Donald Kalfen

Donald Kalfen

As we previously reported, the Securities Exchange Commission (SEC) adopted a Final Rule on the Dodd-Frank mandatory compensation recoupment policy, which comes just two months after the SEC adopted a final rule on its complex pay versus performance disclosure requirement.

The Final Rule covers nearly all public companies listed on a national securities exchange (including emerging growth companies, smaller reporting companies and foreign private issuers) but does not immediately take effect. Companies are not required to take any action at this time.

The Final Rule will become effective once the national securities exchanges amend their listing standards to require listed companies to adopt a mandatory compensation recoupment policy, and the SEC approves such amendments. Companies will have up to 60 days to adopt a compliant policy once the Final Rule becomes effective. This entire process could take up to 15 months, meaning companies potentially would not have to adopt a compliant compensation recoupment policy until January 2024.

Under the mandatory recoupment policy, if a public company is required to issue a financial restatement due to material noncompliance with any financial reporting requirement under the securities laws, the company would be required to recoup “excess” incentive compensation received by a covered executive officer during a three-fiscal-year “look-back period.” No fault on the part of an executive officer is required for excess incentive compensation to be subject to recoupment.

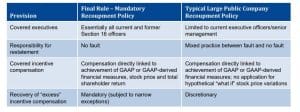

The majority of large public companies already have in place compensation recoupment policies; however, nearly all of these policies are not compliant with the Final Rule’s mandatory recoupment policy. This is predominantly the case because the majority of these policies or provisions allow committee/board discretion to determine on a case-by-case basis whether to seek repayment under the clawback policy – but there are other differences summarized in the table below.

Once the listing standard amendments become effective, companies will be required either to substantially amend their existing recoupment policies or adopt a new compliant policy.

The remainder of this Client Update provides comprehensive details on the requirements of the Final Rule.

Details of Final Rule on Mandatory Recoupment Policy

Overview of Mandatory Recoupment Policy

Public companies will be required to recoup “excess” incentive compensation, if any, earned by an executive officer during a “look-back period” in the event of a financial restatement due to the material noncompliance of the company with any financial reporting requirement under the securities laws. No fault on the part of an executive officer is required for excess incentive compensation to be subject to recoupment.

Amendment to Listing Standards and Covered Entities

The Final Rule directs the U.S. national securities exchanges and associations (“securities exchanges”) to establish listing standards that require listed companies to:

■ Develop and implement written compensation recoupment policies compliant with the Final Rule; and

■ Disclose those compensation recoupment policies and related matters in accordance with SEC rules.

A company that fails to meet the new listing standards would be subject to delisting.

Subject to narrow exceptions, the securities exchanges must apply the new listing standards to all listed companies, including foreign private issuers, smaller reporting companies, emerging growth companies and controlled companies.

The securities exchanges do not have the discretion to exempt certain categories of securities from the new listing standard.

Covered Executive Officers

Mandatory clawback policies will be required to cover essentially all Section 16 officer positions, including president, principal financial officer, principal accounting officer, vice presidents in charge of business units, divisions or functions and any other officer who performance a policy-making function.

The term executive officers includes both current and former executive officers who received incentive-based compensation during the three-year “look-back period” (see discussion below for definition of look-back period).

However, in a change from the Proposed Rule, the Final Rule will only require companies to recover excess incentive-based compensation received by a person (i) after beginning service as an executive officer and (ii) if that person served as an executive officer at any time during the look-back period. Companies will not be required to recover compensation received by an individual while serving in a nonexecutive officer capacity prior to becoming an executive officer.

Restatements Triggering Recoupment of Excess Incentive Compensation

Public companies will be required to recoup “excess” incentive compensation, if any, earned by an executive officer during a “look-back period” in the event of a financial restatement due to the material noncompliance with any financial reporting requirement under the securities laws. No fault on the part of an executive officer is required for excess incentive compensation to be subject to recoupment.

Covered financial restatements include both “Big R” and “little r” restatements. “Big R” restatements revise historical financial statements to correct errors that were material to those previously issued financial statements. With “little r” restatements, companies must restate prior period information in the current period comparative financial statements since the errors are not material to previously issued financial statements, but would result in a material misstatement if either the errors were left uncorrected in the current report or the error correction was recognized in the current period. A company should discuss with its auditor the nuances between Big R and little r restatements.

In contrast to the Proposed Rule, the Final Rule does not define “accounting restatement” or “material noncompliance.” In the Release to the Final Rule, the SEC noted that “existing accounting standards and guidance already set out the meaning of those terms” and that the Final Rule is not intended to affect that guidance.

