Tracy Glassel

Tracy Glassel

Key Takeaways

In our March survey results we reported an overwhelming majority of companies focused on emergency business actions and less on compensation considerations. As of the end of April, it appears companies have taken action on their now identified workforce and compensation strategies. Outlined below are some of the key takeaways.

Impact on the Workforce

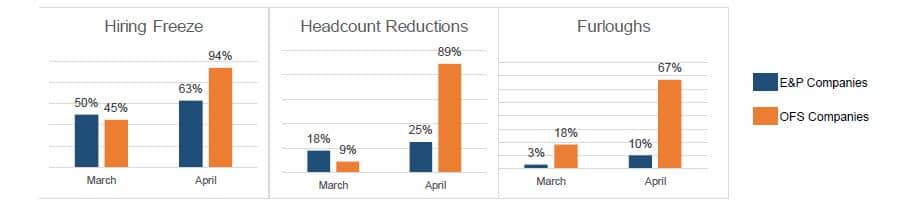

Most companies had quickly implemented a hiring freeze when this crisis began back in early March. Now headcount reductions and furloughs are prevalent within the oilfield services segment; but at this point, remain a minority practice among E&P companies.

Executive salaries reduced

As of April, one-third to one-half of participating oil & gas companies have reduced executive salaries, at least for the top level execs. Cuts range from 10% to 35%, with an average salary reduction of 20%. The duration of these cuts remains uncertain. Will they continue through the end of the year or even into 2021?

Implications for 2020 Bonus

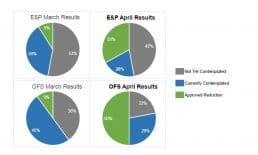

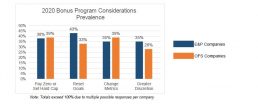

Companies are considering a range of options to address the current environment’s impact on the 2020 bonus program. As of April, ~16% have already zeroed out the 2020 bonus program; other actions being considered for the 2020 bonus are outlined below.

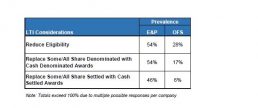

Long-term Incentive Program

As the majority of 2020 annual equity awards were granted prior to the significant downturn, LTI program considerations are predominately focused on off-cycle grants and the potential 2021 LTI program, with limited actions taken at this point.

Retirement Programs

Three-quarters of Oilfield Services companies have approved reducing and/or eliminating company match to employees’ 401(k)/profit sharing program. Less than 20% of E&P participants have approved reductions.

Conclusion

As companies settle into the “new norm” for 2020, the focus will soon likely shift to 2021 compensation program design. How might it need to change? Will oil & gas companies continue their heavy emphasis on LTI?

What are the right incentive metrics? Should oil & gas programs start looking more like “non-oil” programs (i.e., S&P 500)? We promise to keep asking these questions and sharing what we learn with our readers.