Donald Kalfen

Donald Kalfen

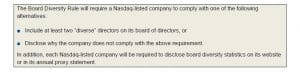

On August 6, 2021, the Securities and Exchange Commission (SEC) approved Nasdaq’s Board Diversity Rule. Nasdaq characterizes this Rule as primarily a disclosure requirement and not a mandate on board composition.

Background of Board Diversity Rule

On December 1, 2020, Nasdaq became the first U.S. national securities exchange to submit a proposal to the SEC seeking approval of new listing rules focused on board diversity (Board Diversity Rule)¹. Nasdaq characterizes the Board Diversity Rule as primarily focused on disclosure of board diversity statistics and not on mandating board diversity. Nasdaq notes that the disclosure standard is designed to: (i) encourage a minimum board diversity objective for companies, and (ii) provide stakeholders with consistent, comparable disclosures concerning a company’s current board composition.

Key Elements of the Board Diversity Rule

Under the new listing rules, each company listed on Nasdaq’s U.S. exchange (subject to certain exceptions) is required to:

- Publicly disclose board diversity statistics in a prescribed format in the company’s annual proxy statement (or similar filing) or on the company’s website.

- Include at least two diverse directors by a specified date, based on the company’s listing tier, as described below, or publicly disclose and explain its noncompliance with the board diversity requirement.

- Generally, a listed company would meet the diversity requirement if its board includes both: (i) a director who self-identifies as female, and (ii) a director who self-identifies as either an underrepresented minority or LGBTQ+.

- “Female” means an individual who self-identifies as a woman, without regard to the individual’s designated sex at birth.

- “LGBTQ+” means an individual who self-identifies as lesbian, gay, bisexual, transgender or as a member of the queer community.

- “Underrepresented minority” means an individual who self-identifies in one or more of the following groups: Black or African American, Hispanic or Latinx, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander, or two or more races or ethnicities.― Nasdaq will not assess the substance of the company’s explanation for noncompliance, but will verify that the company has provided one.

Timeframe for Compliance

The Board Diversity Rule includes the following timeframe for disclosing board-level diversity statistics and complying with (or explaining noncompliance with) minimum board diversity requirements:

- Listed companies are required to disclose board-level diversity statistics using Nasdaq’s standardized disclosure matrix template by the later of August 8, 2022, or the date the company files its proxy statement or its information statement² for the company’s annual shareholder meeting during 2022.

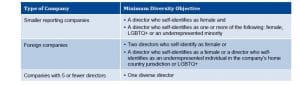

- Listed companies are required to meet the minimum board diversity requirements within a specified timeframe based on their listing tier (or other characteristics), as set forth in the following table:

Companies that do not meet the board diversity objectives within the required timeframes would not be subject to delisting if they provide public disclosure of their reasons for not meeting the objectives.

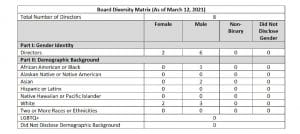

Nasdaq Board Diversity Matrix Template

Companies are required to disclose Board diversity statistics using the following board diversity matrix³ template developed by Nasdaq or a substantially similar format.

A company may supplement the required tabular disclosure with other information such as the skills, experience and any additional attributes (e.g., individuals with disabilities, military veterans) of each of its directors that are relevant to the company. However, a company may not modify the format of the table to include additional attributes of its directors.

Effect of Noncompliance

A company’s failure to adhere to the Board Diversity Rule would cause Nasdaq to take the following actions:

- Notify the company that it is not in compliance with the Board Diversity Rule and allow the company 45 calendar days to submit a plan to regain compliance;

- Upon review of such plan, Nasdaq may provide the company with up to 180 days to regain compliance; and

- If the company does not submit a plan or regain compliance within the applicable time periods, it would be issued a Staff Delisting Determination, which the company could appeal to a hearings panel.

Implementation Guidance

Nasdaq has provided guidance on the implementation of these new requirements, including:

- For the first year a company is required to disclose board diversity statistics, the company is required to publish board diversity statistics for the current year only. Each subsequent year, the company is required to publish its data for the current year and prior year.

- When determining the number of diverse directors, companies may not include emeritus directors, retired directors and members of an advisory board.

- A company that met the diversity objectives but no longer meets the diversity objectives due to a vacancy on its board (e.g., if a diverse director resigns), has a grace period to regain compliance until the later of i) one year from the date of the vacancy or ii) the date the company files its proxy statement in the calendar year following the year of the vacancy.

Board Diversity Services

In order to help advance diversity on boards and help companies comply with the new diversity objective, Nasdaq is offering certain companies complimentary access to two seats of a board recruiting solution, which will allow companies to identify diverse board candidates. Until December 1, 2022, the companies that request access to this service will receive complimentary access for one year.

Special Rules Applicable to Smaller Reporting Companies, Foreign Companies

The Board Diversity Rule allows smaller reporting companies, foreign companies and certain other companies to meet somewhat less rigorous board diversity requirements (or explain why these diversity requirements have not been met).

Meridian Comment. Nasdaq’s Board Diversity Rule reflects the increasing focus on public companies to address representation of women and minorities on their boards of directors. Nasdaq is not alone in seeking to regulate or prescribe standards regarding board composition. California and the State of Washington have both enacted legislation that requires public companies headquartered in California or incorporated in the State of Washington, respectively, to meet board diversity mandates (see Meridian Client Update dated October 22, 2020). In addition, the two major proxy advisors have recently implemented policies on board diversity.

- Beginning this proxy season, (i) ISS and Glass Lewis will generally recommend AGAINST the nominating committee chair if a company’s board does not include any female directors and (ii) Glass Lewis will raise as a concern any board that does not have at least two female directors.

- During the 2022 proxy season, (i) ISS will generally recommend AGAINST the nominating committee chair if a board does not have any apparent racial or ethnic minorities members, absent exceptional

circumstances and (ii) Glass Lewis will generally recommend AGAINST the nominating committee chair if a board with at least seven directors does not include two female directors (Glass Lewis’s current policy requiring a minimum of one female director will remain in place for boards composed of six or fewer directors). - the racial, ethnic, and gender composition of their Boards and executive officers;

- veteran status of any of those directors and executive officers; and

- whether any plan, policy or strategy to promote racial, ethnic, and gender diversity has been adopted.

Also, a pending bill in the US House of Representatives would require public companies to disclose:

1 On February 26, 2021, Nasdaq filed Amendment No. 1 to the proposed Board Diversity Rule, which included material amendments to the proposed rule as originally filed.

2 If the company does not file a proxy, such information would be disclosed in a company’s Form 10-K or 20-F, as applicable.

3 Foreign issuers may elect to use an alternative format for the diversity matrix.

* * * * *

The Client Update is prepared by Meridian Compensation Partners’ Governance and Regulatory Team led by Donald Kalfen. Questions regarding this Client Update or executive compensation technical issues may be directed to Donald Kalfen at 847-235-3605 or dkalfen@meridiancp.com.

This report is a publication of Meridian Compensation Partners, LLC, provides general information for reference purposes only, and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.