Certain revisions to a company’s financial statements would not represent the correction of an error and therefore, would not trigger the potential recoupment of excess incentive-based compensation paid to an executive officer. Such revisions include retrospective (i) application of a change in accounting principle, (ii) reclassification due to a discontinued operation and (iii) revision for stock splits, reverse stock splits, stock dividend or other changes in capital structure.

Look-Back Period

Upon a Trigger Event, a public company will be required to recover excess incentive compensation received by an executive officer at any time during the three completed fiscal years immediately preceding the date on which the company is required to prepare an accounting restatement (i.e., lookback period). This date would be the earliest of:

■ The date the issuer’s board of directors, a committee of the board of directors, or the officer or officers of the issuer authorized to take such action if board action is not required, concludes, or reasonably should have concluded, that the issuer is required to prepare an accounting restatement due to the material noncompliance of the issuer with any financial reporting requirement under the securities laws;

or

■ The date a court, regulator or other legally authorized body directs the issuer to prepare an accounting restatement.

Example of Application of Look-Back Period

Assume a calendar year company determined in November 2024 that a restatement of previously issued financial statements is required and files the restated financial statements in January 2025. In this case, the three-year look-back period would cover fiscal years 2021, 2022 and 2023.

The SEC rejected commenters’ suggestions that the look-back period end on the date on which a company actually files restated financial statements.

Definition of Incentive-Based Compensation

“Incentive-based compensation” is any compensation that is granted, earned or vested based wholly, or in part, upon the attainment of any “financial reporting measure.”

Definition of Financial Reporting Measure

Financial reporting measures are limited to:

■ Measures determined and presented in accordance with the GAAP;

■ Measures derived wholly, or in part, from GAAP measures;

■ Company stock price; and

■ Total shareholder return on company stock.

Excluded from the definition of incentive-based compensation are awards that are granted, earned or vested based solely upon the occurrence of non-financial reporting measures (e.g., individual performance goals, qualitative goals).

Financial reporting measures include, but are not limited to (i) revenues, (ii) net income, (iii) operating income, (iv) profitability or one or more reportable segments, (v) financial ratios and (vi) liquidity measures.

Examples of Compensation Treated as Incentive-Based Compensation

Compensation that meets the definition of incentive-based compensation includes, but is not limited to:

■ Non-equity incentive plan awards that are earned based wholly, or in part, on satisfying a financial reporting measure performance goal;

■ Bonuses paid from a “bonus pool,” the size of which is determined based wholly, or in part, on satisfying a financial reporting measure performance goal;

■ Performance share units, restricted stock, restricted stock units, stock options and stock appreciation rights that are granted or become vested based wholly, or in part, on satisfying a financial reporting measure performance goal; and

■ Proceeds received upon the sale of shares acquired through an incentive plan that were granted or vested based wholly, or in part, on satisfying a financial reporting measure performance goal.

Examples of Compensation Not Treated as Incentive-Based Compensation

Compensation that is not treated as incentive-based compensation includes, but is not limited to:

■ Salaries;

■ Bonuses paid solely at the discretion of the compensation committee or board that are not paid from a “bonus pool,” the size of which is determined based wholly, or in part, on satisfying a financial reporting measure performance goal;

■ Bonuses paid solely upon satisfying one or more subjective standards (e.g., demonstrated leadership) and/or completion of a specified employment period;

■ Non-equity incentive plan awards earned solely upon satisfying one or more strategic measures (e.g., consummating a merger or divestiture), or operational measures (e.g., opening a specified number of stores, completion of a project, increase in market share);

■ Time-based equity awards; and

■ Performance-based equity awards for which vesting is contingent solely upon attaining one or more non-financial reporting measures.

Determination of When Incentive Compensation is Received by an Executive Officer

Incentive-based compensation will be deemed received by an executive officer in the fiscal period during which the financial reporting measure specified in the incentive-based compensation award is attained. This would be the case regardless of whether the payment or grant occurs after the end of that period (e.g., the payment of the compensation is subject to a multiyear deferral period) or whether the payment

remains subject to a substantial risk of forfeiture.

Examples of Determination of When Compensation is Received

The following are examples of when compensation would be considered received by an executive officer:

■ If the grant of an award is based wholly, or in part, on satisfaction of a financial reporting measure, the award would be deemed received in the fiscal period when that measure was satisfied.

■ If an equity award vests upon satisfaction of a financial reporting measure performance condition, the award would be deemed received in the fiscal period when it vests.

■ A non-equity incentive plan award would be deemed received in the fiscal year that the executive officer earns the award based on satisfaction of the relevant financial reporting measure performance goal, rather than a subsequent date on which the award was paid.

■ A cash award earned upon satisfaction of a financial reporting measure would be deemed received in the fiscal period when that measure is satisfied.

