Ron Rosenthal

Ron Rosenthal

A wave of lawsuits surrounding director compensation surfaced a couple of years ago, often alleging “excessive” pay for boards of directors on a variety of grounds. Because boards set their own pay levels, there are potential legal ramifications due to the “self-dealing” nature of director compensation. While lawsuits were settled and subsequent litigation has subsided, the topic is back in the spotlight in light of updated proxy advisor voting guidelines.

New ISS and Glass Lewis policies may lead to compensation committee scrutiny and director disapprovals. Boards must continue being open and transparent about their pay practices in order to ensure that their investors understand how director pay aligns with shareholder value.

For example, the new Glass Lewis guidelines say, “Fees should be competitive in order to retain and attract qualified individuals, but excessive fees represent a financial cost to the company and potentially compromise the objectivity and independence of non-employee directors.”

“If ISS sees a pattern of two or more years of excessive director pay in relation to peers of similar size and complexity, they might recommend a vote against those responsible,” noted Ron Rosenthal, a lead consultant with Meridian Compensation Partners, during a recent Equilar webinar.

What Constitutes “Excessive”?

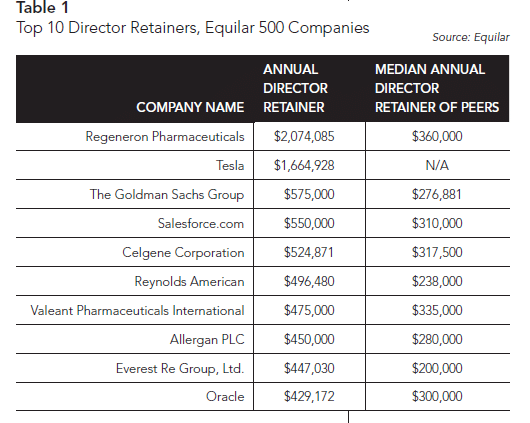

In conjunction with its annual Director Pay Trends report, Equilar released a list of the top 10 highest annual director retainers in the Equilar 500 (Table 1). While director compensation is much more complicated than just a base retainer, a retainer for non-executive directors is the most common feature amongst all company policies and provides a meaningful benchmark.

In fiscal year 2016, the median base retainer for all directors—inclusive of cash and equity—was $245,000. That constituted nearly a 20% increase from 2012, when the median retainer was $205,000. However, in any individual year, gains were modest, anywhere from 2% to 5%.

“Companies regularly benchmark competitive pay levels—often on an annual or biennial basis—to confirm that the compensation awarded to directors is competitive and appropriate,” said Rosenthal. “Many boards prefer to make regular, modest increases to the annual retainer to ensure the program remains market competitive, instead of larger periodic increases. This preference may be driving, in part, the consistent, modest growth in annual retainers for outside directors.”

When compared to the median annual director retainer of their respective peer groups, Equilar found that seven of the 10 companies with the highest retainers paid their board over 50% more than their peers. (Tesla does not disclose a peer group.) In fact, four companies paid over double the median of their peer group. Six of the nine companies with peer groups had the highest retainer amongst their peers—however, Celgene, Oracle and Valeant Pharmaceuticals each have a peer in this top 10 list, putting them second among their peers.

Director compensation is much more complicated than base retainers since directors can receive additional fees for serving in leadership positions or sitting on various committees. Where one area of compensation might fall short, another area can be increased to compensate. For example, instead of paying directors to attend meetings, a company may incorporate that per meeting value into the overall retainer.

However, when a company analyzes their director compensation policy, they do so on a component-by-component basis in addition to overall pay. Therefore, while Table 1 only shows one aspect of director compensation, it does provide a view into what investors and proxy advisors will be comparing and how compensation values will be evaluated.

