Donald Kalfen

Donald Kalfen

On October 26, 2022, the Securities and Exchange Commission (SEC) approved (by a 3 to 2 vote) a final rule that requires public companies to adopt and implement a mandatory clawback policy.

The Final Rule covers nearly all public companies listed on a national securities exchange (including emerging growth companies, smaller reporting companies and foreign private issuers).

The Final Rule is not immediately effective. Companies are not required to take any action at this time.

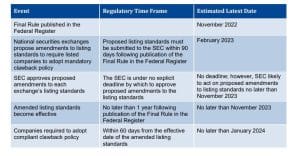

The Final Rule will become effective once the national securities exchanges amend their listing standards to require listed companies to adopt a mandatory clawback policy and the SEC approves such amendments. This process could take up to 15 months, meaning companies potentially would not have to adopt compliant clawback policies until January 2024. The below table outlines key steps and dates in this process:

After the Final Rule becomes effective, listed companies will be required to adopt and implement a mandatory clawback policy. This policy must require a company to recoup “excess” incentive-based compensation paid to an executive officer during a three-year look-back period due to certain financial restatements (subject to certain narrow exceptions). The principal terms of the mandatory clawback policy are described below.

■ Covered Executives. All current and former Section 16 officers (“Executive Officers”) who earned “incentive-based compensation” during a three-year “look back period.”

■ Clawback Trigger Event. A financial restatement due to a material noncompliance with any financial reporting requirement under the federal securities laws, with no requirement of employee misconduct. This includes both “Big R” and “little r” restatements. “Big R” restatements revise historical financial statements to correct errors that were material to those previously issued financial statements. With “little r” restatements, companies must restate prior period information in the current period comparative financial statements since the errors are not material to previously issued financial statements, but would result in a material misstatement if either the errors were left uncorrected in the current report or the error correction were recognized in the current period. A company should discuss with its auditor the nuances between a Big R and little r restatements.

■ Amount Subject to Mandatory Recoupment. “Excess” incentive-based compensation received by an Executive Officer during the three-year look-back period.

■ Look-Back Period. The three-year period ending on the date that a public company knew or should have known that it would be required to issue restated financial statements or, if earlier, the date a regulator advised a public company of the need to restate its financial statements.

■ Incentive-Based Compensation. Any compensation that is granted, earned or vested based wholly, or in part, upon the attainment of any “financial reporting measure.” Financial reporting measure includes any GAAP measure, any measures derived from a GAAP measure and any measure related to total shareholder return and stock price.

■ Excess Incentive-Based Compensation. The amount by which incentive-based compensation received by an Executive Officer during a Look-Back Period exceeds the amount of incentive-based compensation that otherwise would have been received by the Executive Officer had it been determined based on the restated financial results. The recoverable amount would be calculated on a pre-tax basis. For incentive-based compensation based on stock price or total shareholder return, the recoverable amount may be determined based on a reasonable estimate of the effect of the accounting restatement on the applicable measure.

■ Non-Covered Compensation. Salary, discretionary bonuses, bonuses earned for achieving strategic or operational metrics, bonuses earned for achieving subjective standards, time-vested cash awards and time-vested equity awards, including time-vested stock options, stock appreciation rights, restricted stock and RSU grants.

■ Recoupment Mandatory. Companies must recoup excess incentive compensation, except if recovery costs exceed recoverable amount, recovery would violate home country law of the issuer, or recovery would likely cause a tax-qualified retirement plan to fail to meet statutory requirements.

■ Means of Recovery. At the discretion of the company (e.g., seek amounts recoverable directly from Executive Officer; offset amounts recoverable against other compensation due an Executive Officer is allowable).

■ Disclosure Requirements. Companies must disclose their mandatory clawback policy as an exhibit to their Form 10-K filings and, as applicable, disclose the aggregate excess incentive-based compensation attributable to a financial restatement, and certain other related information, in their annual proxy.

We will be publishing a comprehensive Client Update on the Final Rule in the coming days.

* * * * *

The Client Update is prepared by Meridian Compensation Partners’ Governance and Regulatory Team led by Donald Kalfen. Questions regarding this Client Update or executive compensation technical issues may be directed to Donald Kalfen at 847-235-3605 or dkalfen@meridiancp.com.

This report is a publication of Meridian Compensation Partners, LLC, provides general information for reference purposes only, and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.

www.meridiancp.com