Donald Kalfen

Donald Kalfen

On July 13, 2022, the Securities Exchange Commission (“SEC”) adopted amendments to the rules governing advice provided by proxy advisory firms (“2022 Amendments”).

The 2022 Amendments rescind prior conditions a proxy advisory firm (“PAF”) must meet to be exempt from the proxy rules’ information and filing requirements, which will result in public companies being unable to review a PAF’s proxy report contemporaneously or in advance of when it is sent to PAF clients.

Background

Historically, the SEC has exempted certain kinds of solicitations from the proxy rules (i.e., information and filing requirements). For example, the SEC has exempted communications by persons not seeking proxy authority and providing proxy voting advice given by advisors to their clients under certain circumstances. PAFs have historically relied on these exemptions to provide proxy voting advice, without the necessity of complying with the filing and information requirements of the proxy rules.

In 2019, the SEC issued guidance that clarified the application of the proxy rules to the provision of proxy voting advice (the “Interpretive Release”). Under the Interpretive Release, the SEC clarified that PAFs’ proxy voting advice (i.e., vote recommendations) generally constitutes a solicitation under the proxy rules. Proxy solicitations must satisfy Rule 14a-9, which requires solicitations to be free from false or misleading statements or omissions of material facts. A PAF’s failure to comply with the requirements of Rule 14a-9 could subject it to legal sanctions and penalties.

To avoid potential noncompliance with Rule 14a-9, the Interpretive Release suggests that a PAF may need to disclose information on: (i) its methodology used to formulate its voting advice, (ii) the source of third party information (other than information publicly disclosed by the registrant) used to develop its proxy voting advice and (iii) conflicts of interests.

In 2020, the SEC adopted final rules (“2020 Final Rules”) that codified the Interpretive Release. Specifically, the 2020 Final Rules condition a PAF’s exemption from the information and filing requirement on meeting the following conditions:

■ Disclosure of conflicts procedures

■ Adoption of written policies and procedures designed to ensure that the PAF’s proxy voting advice is made available to registrants

■ Adoption of written policies and procedures designed to ensure that the PAF provides clients with a registrant’s views about the PAF’s proxy voting advice, so that they can take such views into account as they vote proxies (collectively, “Exemption Requirements”)

2022 Amendments

The 2022 Amendments to the 2020 Final Rules modify the Exemption Requirements. According to the SEC, the adoption of the 2022 Amendments were motivated, in part, by institutional investors and other PAF clients who have continued to express strong concerns about the 2020 Final Rules’ impact on their ability to receive independent proxy voting advice in a timely and cost-effective manner.

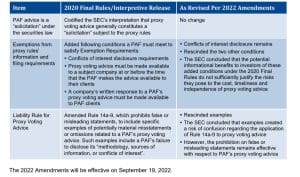

The chart below shows the 2020 Final Rules and the revisions of those rules under the 2022 Amendments.

Views of Institutional Shareholder Services (ISS)

ISS views the 2022 Amendments as not going far enough. In a press release, ISS applauds the SEC “for removing some of the 2020 Final Rule’s more draconian provisions”, but notes “the rule should have been rescinded in its entirety.” ISS further notes that the SEC’s rulemaking “misses the mark by failing to address the most critical defect; namely, the reclassification of proxy advice provided in a fiduciary capacity as proxy solicitation. ISS believes [the SEC’s] decision to regulate a form of independent investment advice as though it were a solicitation of a specific outcome in a shareholder vote exceeds the agency’s statutory authority, is contrary to law, and is arbitrary and capricious.”

ISS made clear that it would continue its litigation against the SEC challenging the 2020 Final Rules and the 2019 guidance on which they were based.

Meridian comment. The SEC’s decision to adopt the 2022 Amendments that eliminate key components of the 2020 Final Rules is not surprising given the SEC’s previous (and highly unusual) decision not to enforce the 2020 Final Rules. The 2022 Amendments eliminate provisions of the 2020 Final Rules that were viewed as a balanced outcome of the years’ long effort to i) enhance PAF regulation, and ii) address the concerns of business groups and certain other market participants. For example, the 2020 Final Rules were supported by the Business Roundtable, Nasdaq, the Society for Corporate Governance and the National Investor Relations Institute, among others.

Due to the 2022 Amendments, companies will need to continue to review reports issued by PAFs in short order following the date of publication and promptly communicate any concerns about material misstatements to the PAFs. A company may choose to go a step further and respond to a PAF’s proxy voting advice in a Form 8-K filing. In this case, a company should be previewing its response among its largest institutional investors prior to the date of the company’s annual shareholder meeting.

* * * * *

The Client Update is prepared by Meridian Compensation Partners’ Governance and Regulatory Team led by Donald Kalfen. Questions regarding this Client Update or executive compensation technical issues may be directed to Donald Kalfen at 847-235-3605 or dkalfen@meridiancp.com.

This report is a publication of Meridian Compensation Partners, LLC, provides general information for reference purposes only, and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.

www.meridiancp.com