Caroline Montalbano

Caroline Montalbano

In October 2022, the Securities Exchange Commission (SEC) adopted a Final Rule on the Dodd-Frank mandatory compensation recoupment policy. The Final Rule covers nearly all public companies listed on a national securities exchange (including emerging growth companies, smaller reporting companies and foreign private issuers) and requires companies to implement a compliant recoupment or “clawback” policy.

See Meridian’s March 15 Client Alert for additional information on the securities exchanges’ proposed listing standards and estimated timeline to comply.

Although the new rules are not immediately effective, listed companies must adopt compliant clawback policies no later than 60 days after SEC approval of the securities exchanges’ proposed amendments.

Now is the time to review existing clawback provisions and policies and design and implement a clawback policy that is both compliant and supports the company’s governance objectives.

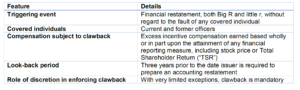

Outlined below are key provisions of a Dodd-Frank compliant clawback policy.

Clawback Policy Implementation Considerations

The new rules are prescriptive and narrow in their definition of triggering events, compensation subject to clawback and limited use of discretion in enforcing a clawback.

Companies may wonder if a broader clawback policy that includes additional covered individuals, different kinds of triggering events (e.g., misconduct unrelated to a financial restatement), a broader definition of incentive compensation and a provision allowing for Board discretion can co-exist with a Dodd-Frank compliant policy.

The short answer is yes, companies can maintain a clawback policy that goes beyond the scope of the new rules. However, companies may find it easiest to implement a standalone compliant clawback policy applicable to financial restatements and maintain a separate clawback policy that covers a broader scope of triggering events, broader definition of compensation or broader population of covered individuals and retention of Board discretion when evaluating these clawbacks.

Considerations for Oil & Gas Companies: Evaluating Going Beyond the Scope of Mandatory Clawbacks

The question of whether to maintain or implement a clawback policy that goes beyond the scope of the new rules is universal across all industries; however, oil & gas companies may find that their incentive compensation designs present unique considerations.

Oil & gas incentive plans often feature greater use of non-financial metrics, separately weighted discretionary components, heavier weighting to long-term incentive (“LTI”) compensation and broader incentive plan participation than other industries. Each of these may be considered when evaluating how broadly to define clawbacks.

Non-Financial Incentive Metrics

As noted above, compensation subject to mandatory clawback is defined as compensation based on the attainment of any financial reporting measure. Although financial measures (e.g., cash flow, returns and cost) feature prominently in oil & gas incentive plans, operational metrics such as production, safety and ESG are still widely prevalent. Companies may consider whether they would like to expand the definition of compensation subject to clawback to capture any misstatement or correction of a formulaic component of all incentive plan metrics, including compensation earned based on the following:

■ Production

■ Reserves Replacement

■ Exploration

■ Safety

■ Spills

■ ESG

■ Strategic measures, including milestones, major projects, acquisitions/divestitures

Since not required under the SEC’s rules, this provision would not have to be a mandatory clawback and could allow for Board judgment in determining whether to clawback any excess compensation.

Many oil & gas short-term incentive (“STI”) plans also include a discretionary component, often separately weighted as part of the overall STI design. Compensation earned for a discretionary or qualitative component will not tie neatly to specific financial or non-financial performance. Similar to the non-financial measures listed above, companies will want to explore how discretionary components of STI plans will be treated for clawback policies. For example, if information used in determining the payout for the discretionary component is incorrect, would the Board want the ability to clawback excess incentive compensation?

Definition of LTI Compensation Subject to Clawback

The Dodd-Frank compliant definition of incentive compensation tied to financial reporting or stock price measures excludes time-based stock options and restricted stock/units. Given the often greater weighting on LTI for oil & gas companies (relative to general industry), this still leaves quite a bit of LTI value outside the scope of the required mandatory clawback.

Although not subject to mandatory clawback tied to a financial restatement, companies may consider whether to include time-based LTI in their definition of compensation subject to clawback under other triggering events, recognizing however, that actually clawing back time-based awards may be challenging to do.

Definition of Covered Individuals Subject to Clawback

Oil & gas companies often award incentive compensation, particularly LTI, further in the organization than many industries. With this broad population in mind, companies will need to evaluate how far to extend the clawback policy and who will be a covered individual in the event of a recoupment by testing the definition of participants subject to clawback across possible triggering events.

Clawback Triggers

In addition to the items mentioned above, companies may consider whether to broaden their definition of events triggering a clawback to include, for example, misconduct, acts in violation of company policies, violation of restrictive covenants, and/or a significant safety or environmental event. These provisions have received more attention following several corporate scandals, particularly if they could have a material adverse effect on the company’s stock price and/or reputation. Some oil & gas companies have already adopted these types of provisions.

Where Do Companies Go from Here?

As noted above, now is the time to get started. We suggest the following steps:

■ Identify and review existing clawback policies, if in place.

■ Identify clawback provisions in other plan documents such as short- and long-term incentive plans, award agreements, employment agreements, retirement plans, severance plans, etc.

■ Compare existing clawback provisions to the new rules to understand differences.

■ Take this opportunity to consider scenarios that may trigger a clawback; how might the company think about compensation subject to clawback and the covered participants in each situation? If not already in place, is this an opportunity to consider a separate, broader clawback policy that extends to situations of misconduct, or expands the definition of compensation subject to clawback, while allowing more discretion in enforcement?

■ Develop a plan for implementation. Early discussions indicate many companies may maintain their existing (or develop a separate) clawback policy that allows discretion when enforcing clawbacks outside the scope of the new rules, and implement a separate, narrowly focused financial restatement clawback policy that complies with the new rules.

With a short window of 60 days to comply once the SEC approves the listing exchange amendments, we encourage companies and compensation committees to explore these topics in the Spring or Summer meetings.

Archived copies of previous Energy Insights can be found by going to www.meridiancp.com/insights and selecting Oil & Gas from the dropdown list.