Matt Seto

Matt Seto

With the proxy season largely wrapped up for most companies, this update provides a short summary of 2022 highlights in three key areas related to AGM voting:

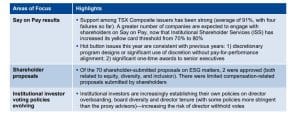

Say on Pay Results

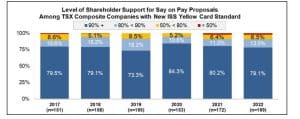

Average level of support is 91% so far this year (through beginning of September). The chart below illustrates historical and 2022 results using the new “yellow card” support standard from ISS in Canada.

On average, over the last six years, the historical yellow card zone of 50%-70% support comprised 2.1% of companies in the S&P/TSX Composite. With the change in the ISS yellow card threshold, an average of 6%-7% of companies would have historically been in this zone, reflecting a roughly 3x increase.

About 9% of companies received Say on Pay support of less than 80% (the yellow card zone or lower)

― 80% support reflects ISS’s new “yellow card” zone in Canada (formerly 70%) aligning with Glass Lewis (i.e., the other main proxy advisor) and CCGG standards; this is the level of support below which ISS expects robust engagement with shareholders on executive compensation issues, including disclosure of this engagement in the following year’s proxy

ISS recommended “AGAINST” Say on Pay at 10 Canadian companies, including:

― Six companies that passed: Cronos Group (95%), GFL Environmental (82%), SmartCentres (70%), Methanex (68%), Colliers International Group (66%), Bausch Health Companies (65%)

― Four companies that failed: CI Financial (45%), BlackBerry (44%), Enghouse Systems (37%), Agnico Eagle Mines (24%)

The drivers of the recommendations AGAINST often included 1) discretionary program designs without pay-for-performance alignment (according to the ISS quantitative tests) and 2) one-time awards to senior executives without sufficient business rationale disclosed.

Shareholder Proposals

We are continuing to see an increase in shareholder-submitted proposals at Canadian AGMs on environment and social matters (n=70 so far). The majority relate to diversity, adoption of French language, and climate change targets. However, the approval rate remains low, with only 2 proposals approved, both related to employee equity, diversity, and inclusion matters (Toromont, 99% support and Constellation Software, 63% support). There were four pay-related proposals, none of which attracted significant support.

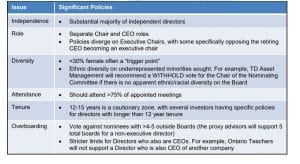

Institutional Investors

Institutional investors are increasingly developing their own policies on Board composition and director elections which, in some instances, are more stringent than those of the proxy advisors:

![]()

The Client Update is prepared by Meridian Compensation Partners. Questions regarding this Client Update or executive compensation technical issues may be directed to:

Christina Medland at (416) 646-0195, or cmedland@meridiancp.com

Andrew McElheran at (416) 646-5307, or amcelheran@meridiancp.com

Andrew Stancel at (647) 478-3052, or astancel@meridiancp.com

Andrew Conradi at (416) 646-5308, or aconradi@meridiancp.com

Matt Seto at (647) 472-0795, or mseto@meridiancp.com

Rachael Lee at (647) 975-8887 or rlee@meridiancp.com

Kaylie Folias at (416) 891-8951, or kfolias@meridiancp.com

Faiza Mirza at (416) 583-3746 or fmirza@meridiancp.com

Jason Chi at (416) 646-0651, or jchi@meridiancp.com

This report is a publication of Meridian Compensation Partners Inc. It provides general information for reference purposes only and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.

www.meridiancp.com