David Bixby

David Bixby

Introduction

Designing and administering an effective executive compensation program can be a delicate balancing act for a public company compensation committee. Balancing attraction, retention, and motivation with fairness to shareholders, or balancing internal strategic alignment with external “best practices” are two common examples. While perhaps not as explicit a consideration, compensation committees must also strike a balance between complexity and opportunity.

In the process of aligning internal considerations with external perspectives, public company executive compensation programs have become increasingly complex over the past twenty years. An increasingly large portion of executive compensation is comprised of performance-based, long-term incentives that tie payouts to achievement of multi-year performance goals. These programs can become quite difficult to communicate to participants and shareholders. In some cases, they can also drive increasingly large grant values and payout multiples in order to maintain the desired level of retention and motivation.

The confluence of enhanced market uncertainty in an election year with the global economic chaos wrought by the COVID-19 pandemic is forcing corporate boards to confront challenging questions about the treatment of outstanding incentive compensation arrangements. Perhaps more importantly, it might also encourage boards to rethink the structure of their long-term incentive programs going forward.

Traditional Long Term Incentive Plans

According to Meridian’s 2020 Governance and Design Survey, the average large U.S. public company CEO has long-term incentive compensation comprised of the following three components (average percent of total value in parentheses):

- Stock options (18%): only have value to executives if stock price increases from the date of grant. They can provide a powerful shareholder-aligned incentive to grow stock price, but they have poor line of sight for recipients, and traditional options are not viewed as performance-based by the leading proxy advisory firms.

- Restricted shares/units (21%): have value to the recipient, even if stock price falls after the date of grant, and vest based upon continued employment. Awards enhance retention and align realized value with shareholders, but some observers deride them as “pay for pulse.”

- Performance shares/units (61%): earned over a multi-year period only to the extent that financial or stock price metrics are achieved over that period. Actual payouts may vary from 0% of target to 200% or more. Investor and advisory firm preferences have accelerated their adoption. These awards can combine positive aspects of stock options and restricted stock but require more time and energy to design, administer, and explain.

Responding to COVID-19

So far our internal surveys indicate that most committees are in a “wait and see” mode, deferring decisions on outstanding cycles until they get closer to the end of each performance period where they can more fairly assess the impact of COVID-19. Our data also indicate that one of the most common adjustments companies plan to make in their 2021 long-term incentive awards is an increased use of time-vested restricted stock.

The rationale for this predicted shift is not hard to understand. In this environment, restricted stock provide two key advantages over performance-based LTI:

- More certain retention value for executives in an uncertain environment; and

- No requirement to set realistic multi-year performance goals, a well-nigh impossible task for some companies right now.

Some increased simplicity and certainty can be a welcome if temporary port in the COVID-19 storm. But should this shift necessarily be temporary?

The Argument for Greater Simplicity

There is a compelling argument, particularly in our current environment, for a more lasting move toward simplicity. However, in the balancing act of executive pay design, there are tradeoffs.

In late 2019, The Council of Institutional Investors (CII) published new executive compensation guidelines that called for simplified compensation programs with more time-vested restricted stock and longer vesting periods. Along with some other preferences, the CII guidelines call for:

- Simple programs that are easy for shareholders to understand and evaluate

- Restricted stock generally preferable to performance-based equity

- Vesting over periods of at least five years (as opposed to the more traditional three-year vesting period for US public companies), with vesting or ownership requirements continuing past retirement

The CII guidelines reflect a concern that the complexity associated with performance-based incentive plans can cloud the pay for performance picture for investors. The enhanced simplicity of more restricted stock can also:

- Simplify disclosure – less complexity in the long-term incentive program could significantly reduce the length of proxy pay disclosures and increase understanding.

- Simplify process – more restricted stock means less wrangling over compensation program design and administration, and leaves more time for managing the business. Crucially for many committees today, this also means less time spent deciding how to adjust metrics in long-term plans that become “broken” by market shocks like COVID.

- Improve “bang for buck” – the expense that must be recognized for a restricted stock grant is almost certain to be closer to the perceived value to the executive than it would be for a performance share or stock option award.

- Reduce dilution – by the same token, a restricted stock award also requires fewer shares to deliver the same expected value as an award of stock options or performance shares and can reduce the rate of shareholder dilution.

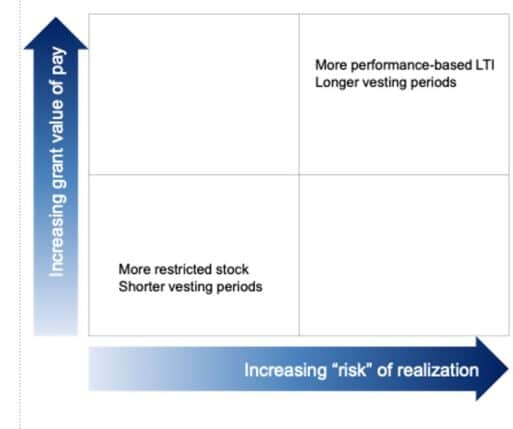

However, no change to the executive compensation happens in a vacuum. As discussed above, CII calls for longer vesting periods – which can help further align executives with shareholders on a truly long-term basis and can potentially help better bridge periods of temporary uncertainty. Another crucial piece of the equation is the size of the opportunity. If companies reduce the inherent “risk” of CEO compensation by reducing or eliminating performance-based awards, they should also consider whether the size of the current pay opportunity should be adjusted accordingly.

Is More Restricted Stock Right for Your Organization?

Given everything happening around us, now may be the perfect time for many organizations to rethink their executive compensation strategy. Simplification should be one of the alternatives on the table. The compensation discussion and analysis section of the proxy continues to expand, and shareholders are looking for greater clarity. Executive teams may also reasonably question whether complex long-term incentive programs actually drive any meaningful change in behavior or performance.

In the end, every company should carefully evaluate the design of their own program and its alignment with their unique business and talent strategies. Upon reflection, some companies may determine that a shift to a simpler long-term incentive program with longer vesting may be a much more effective solution than following prevailing peer group practice.

Get in touch with Meridian Compensation Partners to determine the best performance plan model to adopt as you re-evaluate during this time of great uncertainty. Each organization should consider its options and metrics specific to them, and we can help determine what makes sense to incorporate into a plan.