Donald Kalfen

Donald Kalfen

On July 13, 2022, the Securities Exchange Commission (“SEC”) proposed new rules on allowable exclusions of shareholder proposals from a company’s proxy.

The proposed rules would narrow circumstances in which a company may exclude a shareholder proposal from its proxy statement. As a result, we may see an increase in shareholder proposals that must be included in company proxy statements.

Background

Rule 14a-8 requires companies that are subject to the federal proxy rules to include shareholder proposals in their proxy statements to shareholders, subject to certain procedural and substantive requirements. The rule is intended to facilitate shareholders’ rights under state law to present their own proposals at a company’s meeting of shareholders and the ability of all shareholders to consider and vote on such proposals.

Under Rule 14a-8, a company may seek to exclude a shareholder proposal from its proxy materials under one of thirteen substantive bases for exclusion (“Exclusions”). If a company intends to exclude a shareholder proposal from its proxy materials, it is required to “file its reasons” for doing so with the SEC. These notifications are generally submitted in the form of no-action requests, with companies seeking the SEC staff’s concurrence that they may exclude a shareholder proposal.

Proposed Amendment to Rule 14a-8

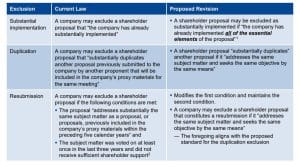

The SEC is proposing to modify the following three Exclusions:

■ The substantial implementation exclusion,

■ The duplication exclusion, and

■ The resubmission exclusion.

The SEC notes that, in the aggregate, the above three exclusions represent a significant percentage of the no action requests the SEC staff has received under Rule 14a-8. Companies often seek to exclude a particular shareholder proposal on several bases and may argue in the alternative.

In the release to the proposed amendment, the SEC claims that the modifications will:

■ Provide greater certainty and transparency to shareholders and companies as they evaluate whether an Exclusion applies to a particular proposal, and

■ Facilitate communication between shareholders and companies on important issues.

The comment period for the proposed amendments ends on September 12, 2022.

Proposed Revisions to Three Exclusions

The proposed amendments would revise the substantial implementation, duplication and resubmission bases for excluding shareholder proposals, in the following respects:

The SEC did not modify the “ordinary business exclusion” but affirmed the standards it articulated in 1998 for determining whether a proposal relates to a company’s ordinary business. A company may exclude an ordinary business related proposal from its proxy statement unless the proposal focuses on a “significant social policy issue.” In November 2021, the SEC revised its interpretative guidance on the “ordinary business exclusion”, and broadened the scope of permissible proposals that address “significant social policy issues”. This has resulted in a marked increase in environmental and social shareholder proposals coming to a vote.

Meridian comment. The proposed rules were approved by a 3 to 2 vote of the SEC’s Commissioners, with the three Democratic Commissioners reversing course from prior SEC actions.

In her statement in opposition to the proposed rule, Republican Commissioner Hester Peirce noted that, only two years ago, the SEC had adopted the last amendments to Rule 14a-8 recalibrating the balance between allowing shareholder proposals to be included in a company’s proxy materials against “the reality that consideration of such proposals consumes company and shareholder resources.” Ms. Peirce said she could not support a proposal that would “upset that careful calibration by narrowing companies’ ability to exclude proposals that they have substantially implemented, are duplicative of other proposals, or are resubmissions of prior failed proposals.” Similarly, Republican Commissioner Mark Uyeda stated that the proposed rules would “effectively nullify the 2020 amendments to the resubmission exclusion and render this basis almost meaningless.”

The proposed rules may result in an increase in the number of shareholder proposals included in company proxy materials, which would result in companies diverting additional resources to respond to these proposals.

¹ The SEC notes in its proposed rule release that the proposed new standard “would still require a degree of substantive analysis – a determination of which elements of the proposal are the ‘essential elements’ and an analysis of whether those elements have been addressed.” A company would be permitted to exclude a proposal it has not implemented precisely as requested as long as the differences between the proposal and the company’s actions are not essential to the proposal.

² In 2020, the SEC amended the threshold levels of shareholder support that must be received in order for a company to exclude a proposal on the basis of the Resubmission Exclusion (see https://www.sec.gov/rules/final/2020/34-89964.pdf). A shareholder proposal would be considered as not receiving sufficient shareholder support if the proposal did not receive at least:

- 5% of the votes cast if previously voted on once;

- 15% of the votes cast if previously voted on twice; or

- 25% of the votes cast if previously voted on three or more times.

* * * * *

The Client Update is prepared by Meridian Compensation Partners’ Governance and Regulatory Team led by Donald Kalfen. Questions regarding this Client Update or executive compensation technical issues may be directed to Donald Kalfen at 847-235-3605 or dkalfen@meridiancp.com.

This report is a publication of Meridian Compensation Partners, LLC, provides general information for reference purposes only, and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.

www.meridiancp.com