Andrew McElheran

Andrew McElheran

As 2019 comes to a close, this alert provides updates on three fronts:

▪ The implementation date for changes to the taxation of stock options in Canada has been delayed.

▪ A new position paper on the use of non-GAAP performance measures has been released by the Canadian Coalition for Good Governance (CCGG).

▪ Proxy advisor policies for 2020 have now been finalized – most notable is Institutional Shareholder Services’ (ISS’s) formal adoption of Economic Value Added (EVA) as a component of its quantitative pay-for-performance test.

Delay in the New Tax Rules for Stock Options

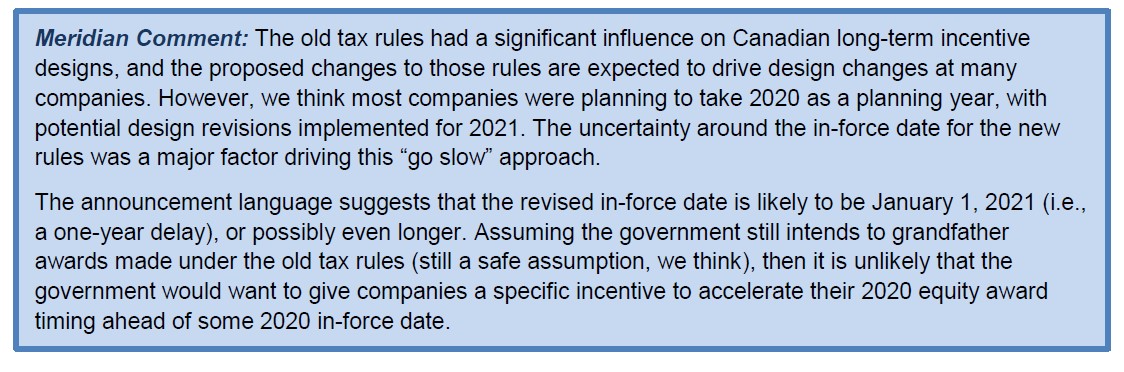

As discussed in earlier Meridian client updates (available here, and here), in 2019 the Federal government announced a planned change to the tax treatment of stock option gains. The essence of the proposal was to remove the effective capital gains tax treatment on stock option gains, for most option awards at most companies. The main outstanding issue was how the government would define “start-up, emerging, and scale-up” companies, which would still be eligible to use the existing tax rules on stock options. A consultation period on this subject closed on September 16, 2019.

Now, the Department of Finance has announced that the new tax rules will not come into force on January 1, 2020, as originally planned. Instead, the coming-into-force date will be announced with the 2020 Budget. The announcement also states that the new effective date “will provide individuals and businesses to review and adjust to the new employee stock option tax rules”.

New CCGG Position Paper

In December 2019 the CCGG, whose membership includes Canadian institutional investors that collectively represent ~$4 trillion in assets, released a research paper entitled “Use of Non-GAAP Measures in Executive Compensation”. The complete paper can be found here. The research was motivated by CCGG’s impression that there was an “increasing prominence” of non-GAAP financial measures in use in the incentive compensation programs at Canadian public companies.

Based on a review of 100 TSX Composite companies, the paper found that:

▪ Adjusted financial measures are used in ~70% of annual incentive plans, and used as the primary determinant (greatest weighting) more than half the time. They are also used in ~45% of long-term performance share unit (PSU) plans, and used as the primary measure 30% of the time. The numbers are lower for long-term plans because relative total shareholder return (TSR), a non-financial measure, is the most prevalent PSU plan metric.

▪ Most adjusted measures are broadly defined (e.g., the definitions provide for adjustments based on high-level criteria such as “unusual items”), and allow for or require significant discretion in their application. Moreover, most companies do not provide any rationale for why an adjustment was used.

▪ The measures have a significant impact on executive compensation, particularly by comparison to their closest GAAP analog.

The paper emphasizes that CCGG does not consider adjusted financial measures to be “inherently problematic”, but believes that their use “necessitates additional disclosure”. It provides a list of potential enhancements to disclosure, including (for example) clear definitions of non-GAAP measures used and reconciliation to their GAAP analogs.

