Christina Medland

Christina Medland

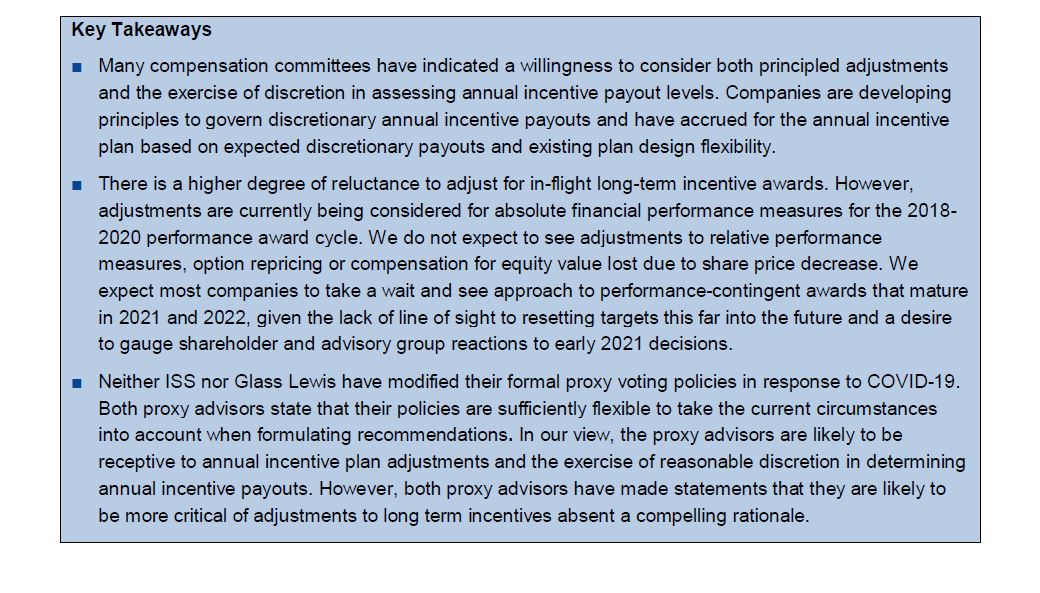

For many companies, incentive goals set before the pandemic have become unachievable. In the short term, companies prioritized emergency planning, safety, layoffs and communications to employees and other stakeholders. A small minority of companies that had clear line of sight by mid-year may have reset annual incentive targets or made changes to their annual incentive plan designs and metrics. However, most companies adopted a “wait and see” approach.

As fall approaches, companies are discussing how to determine annual incentive payouts and what, if anything, to do with in-flight long term incentives.

This client update covers the following:

1. Approaches to assessing annual incentive performance

2. Approaches to in-flight long term incentives

3. Proxy advisor COVID related incentive compensation guidance

We will address annual and long-term incentive program design issues for 2021, and the results of Meridian’s internal on COVID-19 related pay actions, in subsequent Client Updates.

Annual Incentives

We expect that many companies will consider both adjustments to their annual incentive plans, and the pure exercise of discretion, governed by high-level principles.

Adjustment Principles

Many compensation committees already have formal principles for adjustments to incentive plan performance. Some pertain to specific topics like M&A or foreign exchange, while others are higher-level items. We have included sample principles at the end of this update.

Adjustment principles are generally a good starting point for considering annual incentive payouts, with discretion exercised to the extent that stated adjustment categories do not fully address the situation. Adjustments should be considered symmetrically. Many companies have lost significant revenue due to COVID-19, but some companies have benefited from:

▪ Reduced payroll, business development and travel costs, lower turnover, and improved safety;

▪ Improved cash flow by reducing capital expenses, buybacks and/or dividends; and

▪ An accelerated move to more profitable digital operations.

It will be important to be balanced and symmetrical in considering appropriate adjustments and to articulate a compelling rationale for them.

Discretion

For many companies, stated adjustment principles do not adequately address an event like COVID-19. This will mean that a “pure” exercise of discretion may be required to provide an annual incentive outcome that reasonably reflects management’s efforts and achievements. There are two initial considerations for the application of discretion:

■ Review annual incentive plan language (if there is a formal document) – is discretion allowed?

■ Determine if the discretion will apply uniformly across the organization or will be applied only to non- executive employees.

The following factors may provide relevant guidance for the exercise of discretion:

In addition, we expect that many companies will implement specific guardrails to manage affordability:

▪ Cap payout at target—we expect discretion to be used to provide “some” payout, rather than a zero payout, to recognize extraordinary efforts in a difficult year. We do not expect discretion to be used to provide significantly above target payouts—except in extraordinary circumstances.

▪ Profitability/affordability hurdle or pool—we expect to see discretion exercised within explicit affordability limits, which may be pre-determined, including through fixed pools.

