Mere weeks after boards approved compensation outcomes from 2019 performance, there’s a temptation to revisit or change those outcomes under the lens of 2020 performance. We believe that in the large majority of cases, those 2019 outcomes should stand on their own merits. Current events will instead impact 2020 outcomes – meaningfully.

We believe the large majority of companies will not make incentive program or target changes until there is greater certainty and less volatility, absent immediate needs and circumstances (e.g., significant immediate headcount reductions, proxy/activist contests, etc.).

How Compensation will contribute in 2020

The compensation waters may remain calm during these first few weeks, as companies adjust to new working conditions and commit to new 2020 business plans. Very soon, however, compensation will need to contribute quickly to a new set of priorities. It appears that the required G&A reductions at many oil & gas companies may be both near-term and significant.

How might compensation contribute to 2020’s required savings?

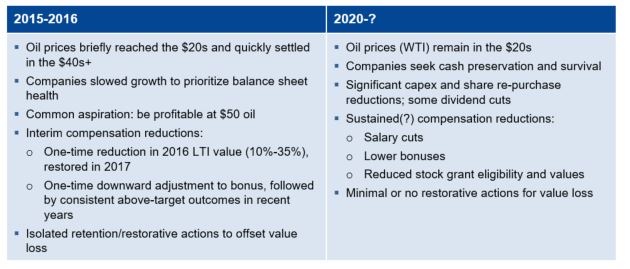

- Salaries. Rescinded salary increases; potential salary reductions (some already announced), that extend across the workforce and up through the executive level (and potentially extending to outside director compensation – please look for a Meridian blog posting on this topic next week).

- Bonuses. More discretion in the bonus; potential early caps (at 50%, 100% of target) or outright cancellations of the 2020 bonus. It’s far less likely that beating a revised business plan will generate above-target 2020 bonuses (in contrast to 2016’s above-target outcomes in many cases). Any bonus deemed affordable for 2020 will likely include ample discretion in the performance and payout evaluation.

- Equity Grants. Reduced LTI grant values for awards not yet made; unlikely supplemental, retention or make-up actions on outstanding stock awards or underwater options.

Permanent Changes will align with the New Energy Landscape

Among the independent energy companies across multiple sectors, future compensation programs seem unlikely to return to last year’s status quo. Under a new competitive and operating landscape, we believe companies will consider wholesale and permanent changes to compensation programs, challenging or up-ending some widely held practices that have evolved over the past two decades.

After companies implement 2020-specific compensation actions, we expect they will turn their attention mid-year to the 2021 program, their model for the future. The new program will still need to engage the workforce to achieve difficult objectives, but probably through different means. Changes may include:

- Lower compensation cost, with pay levels aligned more closely with general industry benchmarks

- Less equity-based compensation; aligned with a focus on returns more than growth (and aligned with general industry standards)

- Less variable pay across the broad workforce; more employees with merely a salary/cash bonus combination

- New performance metrics and standards – perhaps absolute cash profits or returns as prerequisites to fund a bonus

Events and markets over the next several months may offer some relief, but at this juncture we expect that this downturn may create fundamental and lasting change in industry compensation. In many cases, companies will not have time to make “gradual” adjustments. Investors may reward those who reposition sooner under the new value equation.