Tina Murphy

Tina Murphy

In April 2021, I wrote a blog post that explained the basics of SPACs and detailed their recent rise in popularity (https://www.meridiancp.com/insights/the-basics-of-spacs/). One year has passed since that post and it seems like a good time to reflect on 2021, which I previously dubbed the “Year of the SPAC on Steroids.” In this post, I detail recent SPAC statistics, explain why private companies that went public via SPAC merger may not have been as successful as many had hoped, and discuss how this can affect executive compensation at the newly-public companies.

The SPAC Phenomenon

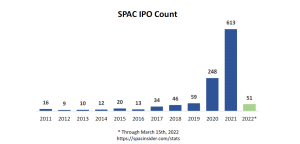

In 2020, 248 SPACs completed an initial public offering. 70 of those SPACs are still searching for a target. In 2021, a record 613 SPACs completed an initial public offering. A whopping 489 of those SPACs are still searching for a target. And in the first 2.5 months of 2022, 51 SPACs completed an initial public offering, with all of them still searching for targets. That means that there are at least 610 SPACs still looking for targets. (https://spacinsider.com/stats/).

SPACs are Struggling After Completion of the Business Combination

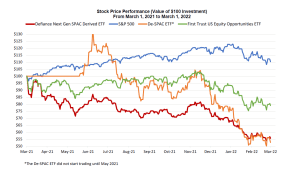

While the S&P 500 is up 10% from March 1, 2021 until March 1, 2022, the Defiance Next Gen SPAC Derived ETF and the De-SPAC ETF, which both track the performance of U.S.-listed private companies that became public as a result of a merger with a SPAC, are both down ~45%. The First Trust US Equity Opportunities ETF, which tracks the performance of the largest and most liquid U.S.-based traditional IPOs, is down 20% over the same time period.

SPACs are struggling after completion of the business combination for a few main reasons:

- Over Supply and Impending Deadlines: As noted above, over 600 U.S.-listed SPACS are currently searching for a company to take public within the next two years. That is more than 1.5x the number of SPACs that have gone public and completed mergers since 2009! As a result, SPAC founders are competing with each other and feeling the market pressure to get a deal done, even if it is not an appropriate fit or the right time. These founders, along with the banks, are also extremely financially incentivized to complete a deal. The founders benefit from the acquisition through their stake in the new company, which is traditionally 20% of the common stock. The founder will make millions of dollars, even if the stock price declines and other shareholders suffer. Banks are also motivated to get a deal done as most of their underwriting fees are delayed until the merger is complete. If investors view this “marriage” as hasty, stock prices will undoubtedly decline.

- Redemptions: As you may recall, SPAC investors have the opportunity to redeem their shares prior to the business combination for a pro-rata share of the funds in the trust account. Even if a shareholder votes in favor of the combination, he or she can still redeem his or her shares. According to SPAC Alpha, from January 2021 to July 2021, the average monthly SPAC redemption rate ranged from 7%-43%. From July 2021 to November 2021, this range jumped to 43%-67%. For Buzzfeed, whose transaction closed in December 2021, almost 95% of the SPAC’s shares were redeemed. As a result, Buzzfeed only raised $16M instead of an expected $288M, which led to another round of financing. These redemptions can erode returns for SPAC shareholders who choose not to redeem shares, as they now have to carry more of the cost. While high redemption rates don’t automatically signal that a company’s shares will perform poorly after the transaction, they do show that investors may be more risk averse than they once were.

- Failing to Meet Business Projections: One reason that SPACs have become so popular is because these private companies can present forward-looking projections for revenue and/or profitability (unlike private companies that go public via traditional IPOs). Publishing a strategic growth plan can often help to attract interest and support. However, many of these newly-public companies are missing the forecasts they used to win over investors, oftentimes just a few months after making those projections. This can lead to significant declines in stock price.

What Does this Mean for Executive Compensation?

The timeline of a SPAC merger is usually 3 to 6 months versus potentially up to a year for a traditional IPO. While this accelerated timeline can be exciting, it can also pose challenges. The new public company has to quickly set up the necessary compensation programs and policies to attract and retain executive talent. Most importantly, the new company will need to determine the treatment of outstanding equity awards, the size of the equity pool going forward, and details of the long-term equity incentive plan.

A majority of newly-public companies provide a grant of equity-based incentives to executives at IPO/consummation of the SPAC merger. This helps to retain top talent and align executives with share-holders. Based on our experience, these grants are sizeable, and often range between 1x and 2.5x the size of the participant’s annual target grant. In a traditional IPO, the company can file a Form S-8 promptly after the public offering is complete, allowing equity awards to be granted immediately. SPACs, on the other hand, are not permitted to file a Form S-8 until 60 days after the business combination is complete.

This 60-day waiting period can pose some interesting obstacles. After the SPAC merger is complete, the newly public company begins trading around $10/share – a value that the company just spent months emphasizing to the SPAC founders and potential investors. But the volatility of the stock price over the next 60 days has proven to be astronomical, and we often see a dip in the stock’s value.

What if the stock price drops to $5/share when it comes time to grant the “IPO Award” 60 days post-merger?

- If the company wants to deliver the initially intended target grant value to each executive, it will now require TWICE the amount of shares. That may not be feasible given the size of the initial share reserve approved by shareholders.

- If the company grants the amount of shares required based on a $10 stock price, each executive will receive HALF of his/her originally intended grant value.

- Although not extremely common, the company may decide to grant shares based on a volume weighted average price (VWAP) to find some sort of middle ground.

- If the company had planned to grant options, there are even more questions about the strike price. Does the strike price remain at $10 (meaning the options are instantly “underwater”), is it set equal to the grant date price, or is it based on a VWAP?

The obstacles created by the 60-day waiting period can lead to a turbulent start for the company’s long-term equity incentive plan. If the company has to use a greater number of shares than originally expected, it may have to request additional shares from stockholders much more quickly than anticipated. On the other hand, if the size of the equity grant is smaller than expected, or the strike price on the options is much higher than the current stock price, the company may face a multitude of retention issues.

The experienced Executive Compensation Consultants at Meridian can help newly-public companies navigate this difficult, yet vital, process as all newly-public companies want to get off to a good start with both executives and shareholders.

Looking Ahead

Due to a systemic decline in SPAC returns, the excess of SPACs currently looking for a target, and greater regulatory scrutiny, I think it’s safe to say that there will be less SPAC IPOs in 2022 than there were in 2021. There are currently 600+ SPACS that are still looking for a target. How many of these will complete a business combination? How many will opt to liquidate? Of those that complete a business combination, how many will be able to create sustained value for its shareholders? These questions will surely be on the minds of potential investors, who must now be more conscientious than ever when investing in a SPAC.