Jim Heim

Jim Heim

Background

Environmental, Social, and Corporate Governance (or “ESG”) refers to the three central factors in measuring the sustainability and societal impact of a company.

Many small-cap company boards are currently assessing company posture with respect to monitoring and reporting progress relative to various ESG-related topics. A common precipitating event is a direct inquiry from an investors relating to recently published ratings reports from various data vendors and shareholder watchdog groups (the “ESG Risk Ratings” from Sustainalytics¹ are an example).

The overall governance ecosystem, business maturity, and internal resources for these companies differ from large-cap companies. Following is a high level summary of emerging trends specific to how relatively young and growing small-cap companies may link compensation with progress relative to ESG benchmarks and goals, after consideration of:

■ Factors impacting the prominence of ESG measurement and disclosure

■ Compensation-specific perspectives of the “Big Three” institutional investors

■ Reconciling distinct investor perspectives

■ Compiling—and using—data

Factors impacting the prominence of ESG measurement and disclosure

■ The growing interest in ESG metrics is precipitated by both increasing institutional investor focus on sustainable business practices and a re-examination of the role of stakeholder perspectives beyond investors.²

■ A cottage industry of firms specializing in providing sustainability-related analytics has emerged. Reports from standard setters such as the Sustainability Accounting Standards Board (“SASB”) are increasingly considered in institutional investor decisions. The SASB’s has published reporting standards specific to various sectors.³

■ While not required, in recent years most large companies have published Corporate Social Responsibility Reports in response to demands for more transparency on sustainable business practices and societal impact from not only investors but also customers, employees, suppliers and other stakeholders. These CSRs have swiftly evolved from “emerging practice” to “best practice” to “expected practice” for large companies.

■ The SEC’s new 101(c) standard for human capital disclosure (part of the SEC’s Regulation S-K modernization effort) will greatly expand the universe of available data on how companies manage their workforce. The principles-based disclosure may include details on topics ranging from workforce demographics to compensation practices. This expanded disclosure is required beginning in 2021. Over time, sector-specific standards are likely to evolve with respect to the roster of data items that companies disclose.

Compensation-specific perspectives of the “Big Three” institutional investors

BlackRock, Vanguard and State Street Global Advisors (SSGA) have each implemented ESG considerations in their policy voting guidelines. At a high level:

■ BlackRock views the recommendations of the Task Force on Climate-related Financial Disclosures (“TCFD”) and the standards put forth by the SASB as appropriate and complementary frameworks for companies to disclose financially material sustainability information. BlackRock also expects companies to disclose workforce demographics in line with the U.S. Equal Employment Opportunity Commission’s EEO-1 Survey. While BlackRock is vague with respect to how ESG matters are considered when formulating Say on Pay (“SOP”) votes, it does make the statement that “We support incentive plans that foster the sustainable achievement of results.”

■ Vanguard also references SASB and EEO-1 reporting frameworks and is looking for companies to strengthen oversight of diversity-related strategies and risks and to disclose diversity measures beyond the boardroom. In a recent “Investment Stewardship Insight” publication about executive pay during COVID-19, Vanguard encouraged boards to apply both a financial and, increasingly, a social lens when considering how executive pay, HCM, or capital allocation decisions factor into the overall context and public perception of a company’s practices.

■ SSGA has its own ESG scoring system, R-FactorTM. In 2021, SSGA has indicated that it expects US companies in its portfolio to articulate their risks, goals and strategy as related to racial and ethnic diversity, and to make relevant disclosure available to shareholders. SSGA has not yet specifically described ESG-related items that it may consider for its SOP votes.

Reconciling distinct investor perspectives

While there is clear, consistent appetite for additional detail on ESG-related topics in the investor community, it is important to note that investors are not homogenous with respect to their views on items such as HCM (e.g., how to assess and use the information collected). Consequently, internal drivers—not external forces—should represent the foundation for compensation program design.

Do the Company’s strategic business plan and human capital management priorities suggest there are specific ESG-related initiatives that would represent an opportunity for competitive advantage? How might improvement or progress relative to these initiatives be measured? Viewed through these lenses, the Company may be able to generate a roster of measures that will capture the current health of the business and serve to monitor progress over time.

A useful example is diversity & inclusiveness. Different companies may find that their greatest weakness (and perhaps opportunity) is attraction of diverse candidate pools, others may find that they struggle with the retention of mid-career women, while still others may wish to address divergent engagement scores for distinct populations.

Compiling—and using—data

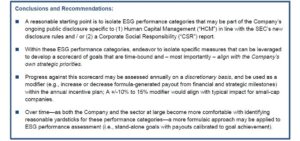

A near-term focus for 2021 may be to develop comfort and expertise in articulating ESG priorities specific to the Company, establish categories of measurement that capture those priorities, and develop specific goals within those categories. Research priorities may include:

■ Understanding what categories of measures are both practical (can be tracked) and useful (align with internal strategic priorities).

■ Become familiar with the scorecards the Company’s own major investors will be using and how SASB views the industry sector.

■ Benchmark how others in the sector are thinking about these issues as indicated in CSR reports. While it is likely not practical for most small-caps to undertake an initiative of similar scope and with as detailed reporting as the typical Fortune 500 company, reviewing a few reports will help to generate a roster of potential goals and better understand how others in the sector are thinking through these issues.

¹ Sustainalytics is a global leader in ESG and Corporate Governance research and ratings. Its research is referenced by many institutional investors.

² Among many examples:

a) In 2016, at the invitation of the International Business Council of the World Economic Forum the influential attorney Martin Lipton of Wachtell Lipton Rosen & Katz prepared The New Paradigm – A Roadmap for an Implicit Corporate Governance Partnership between Corporations and Investors to Achieve Sustainable Long-Term Investment and Growth. The document conceived of corporate governance as a collaboration among corporations, shareholders and other stakeholders to achieve long-term value and resist short-termism.

b) In 2019, 181 CEOs signed the Business Roundtable’s Statement on the Purpose of a Corporation and committed to leading their companies for the benefit of all stakeholders, which includes customers, employees, suppliers, communities, and shareholders.

³ Can be found at https://www.sasb.org/standards-overview/download-current-standards/