Meaningful Limits: How Boards Can Stay on the Right Side of Shareholders (and the Law)

In a recent webinar hosted by Equilar and Meridian Compensation Partners, Michael Falk, a partner with law firm Kirkland & Ellis set the stage. “We are seeing a trend now that corporations will put a ‘meaningful limit’ into their director compensation plan if it’s not in there already,” he said. “Recent lawsuits showed that you want to have a separate limit that is specific to directors, proposing that the board will pay no more than a certain value transferred to directors in any one year in combined cash and equity.”

As the median base retainer for Equilar 500 companies was $245,000 in fiscal year 2016, limits should land in the $500,000 to $750,000 range if they are following the typical trend of a 2-3x multiple.

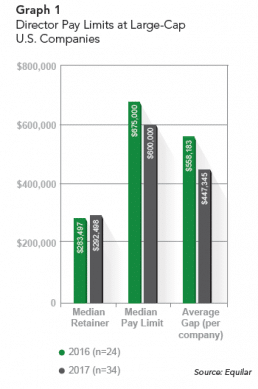

An Equilar study of 100 large-cap U.S. companies found that 34 of them disclosed director pay limits in 2017, vs. 24 in 2016. Key data points from the study follow (see Graph 1):

• The median director retainer for those 34 companies in 2017 was $292,498, and indeed, the median cap was $600,000, just over 2x.

• For the 24 companies that disclosed a limit in the 2016, the median retainer was $283,497 and the median cap was $675,000.

• The average gap between limits and median pay was $447,345 in 2017, down from $558,183 from the year prior—suggesting that limits put in place in 2017 were lower than those already existing.

• However, in 2017, four companies had maximum director retainers that exceeded the stated limit vs. only one in 2016.

While meaningful limits are meant as a legal protection, and these limits will certainly help sidestep the critical eye of proxy advisors, they have a practical function as well. Because a typical limit is about 2–3x the base retainer, it helps account for special awards or unusual situations that may warrant higher compensation for directors outside of the typical retainer.

For example, the limit would cover additional board responsibilities (i.e., a chair position, which, according to the Equilar report, receives a median $160,000 retainer on top of the base), as well as any special situations. Those may include initial awards, which are provided when a director joins the board and are often larger than the base retainer in order to provide immediate vesting in the company. They may also include pay for M&A committees or other special committee formations that arise outside of the expected scope of board service to respond to a particular issue.

Alphabet provides an example of how “meaningful limits” are used. The company has a director pay limit of $1.5 million, and in 2016, the company awarded just over $1 million to a new director, Roger Ferguson, as an initial grant of stock. The explanation, as disclosed in the company’s proxy (p. 37), is below:

“Roger was appointed to serve as a member of our Board of Directors and the Audit Committee effective June 24, 2016. In connection with his appointment, he received our standard initial compensation for new non-employee directors consisting of a $1.0 million GSU grant made July 6, 2016 (the first Wednesday of the month following his appointment).”

And here’s the note from the previous page, which outlines the limit: “Under Alphabet’s 2012 Stock Plan, the aggregate amount of stock-based and cash-based awards which may be granted to any non-employee director in respect of any calendar year, solely with respect to his or her service as a member of the Board of Directors, is limited to $1.5 million.”

So, while Alphabet’s board base retainer was $425,000, the director pay limit is just over 3x that amount because the company provides a standard, one-time initial award of $1.0 million to ensure directors are immediately vested. The limit has been approved by shareholders, and therefore, there is transparency around the practice.

Generally, one reason why we have seen base retainers rise over the past few years is to acknowledge the increase in time commitments for directors. In the past, board members would be paid “meeting fees” for their attendance at quarterly meetings, but since directorships have become more of a full time job given the rate of change and the “always-on” nature of today’s corporate environment, the ad hoc payments for meetings make less sense, since what can be constituted as a “meeting” is less clear. That said, in the cases where additional compensation is warranted, the limits allow some discretion. While they are a legal protection, they also have practical applications while explicitly assuring shareholders of a reasonable cap on director compensation.

For more information on the report cited in this article, visit www.equilar.com/reports.html. You may view clips and request webinar replays at www.equilar.com/webinar-videos.