The proxy advisors have expressed a preference for companies to make contemporaneous disclosure of changes to annual incentives. We do not expect many companies to make this disclosure and even fewer to make “contemporaneous” disclosure of a decision to use discretion in assessing the payout. However, we think that it makes sense to adopt—as early in the process as possible—a set of principles and contextual information that will be considered by the compensation committee in any exercise of its discretion.

Ultimately, we expect the proxy advisors to consider whether the payout is reasonable under all the circumstances, based on the company’s disclosure. Having a set of principles and information to be considered, determined in advance, is likely to improve both the outcome of the exercise of discretion and related disclosure. It will also help to manage employee expectations.

In-Flight Long Term Incentives (LTI)

We expect to see some companies considering adjustments and/or the exercise of discretion for in-flight LTI, but a much smaller percentage than will do this for the annual plan. However, we do not expect to see the following, except in quite extraordinary circumstances:

▪ Repricing or exchanging of stock options.

▪ Adjustments to relative performance measures (e.g., relative TSR).

▪ Compensation for equity value lost, through a decrease in share price.

▪ Exercising discretion or making changes that result in materially above target payouts on performance contingent plans.

We expect companies to delay making decisions about LTI—i.e., to consider 2018-2020 awards this fall (for calendar year end companies), with final decisions made at the time of award payout in early 2021. While there will be exceptions, we also expect most companies to delay consideration of 2019-2021 and 2020-2022 awards until closer to the time when these awards pay out. There is a concern that targets reset now could look unreasonable in 1.5 to 2.5 years’ time—either because companies have not had the expected recovery and re-set targets remain impossible to achieve, or because companies have had a full rebound which made any reset of targets unnecessary and/or the re-set targets too easy to achieve.

Decisions about LTI will be informed by other compensation decisions—i.e., we may see more appetite for adjusting/resetting LTI at companies that dramatically cut salaries and/or paid close to zero for 2020 annual incentives.

Some of the reasons that companies may approach LTI differently are:

▪ These plans are designed primarily to drive alignment with shareholders (with the annual plan having the labouring oar on driving employee behavior). LTI compensation is often also concentrated at senior leadership levels, which should have pay outcomes more aligned with performance and shareholder experience.

▪ There is often a concept of “enduring standard” in setting long term incentive plan targets—this means that long term targets are set more based on mid-term strategic and shareholder expectations, and less based on the numbers from a 3 year budget/forecast.

▪ The expectation should be that, over the longer term, the LTI will, on average, payout at target.

Proxy Advisor Guidance Related to Incentive Compensation

ISS and Glass Lewis did not change any of their formal proxy voting policies related to incentive compensation. However, both advisors do suggest providing enhanced disclosures that companies might wish to make regarding material changes in their compensation programs.

ISS Guidance

■ In its guidance, ISS encourages companies to provide forward-looking disclosure of 2020 adjustments to shareholders of the nature, scope and rationale for such adjustments. ISS notes that “such disclosures will provide shareholders with greater insights now and next year into the board’s rationale and circumstances when the changes are made.” However, the guidance is silent as to whether such early disclosure would be taken into account when ISS evaluates the merits of design changes to the 2020 annual incentive plan, in 2021.

■ ISS indicated that it would view changes to long-term performance plans skeptically. The choice of vaguer language with respect to annual incentives suggests that ISS will use more rigor in evaluating changes made to annual plans.

Glass Lewis Guidance

■ Glass Lewis did not offer any specific guidance related to annual incentive disclosure beyond suggesting that shareholders are most likely to support changes in compensation programs that are “proportional” under the circumstances, and consider the impacts on both shareholders and employees.

■ Notably, Glass Lewis suggests that companies that have a “good track record on governance, performance and the use of board discretion” prior to the pandemic will be afforded more latitude from Glass Lewis in its analysis.

Sample Incentive Plan Adjustment Principles

1. Adjusted financial and/or operational data will be used in performance measure definitions that better reflects Company XYZ’s economic performance than GAAP/IFRS data.

2. Adjustments are only considered for events that occurred after and were not reflected in the budget/plan applicable to the in-cycle award.

3. Adjustments are only considered for events which are clearly outside the scope of management’s control.

4. Adjustments are considered to prevent management from undertaking discretionary transactions to improve performance or defer decisions that would otherwise negatively impact incentive plan results.

* * * * *

The Client Update is prepared by Meridian Compensation Partners. Questions regarding this Client Update or executive compensation technical issues may be directed to:

Christina Medland at (416) 646-0195, or cmedland@meridiancp.com

Andrew McElheran at (416) 646-5307, or amcelheran@meridiancp.com

Andrew Stancel at (647) 478-3052, or astancel@meridiancp.com

Andrew Conradi at (416) 646-5308, or aconradi@meridiancp.com

Matt Seto at (416) 646-5310, or mseto@meridiancp.com

Kaylie Folias at (416) 644-0733, or kfolias@meridiancp.com

This report is a publication of Meridian Compensation Partners Inc. It provides general information for reference purposes only and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should with appropriate advisors concerning your own situation and issues.

www.meridiancp.com