Andrew McElheran

Andrew McElheran

Christina Medland

Christina Medland

The budget proposed to eliminate the preferential tax treatment of stock options, above an annual $200,000 face value, for large, long-established, mature firms. (See Meridian’s update here for details of the original proposal.)

The highlights of the implementation language include:

- The new tax rules will take effect for grants made on or after January 1, 2020. Awards made before that time will remain subject to the existing tax rules.

- The existing tax rules will also remain in place for stock options granted at Canadian Controlled Private Companies (CCPCs), as well as at companies that are “start-ups, emerging or scale-up companies” (which will be defined by regulation following a consultation period, ending September 16, 2019).

This means that, in general, an employee at a start-up will continue to be eligible for effective capital gains tax rates on exercise of options, while the company that granted the option cannot claim a tax deduction on this compensation value.

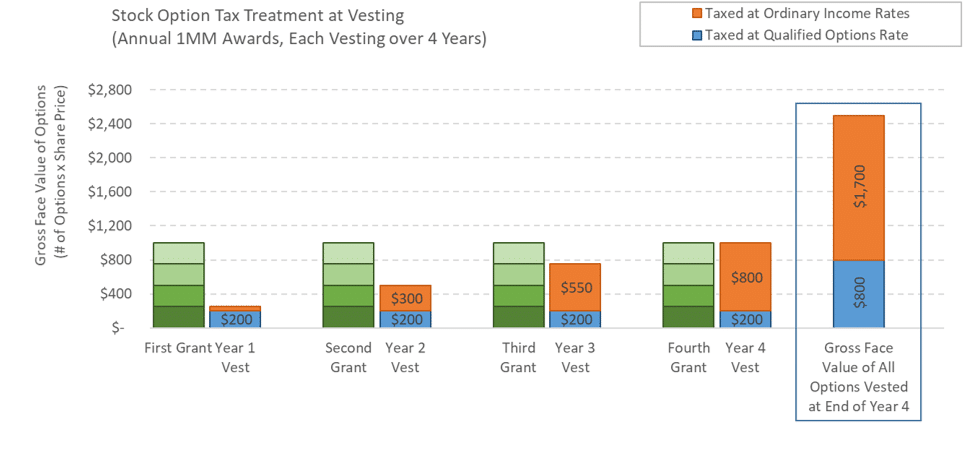

- Starting January 1, 2020, at companies that are not CCPCs or start-ups, up to $200,000 of stock option value that vests each year will continue to be eligible for effective capital gains tax rates. The value will be determined based on the face value of the underlying shares at grant (not based on the Black-Scholes or similar formula). Any additional value vesting in a given year will be “non-qualified” and taxed at full income rates, but the company may claim a deduction on the non-qualified value.

The following graph illustrates how the vesting provisions work with overlapping option awards, on the assumption that each year, the company grants an executive 50,000 options to buy stock at $20/share ($1 million of face value) that vests 25% per year (i.e., $250,000 in face value vests each year).

This is a shift in approach from the initial proposed treatment of stock options, which applied the $200,000 to options granted, rather than vesting in a year. While not a real change in substance, this effectively allows a ramp up of the effect of the proposed legislation over time.

- A company may also designate a stock option award as “non-qualified”, at the time of grant—making the award fully taxable to the executive and also deductible to the company. (CCPCs and other early stage companies may not make this designation.)

- At the time of grant, employers will be required to notify employees in writing that the options are not qualified (either by designation of the company, or because the award is outside of the $200,000 cap). The company must also notify the Canada Revenue Agency of the award of non-qualified options.

- The corporate tax deduction on a non-qualified option will be available to the company if:

- The company was the employee’s employer when the award was granted (which would eliminate the deduction for awards made to employees of a subsidiary—this seems a strange result and it is not clear if this was intended);

- The effective capital gains tax treatment would have been available to the employee had the award been qualified;

- The company has complied with the notification requirements listed in the previous point.

- If there are multiple grant tranches vesting in a year, they will count against the $200,000 limit based on the order in which they were granted. Similarly, if an employee exercises stock options that are identical except some are qualified and some are non-qualified, the qualified options will be deemed to have been exercised first.

Meridian Comment: As expected, many public companies will be affected by this change in tax treatment. The clarification that the $200,000 cap will apply to value vesting in a year means the change will come into full effect more gradually.

The limitations on the preferred tax treatment of stock options aligns with tax treatment in the United States (where income realized upon the exercise of most stock options is taxed at ordinary income tax rates, not capital gains rates). There is a similar tax treatment available for “qualified” stock options in the U.S. (known as “incentive stock options” or “ISOs”), but most U.S. companies issue only non-qualified stock options. We expect that larger Canadian companies may over time, similarly elect to have all options treated as non-qualified options.

We continue to expect that, in light of the proposed legislation, companies subject to the $200,000 cap will take a fresh look at their long-term incentive design and vehicle mix. Option usage may decline and long-term incentive compensation levels may increase.

In order to fill the gap left by a reduction in options, more companies may consider treasury-settled share unit plans, in order to provide a longer term, tax deferred form of equity incentive.

* * * * *

The Client Update is prepared by Meridian Compensation Partners. Questions regarding this Client Update or executive compensation technical issues may be directed to:

Christina Medland at (416) 646-0195, or cmedland@meridiancp.com

Andrew McElheran at (416) 646-5307, or amcelheran@meridiancp.com

Andrew Stancel at (647) 478-3052, or astancel@meridiancp.com

Andrew Conradi at (416) 646-5308, or aconradi@meridiancp.com

Matt Seto at (416) 646-5310, or mseto@meridiancp.com

This report is a publication of Meridian Compensation Partners Inc. It provides general information for reference purposes only and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.