amount based on the following assumptions: (i) the first 7 tranches are earned prior to the 5th anniversary of the award’s grant date, (ii) the attained market cap of $5 trillion required under the 7th tranche remains the same on the vesting/settlement date of the 7 tranches on the 7.5th anniversary of the grant date and (iii) the last 5 tranches are earned between the 5th anniversary and the 10th anniversary of the award’s grant date.

After the share payment under the foregoing scenario, Mr. Musk would hold 347,918,671 shares of Tesla common stock worth approximately $914.8 billion based on an attainment of an $8.5 trillion valuation on the 10th anniversary of the award’s grant date.