ISS Updates

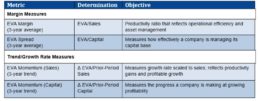

ISS has identified one significant change to its pay-for-performance test for 2020 (for meetings on or after February 1, 2020): the elimination of GAAP financial metrics from the Financial Performance Assessment (FPA) test, and the formal introduction of Economic Valued Added (EVA) metrics in their place. GAAP metrics will still be displayed for informational purposes, but the FPA test will be based solely on four EVA metrics (note, these metrics were included in 2019 ISS reports for information):

Note that the FPA component of the ISS quantitative pay-for- performance test has a fairly limited scope of application: the FPA will be used for companies with a “Low Concern” rating but near the border of a “Medium Concern”, from the initial TSR-based pay-for performance tests, and for companies with an initial “Medium Concern” rating on those initial tests. We expect that a company with borderline TSR-based test results but poor EVA results could have its final quantitative concern rating elevated from “Low” to “Medium”, and vice-versa.

For additional information on EVA as ISS will use it, see Meridian’s client update here.

![]()

ISS will also introduce a 3-year Multiple of Median (MoM) view of CEO pay as a measure of long-term pay on a relative basis. Unlike the 1-year MoM test, which is incorporated in ISS’s pay-for-performance screens, the 3-year test will only be shown for informational purposes.

Glass Lewis Updates

The other main proxy advisor Glass Lewis (GL) has also released its full 2020 policy updates, including:

Director Attendance/Committee Meeting Disclosure

▪ Glass Lewis has codified the factors it will consider when evaluating the performance of governance and audit committee members at TSX companies. GL will generally recommend voting against the governance committee chair when:

1. Records for board and committee meeting attendance are not disclosed, and;

2. Beginning in 2021, the number of audit committee meetings that took place during the most recent year is not disclosed.

▪ Also beginning in 2021, Glass Lewis will recommend against the audit committee chair if the audit committee did not meet at least four times during the year.

Board Diversity

▪ Glass Lewis will not alter its vote recommendation policies on board diversity, but will review any new company diversity disclosure resulting from recent Canada Business Corporations Act (CBCA) amendments coming into effect in 2020 (CBCA’s amendments broaden the meaning of diversity beyond gender diversity to include other “designated groups”, which include Aboriginal persons, members of “visible minorities”, and persons with disabilities).

Board Skills

▪ Glass Lewis clarified its expectation that companies provide meaningful disclosure of board skills in line with developing best practice standards (e.g., board skills matrices). Glass Lewis has developed Board Skills Matrices of its own, which outline the desired competencies of directors in specific industries, but always includes the following four core competencies across all industries: 1.Core industry experience; 2.Financial/audit & risk experience; 3.Legal/public policy experience; 4.Senior executive experience.

For resources companies, as an example, Glass Lewis applies the following additional competencies:

1. Energy/Oil & Gas

2. Environmental/Sustainability

3. Health & Safety

Contractual Payments and Arrangements

▪ Glass Lewis has clarified its approach to analyzing both ongoing and new contractual payments and executive entitlements. In general, Glass Lewis is not supportive of contractual agreements (or the renewal of such agreements) that are excessively restrictive in favour of the executive, including:

1. Excessive severance payments

2. New or renewed single-trigger change-in-control arrangements

3. Multi-year guaranteed awards

Company Responsiveness

▪ Glass Lewis expanded on what it considers an appropriate response following low shareholder support for the last say-on-pay (SOP) proposal, including differing levels of responsiveness depending on the severity and persistence of shareholder opposition. Glass Lewis expects robust disclosure of engagement activities and specific changes made in response to shareholder feedback. Absent such disclosure, Glass Lewis may consider recommending against the upcoming SOP proposal.

The Client Update is prepared by Meridian Compensation Partners. Questions regarding this Client Update or executive compensation technical issues may be directed to:

Christina Medland at (416) 646-0195, or cmedland@meridiancp.com

Andrew McElheran at (416) 646-5307, or amcelheran@meridiancp.com

Andrew Stancel at (647) 478-3052, or astancel@meridiancp.com

Andrew Conradi at (416) 646-5308, or aconradi@meridiancp.com

Matt Seto at (416) 646-5310, or mseto@meridiancp.com

This report is a publication of Meridian Compensation Partners Inc. It provides general information for reference purposes only and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.

www.meridiancp.com