Ministerial acts or other conditions necessary to effect issuance or payment, such as calculating the amount earned or obtaining the board of directors’ approval of payment, would not affect the determination of the date received. Thus, for example, annual bonus and performance share/unit plan payouts would be deemed “received” as of the last day of the fiscal year, even if final determination and payout occurs in the first 90 days of the following year or if payout is subject to a continuing service condition.

Calculation of Excess Incentive-Based Compensation

Generally, public companies will be required to recoup excess incentive-based compensation received by an executive officer during the applicable look-back period. Excess incentive-based compensation is equal to the excess of:

■ The amount of incentive compensation received by an executive officer during the applicable look-back period over

■ The amount of incentive compensation the executive officer otherwise would have received if the incentive compensation had been determined based on the company’s restated financial statements.

The recoverable amount must be calculated on a pre-tax basis.

Examples of the Determination of Excess Incentive-Based Compensation

The following illustrative examples show the determination of excess incentive-based compensation:

■ For incentive-based compensation that is based only in part on the achievement of a financial reporting measure performance goal. A company first would determine the portion of the original incentive-based compensation based on or derived from the financial reporting measure that was restated. The company would then need to recalculate the affected portion based on the financial reporting measure as restated, and recover the excess of the amount paid over the amount that would have been received based on the restatement.

■ For incentive-based compensation that is based on stock price or total shareholder return. The recoverable amount may be determined based on a reasonable estimate of the effect of the accounting restatement on the applicable measure (e.g., share price). A company would be required to maintain documentation of the determination of that reasonable estimate and provide such documentation to the applicable securities exchange.

■ For cash awards paid from bonus pools. If the size of the aggregate bonus pool from which individual bonuses are paid would be reduced based on applying the restated financial reporting measure, then:

― Where the reduced bonus pool is less than the aggregate amount of individual bonuses received from it, the excess amount of an individual bonus would be the pro rata portion of the deficiency.

― Where the aggregate reduced bonus pool would have been sufficient to cover the individual bonuses received from it, then no recovery would be required.

■ For equity awards with performance-based vesting conditions where shares are still held at the time of recovery. The recoverable amount would be the number of shares received in excess of the number of shares that should have been received applying the restated financial reporting measure.

■ For options or SARs with performance-based vesting conditions that have been exercised, but the underlying shares have not been sold. The recoverable amount would be the number of shares underlying the excess options or SARs applying the restated financial measure.

■ For options or SARs with performance-based vesting conditions that have been exercised and the underlying shares have been sold. The recoverable amount would be the sale proceeds received by the executive officer with respect to the excess number of shares.

Coordination with Sarbanes-Oxley Clawback

In the Release of the Final Rule, the SEC notes that there may be circumstances in which both Final Rule and Sarbanes-Oxley could provide for recovery of the same incentive-based compensation. To avoid this result, the Final Rule provides that if an executive officer returns compensation to a company pursuant to Sarbanes-Oxley, such compensation would not also be recoverable under the Final Rule.

Exceptions to Mandatory Clawback Requirement

Generally, a public company will be required to recoup excess incentive compensation from an executive officer upon a trigger event (regardless of fault), except if the company’s compensation committee determines that such recovery would be “impractical.” The Final Rule does not include an exception to recovery of excess incentive compensation for immaterial or de minimis amounts.

Recovery would be considered impractical under the following circumstances:

■ Recovery costs exceed recoverable amount.

■ Recovery would violate home country law of a foreign private issuer.

■ Recovery would be from a tax-qualified retirement plan which would cause the plan to violate the nonalienation requirements.

Means of Recovery of Excess Incentive Compensation

The Final Rule does not prescribe the means by which a company must recover excess incentive compensation upon a Trigger Event. Rather, the means of recovery is left to company discretion. Regardless of the means of recovery, companies will be required to recover excess incentive compensation “reasonably promptly,” a term that is not defined under the Final Rule.

The Final Rule does not restrict securities exchanges from adopting more prescriptive approaches to the timing and method of recovery of excessive incentive-based compensation.

Disclosure Requirements

Public companies will be required to make the following disclosures:

Disclosure of Mandatory Clawback Policy

Public companies will be required to file their mandatory clawback policies as an exhibit to their annual report on Form 10-K (or Form 20-F or 40-F in the case of foreign private issuers).

