Jamie McGough

Jamie McGough

For many companies, it is unlikely that there will be significant (if any) payouts under the executive or managerial bonus plans for 2020. Alternatively, for those that do have payouts, it is similarly unlikely that plan mechanics alone will determine final earned awards. Rather, most will have to apply some degree of discretionary adjustments in determining final payouts. Judgments about whether to apply discretion will be influenced by a number of factors. Potential actions for 2021 design may also undergo changes but some additional time is needed for these events to playout and, therefore, will be subject of a subsequent Client Update later this year.

Room for Discretion?

Items that are typically discussed as potential adjustments in bonus plans, e.g., goodwill impairments, unusual gains and losses, foreign exchange fluctuations, one-time items associated with acquisitions and divestitures, and restructuring costs, all have one thing in common – they can be plausibly imagined, even if unlikely, to impact business results when a year begins. Because they are plausible is the reason they are the subject of debate and discussion of whether to make adjustments when they do impact bonus plans – “should we hold management accountable?”

For most, a global pandemic is not likely to be seen as plausibly within realm of business operations. It is for this reason most Committees will be sympathetic toward, and open to, the possibility of the application of discretion in determining earned awards at the end of 2020.

Scorecard of Factors

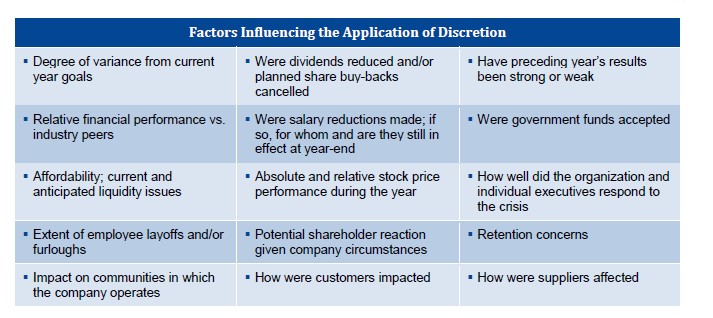

Gauging whether or not discretion is applied in determining an earned award will be highly contingent on a number of factors (see table). The relative importance of these factors will vary from company to company. In some cases, an overwhelmingly negative outcome on just one factor could result in no award. In other cases, several negative factors might, nevertheless, still permit a modest award, especially where individual performance is part of the regular plan design (e.g., 25%). The essential takeaway is that the totality of circumstances as well as considerations of each of the factors below will influence whether a discretionary award is made.

Not only will responses vary by company, indeed, the application of discretion could easily vary within each company as some might conclude to treat senior executives differently than others.

Market Intelligence and Outlook for Annual Incentives

The factors determining whether discretionary adjustments and/or payouts are made will be overwhelmingly based on company-specific factors. However, we can foresee industries that may have greater challenges based on a few of the factors listed that can be quantified. Industries referenced below are based on 6-digit GICS codes.

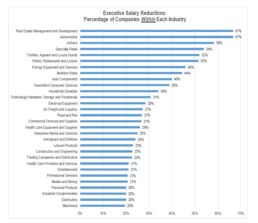

Prevalence of Salary Reductions

Among public companies with annual revenues greater than $400 million, approximately 20% have announced executive salary reductions of one form or another – no doubt in addition to myriad other cost reduction actions. The graphic below illustrates the prevalence of salary reductions by industry. Graph is limited to industries where prevalence is >20%; based on number of companies in the Russell 3000 industry segment.

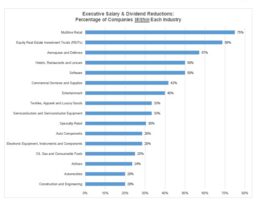

Dividend Reductions or Suspension

Many of these same companies also announced reductions or complete suspension of their dividends. The graphic illustrates industry prevalence of dividend reductions that also made salary reductions. Again, graph is limited to those industries where prevalence is >20%.

Why Focus on Salary and Dividends?

Salary and dividend reductions are particularly unique because they convey the gravity of the liquidity crisis for any company. The industry perspective highlights the pervasiveness among like firms and, therefore, both the competitive backdrop and the industry condition.

This information will be useful for Committees as they assess their company, industry and the variety of steps that have been taken to date. For instance, did our company make such reductions when comparatively few acted in the industry; or did we not have to make reductions while others did? If we made such reductions, were they similar, greater, or lesser? How has our stock price performed vs. our industry for the year? This comprehensive approach helps ensure an informed business decision.

Importantly, there are 18 industries that have no, or very few (<5%), announced salary or dividend actions.

Methods of Applying Discretion

Very few companies are adopting new, revised or “formal” goals for the second half of the year. However, discussions with compensation committees about the state of the current plan and high priority business objectives are occurring. These high priority items will be part of the backdrop for year-end decisions. As few are making any formal assurances to participants that success against these priorities translates into an earned award, there is a high degree of uncertainty. Trust in leadership will be critical to motivating and retaining management teams.

Ultimately, in those instances where discretionary adjustments/payments are made, one or more of the following methodologies are likely to be used:

■ Attempt to neutralize COVID-19 – A sensitivity analysis to understand the magnitude of events and the variance between the two. However, isolating the impact will be a significant challenge for some.

■ Impact of revised business priorities – If performance falls below threshold, threshold funding may be provided to allow for some reward for efforts against new/revised business priorities.

― Actual awards may be made to all participants, or focused on key performers and/or those areas with higher retention risks, depending on individual company circumstances.

― Potential for some variation at business unit levels or individuals that perform at higher or lower levels.

■ Affordability – Percent of target for all participants based on a total bonus pool that is affordable.

■ Judgment – Flat dollar amounts or percentages of salary only for middle or lower level participants –especially for those plans that extend deep into the organization.

Summary

Earned STI awards for 2020 will vary considerably across companies and industries. There will likely be many more zeroes than in past years. At the same time, there will be many companies that apply discretionary adjustments to either the computation of results and/or earned awards. Judgments about whether to apply discretion will be influenced by a number of factors. Taking a comprehensive approach will be essential to an informed business decision.

We are maintaining a regular database of company actions in response to COVID-19 and will continue to keep our clients updated on actions companies are taking related to 2020 annual incentives. We will prepare subsequent client updates related to design considerations for 2021.

* * * * *

The Client Update is prepared by Meridian Compensation Partners, LLC. Questions regarding this Client Update may be directed to Jamie McGough at jmcgough@meridiancp.com.

This report is a publication of Meridian Compensation Partners, LLC, provides general information for reference purposes only, and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.

www.meridiancp.com