Ed Hauder

Ed Hauder

The proxy advisory firms, ISS and Glass Lewis, have had significant influence on the design, disclosure and governance of executive compensation programs at public companies. Recent regulatory actions, combined with institutional investors increasingly setting their own policies, suggest that proxy advisor influence may be declining.

This changing landscape will likely increase the diversity of shareholder voting practices and make it more challenging for companies to anticipate and navigate say on pay voting.

Regulatory Context: 2025 was a year of disruption for proxy advisors

• Texas passed a law to curtail proxy advisor influence – although proxy advisors have filed a lawsuit to prevent or curtail its application.

• In December 2025, President Trump issued an executive order directly targeting ISS and Glass Lewis, which together dominate the market. This order directs federal agencies – including the SEC, FTC and Department of Labor – to assess whether proxy advisors should be subject to heightened regulation and whether their consideration of non-pecuniary factors (such as ESG and diversity considerations) aligns with fiduciary obligations.

Collectively, these federal and state actions reflect broader political skepticism of ESG considerations, which have been part of proxy advisors’ vote recommendations, and concern that the proxy advisors have an outsized influence on say on pay and other vote outcomes.

Institutional Investor Behavior: Fragmentation of Influence

These regulatory headwinds add to a developing shift which saw large institutional investors develop and follow their own proxy voting policies which align their voting decisions with bespoke investment and risk-management goals. This has had three impacts on proxy voting:

1. Decreased Proxy Advisor Influence: This has decreased the influence of proxy advisors, as more institutional investors follow their own policies rather than those of ISS.

2. Increased Complexity: Companies now must consider not only the published proxy voting guidelines of ISS and Glass Lewis, but a broad array of policies and practices from different institutional investors.

3. No “Right” Path: These policies diverge on executive compensation and incentive design, compensation governance, ESG and more, making it difficult or impossible for companies to align with all the key policies of their significant shareholders.

Challenges for Public Companies

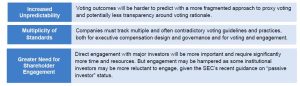

The diversification of approaches to proxy voting may have the following impacts:

Strategies to Navigate the New Landscape

Boards and management teams should consider the following approaches to manage these dynamics effectively:

• Enhance Tracking: Companies should track the key policies of each of their significant investors to understand the impact on executive compensation programs, incentive design and compensation governance.

• Enhance Disclosure: Proxy disclosure should provide clear business rationales, particularly for executive compensation designs or outcomes that are expected to be outside the policies of any significant shareholder. This disclosure is a critical part of navigating complex and conflicting investor policies.

• Proxy Playbooks: Maintain updated internal “proxy playbooks” that map out the proxy voting policies of major holders and proxy advisor firms.

• Understand How Peer Companies are Evaluated: Tracking how investors evaluate peers with similar programs should provide insights, particularly as companies are considering changes to executive compensation, incentive designs or governance practices.

• Align Compensation with Business Strategy: Continue to align compensation programs with overall business strategy and ensure the direct link between strategy and compensation is clearly disclosed.

JPMorgan’s Break with Proxy Advisors

JPMorgan Chase’s asset-management division recently announced it will not use traditional proxy advisory firms for U.S. shareholder voting. Instead, JPMorgan will rely on its own, AIbased voting analytics platform to analyze data and guide voting.

This move is interesting for three reasons:

• Scale: JPMorgan manages trillions in client assets, so this change will affect a large number of companies.

• Data & Technology: It is not clear whether AI-driven analysis will reduce transparency of voting rationales.

• Corporate Sentiment: The change aligns with CEO Jamie Dimon’s criticism of proxy advisors having “undue influence,” and reflects broader corporate frustration with “one-size-fits-all” voting guidance.

JPMorgan’s decision could signal a broader shift among institutional investors away from ISS and Glass Lewis.

Be sure to check out Meridian’s related podcasts:

Engaging With Shareholders on Executive Compensation

Evaluating Executive Pay Through an Activist Lens

Engaging for Excellence: How Shareholder Dialogue Transforms Executive Compensation

* * * * *

The Meridian Beacon is prepared by Meridian Compensation Partners. Questions regarding this Meridian Beacon may be directed to Ed Hauder at 224-775-4852 or ehauder@meridiancp.com.

This report is a publication of Meridian Compensation Partners, LLC, provides general information for reference purposes only and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.