Tracy Glassel

Tracy Glassel

Carrie Guenther

Carrie Guenther

Over the last few years, oil & gas companies in the Russell 3000 have secured high marks from investors on Say on Pay (SOP) votes, reinforcing a positive trend of growing shareholder support of executive compensation practices.

Key SOP Takeaways from the 2025 Proxy Season

• Strong Shareholder Support: SOP vote outcomes for oil & gas companies averaged ~92% and roughly 75% of companies in the sector earned support above 90%.

• Zero Failures: No oil & gas companies in the Russell 3000 failed their SOP vote.

• Less Proxy Advisor Criticism: Only eight companies (8.2%) received an “Against” recommendation from ISS.

SOP Trends Over the Last Three Years

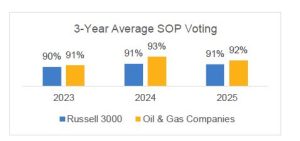

SOP support in the oil & gas sector has remained steady over the last three years, averaging above 90% and exceeding broader general industry support. This sustained momentum underscores the sector’s ongoing efforts to strengthen investor trust through more disciplined compensation practices and enhanced transparency.

What’s Behind the Support?

1. Sharpened Pay-for-Performance Linkages

Over the last several years, companies have redesigned executive pay programs to directly tie compensation to long-term value creation. Key shifts include:

• Increased use of price-aligned metrics (e.g., free cash flow, EBITDA(X)/operating income) in the annual bonus program.

• Continued focus on performance-based awards as the predominant equity vehicle for senior executives.

• Diversification of long-term performance metrics to reflect a broader measurement of performance; exclusive use of relative TSR as a metric is no longer a majority practice.

2. Streamlined Bonus Structures

Short-term incentive plans continue to be more formula-driven, with less weighting on subjective adjustments and enhanced disclosure of subjective factors considered in final bonus payout decisions. Investors and proxy advisors tend to be strongly supportive of this kind of transparency in bonus plans.

3. Improved Disclosure and Investor Outreach

Companies that received lower support in the previous year (typically below the 70% threshold) responded to shareholder feedback; disclosed actions included:

• Plan changes in response to shareholder concerns.

• Enhanced clarification on how bonus goals are set and how payouts are determined (including the impact of commodity price fluctuations).

• Overall, more transparent disclosures.

Where Some Companies Faced Pushback

While most oil & gas companies in the Russell 3000 received a “For” vote recommendation from ISS and strong shareholder support, eight oil & gas companies received an “Against” vote recommendation from ISS in 2025. Although none failed SOP, support level dropped an average of 14 percentage points versus companies with a “For” recommendation. Key factors contributing to lower support included:

• Use of discretionary or one-time awards without clear rationale.

• Inadequate explanations for compensation decisions.

• Poor responsiveness to the prior year’s low SOP support.

• Above target bonus outcomes against lower goals than prior year.

• Increased equity award values with declining stock price.

These will continue to be areas for companies to focus on to avoid a potential negative reaction. Some of these items (i.e., above target bonus outcomes against lower goals and higher equity values with declining stock price) are potentially recurring issues in a cyclical industry sector like Oil & Gas.

Final Thoughts

The generally strong 2025 SOP season highlighted the oil & gas industry’s responsiveness in recent years to investor concerns. Going forward, companies should continue to engage with shareholders on a regular basis, be responsive to shareholder concerns, and be pro-active when there are any signs of potentially weak support.