Disclosure of Excess Incentive-Based Compensation and Recovery Efforts

If at any time during its last completed fiscal year either a company recovered excess incentive-based compensation from an executive officer or there was an outstanding balance of excess incentive-based compensation due from an executive officer, the company would be required to make the following proxy disclosures:

■ For each restatement:

― The date on which the listed company was required to prepare an accounting restatement;

― The aggregate dollar amount of excess incentive-based compensation attributable to such accounting restatement, including an analysis of how the amount was calculated;

― If the financial reporting measure related to a stock price or total shareholder return metric, the estimates used to determine the excess incentive-based compensation attributable to such accounting restatement;

― The aggregate dollar amount of excess incentive-based compensation that remains outstanding at the end of its last completed fiscal year; and

― If the aggregate dollar amount of excess incentive-based compensation has not yet been determined, disclose this fact, explain the reason(s) and disclose the above information in the next annual report.

■ If recovery would be impracticable, for each named executive officer and for all other executive officers as a group, disclose the amount of recovery forgone and a brief description of the reason the company decided in each case not to pursue recovery.

■ The name of, and amount due from, each current and former NEO from whom, at the end of its last completed fiscal year, excess incentive-based compensation had been outstanding for 180 days or longer since the date the issuer determined the amount the person owed.

Disclosure When Accounting Restatement Did Not Require Compensation Recoupment

If at any time during or after its last completed fiscal year a company was required to prepare an accounting restatement, and the registrant concluded that recovery of excess incentive-based compensation was not required under its clawback policy, the company would be required to disclose a brief explanation of the reason not to pursue recovery.

Modification of Summary Compensation Table Disclosure

If a company recovers excess incentive-based compensation from an executive officer, the company would be required to reduce the amount reported in the applicable column of its Summary Compensation Table, as well as the Total Compensation column, for the fiscal year in which the amount recovered initially was reported, and be identified by footnote. In addition, if a company recovers excess incentive based compensation from an executive officer, presumably, the company would also reduce the amount reported pursuant to the pay-versus-performance tabular disclosure.

Executive Officers May Not Be Indemnified

A public company may not indemnify an executive officer or former executive officer against the loss of excess incentive-based compensation that is recouped by the company. In addition, companies are prohibited from paying or reimbursing an executive officer for premiums paid by the executive officer for coverage under a third-party insurance policy to fund potential recovery obligations.

Effective Date

The Final Rule will become effective once the national securities exchanges amend their listing standards to require listed companies to adopt a mandatory clawback policy and the SEC approves such amendments. This process could take up to 15 months, meaning companies potentially would not have to adopt compliant clawback policies until January 2024. The table below outlines key steps and dates:

Application of Final Rule on or after the Effective Date

The Final Rule applies to incentive-based compensation when both of the following conditions are present:

■ The incentive-based compensation was received due to the attainment of a financial reporting measure based on or derived from financial information for any fiscal period ending on or after the effective date of the amended listing standards (“Effective Date”); and

■ The incentive-based compensation was granted, earned or vested on or after the Effective Date.

This application of the Final Rule could result in the clawback of excess incentive-based compensation that relates to a multiyear award granted prior to the Effective Date but that is received after the Effective Date. For example, if the Effective Date is November 1, 2023, the Final Rule would apply to a performance share award granted on January 1, 2022 that is earned based on the achievement of a three-year financial metric through December 31, 2024.

Meridian Comment

We have the following observations on the newly adopted mandatory clawback rule.

■ Expanding the definition of financial restatement to include both Big R and little R restatements will result in a broader application of the mandatory clawback rule than under the proposed rule.

■ Defining a financial reporting measure to include share price and total shareholder return measures will require companies to determine the effect of a financial restatement on company share price, a complex and uncertain undertaking.

■ Linking the 3-year look back period to the date a company “concludes, or reasonably should have concluded” that the company is required to prepare an accounting restatement will require companies to implement procedures to ensure such date is properly identified.

■ Applying the mandatory clawback rule retroactively to previously granted awards could result in the recoupment of compensation in violation of the terms of such awards under an existing award agreement, equity plan or employment contract.

■ Not requiring companies to clawback excess incentive-based compensation when recovery costs exceed the recoverable amount will help companies avoid seeking reimbursement of de minimis and otherwise relatively small amounts of compensation.

Fortunately, companies will likely have 9 to 15 months before they will need to modify their existing clawback policy, or adopt a new compliant clawback policy. However, companies should add the review (or adoption) of a clawback policy to their 2023 meeting calendar, and inventory existing clawback policies/provisions in preparation for the upcoming review.

* * * * *

The Client Update is prepared by Meridian Compensation Partners’ Governance and Regulatory Team led by Donald Kalfen. Questions regarding this Client Update or executive compensation technical issues may be directed to Donald Kalfen at 847-235-3605 or dkalfen@meridiancp.com.

This report is a publication of Meridian Compensation Partners, LLC, provides general information for reference purposes only, and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisers concerning your own situation and issues.

www.meridiancp.com