Michael Brittian

Michael Brittian

Alexis Elliott

Alexis Elliott

In Meridian’s Client Alert from earlier this year, we summarized numerous changes to proxy advisors’ 2025 policy updates for Say on Pay evaluations. With respect to ISS, one change we highlighted was a heightened focus on disclosures of performance-based equity awards in its qualitative assessment of CEO pay-for-performance alignment. In particular, ISS noted that it would consider “non-disclosure of forward-looking goals” in companies’ performance-based equity programs, among a “non-exhaustive” list of other items. ISS noted that multiple concerns are more likely to result in an ISS adverse Say on Pay vote recommendation.

While ISS noted in their U.S. Executive Compensation Policies Frequently Asked Questions document that they made this change because “investors have increasingly expressed concerns with the potential pitfalls surrounding performance equity programs”, they didn’t provide any rationale for this specific change. In this blog, we examine the current practices of oil & gas companies with respect to the disclosure of forward-looking LTI goals.

Use of Performance-Based LTI

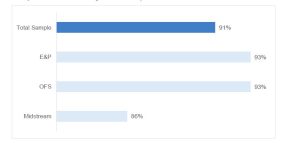

We looked at 2025 proxy filings for a sample of 71 U.S. public oil and gas companies, including 26 E&P companies, 26 oil field services companies, and 19 midstream companies. Since we analyzed 2025 proxy filings, our review was focused on awards granted in 2024. Not surprisingly, performance-based LTI continues to be a widely used vehicle for oil & gas executives.

Types of Performance-Based LTI Metrics Used?

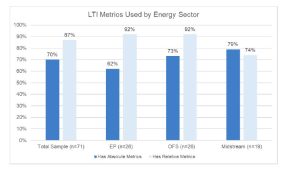

Of the total sample of 71 companies reviewed, 70% disclosed using absolute metrics and 87% disclosed using relative metrics (the numbers don’t add to 100%, because many companies disclose using both absolute and relative metrics). E&P companies tend to use absolute metrics less frequently than other oil & gas companies, while they are most popular among midstream companies.

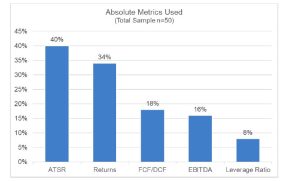

For companies using absolute metrics, the most prevalent metrics used across the sample are absolute Total Shareholder Return (TSR) and returns (e.g., ROIC, ROCE, etc.).

Forward-Looking LTI Disclosure

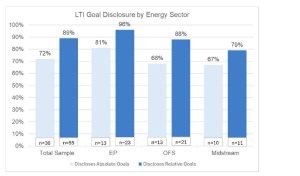

When we reviewed goal disclosures for the sample, we observed that nearly 90% of the total sample disclosed forward-looking goals for their relative performance metrics. Further, nearly three-quarters of oil & gas companies disclosed forward-looking goals for absolute metrics. The highest prevalence of disclosing forward-looking goals for either type of metric was in E&P.

Final Thoughts

We would expect companies to be hesitant in disclosing forward-looking absolute goals, in particular, in order to avoid any disclosure of information that they may deem as confidential (or at least until those results are final and reported publicly in other filings). And among general industry companies, this is likely the primary reason we see such low prevalence of disclosing forward-looking absolute goals.

Therefore, we were somewhat surprised to see the high prevalence of oil & gas companies disclosing forward-looking absolute goals. This is likely because of a greater prevalence of absolute TSR and other metrics where goals might be consistent cycle to cycle such as return on capital. It could also be a perhaps intentional effort to be more transparent to investors. In any case, while ISS has enhanced its focus on companies disclosing forward-looking goals, it is unlikely this was the primary reason oil & gas companies have elected to make these disclosures.

While we plan to review practices again next year, we are not expecting a significant shift in practices in this area; however, those companies under pressure by investors or with lower Say on Pay votes this year may consider providing more forward-looking disclosure (if not done already) as an area of responsiveness in the future.