Jared Berman

Jared Berman

Adam Hearn

Adam Hearn

In response to the constantly evolving COVID-19 pandemic, companies have announced a litany of executive compensation-related actions including layoffs, furloughs, base salary reductions and much more. For long-term incentives (“LTI”), most companies have adopted a “wait and see” approach with respect to issues like: modeling implications of a V, W or U-shaped recovery; valuing existing equity; evaluating the use of discretion and/or revising incentive targets; and assessing the best approach to LTI design in the years ahead.

This Client Update addresses some of the LTI-related considerations as companies strategize next steps, including:

■ The optics of any changes to incentive pay (both immediately and in subsequent proxy filings);

■ Pre-COVID-19 payout expectations and implications of declining use of both relative performance and stock options prior to the outbreak;

■ Outstanding equity awards with respect to recent stock price volatility, industry dynamics and vehicle mechanics; and

■ Post-COVID-19 grant characteristics, from design and value perspectives, as the full impact of the pandemic is understood and companies look to the future to find ways to engage and retain critical talent.

This is one in a series of Meridian market updates on the impact of COVID-19. Additional materials on developing COVID-19-related compensation trends and legislative developments affecting executive compensation may be found on our website. (Visit www.meridiancp.com/insights for client alerts, blogs and other posts on a wide range of COVID-19 topics and developments).

Background

Most board-level conversations initially focused on comprehending and reacting to the impact of the global pandemic rather than concentrating on issues that may be considered a longer-term priority (e.g., revising current pay programs, rethinking future annual LTI grants, etc.). This is understandable since companies in various industries needed to immediately address urgent safety, operational or liquidity matters to keep businesses running and people safe and employed. However, as we emerge from the pandemic induced lockdown, and begin to approach year-end pay decisions, the time may be ripe to begin a thoughtful review of incentive pay programs.

Boards are right to consider the optics of valuing outstanding and future LTI awards at a time when shareholders may not yet have regained pandemic-related losses and many are still grappling with economic and job loss realities created by this event. That said, it is important for organizations to think through the philosophy and mechanics of their LTI programs now, so that they can most effectively drive desired behaviors as world economies recover. Boards and compensation committees will wrestle with difficult questions, including:

■ What the timing of a future recovery could look like?

■ What new performance metrics might best describe future success?

■ How to incentivize desired behaviors?

■ What retention risks does the company face?

■ What actions should be taken?

■ When it is appropriate to act?

The first issue Boards will need to address is when “wait and see” should give way to “time to act.” Organizations are scrambling to stay informed about how other companies, industries and the economy at large are reacting to the recent health crisis and related market volatility. While there are numerous resources tracking market trends and prevalence data relative to cash compensation decisions, information related to LTI modifications will be slower to materialize as companies are likely to wait longer before taking formal action.

There is additional complexity in that there is not just one correct answer. Each industry faces different pressures and recovery scenarios. Even within a given industry, some companies will be better positioned for a recovery than others. Additionally, some existing plan structures provide more flexibility than others. As such, it is important to consider each company’s specific facts and circumstances before landing on any one solution.

Before COVID-19

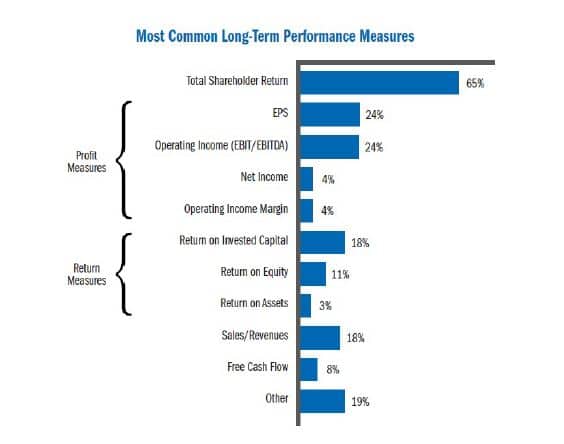

Meridian’s 2020 Trends and Developments in Executive Compensation Survey provides an overview of the pre COVID-19 compensation and governance environment. A brief overview of key highlights of the Survey on pre-COVID-19 long-term incentive awards are provided below, including: (i) use of TSR and other performance metrics in long-term incentive performance awards, (ii) number of long-term incentive vehicles granted and (iii) target value of long-term incentive awards.

The use of total shareholder return (“TSR”) as the sole performance metric has declined over the past four years from 47% in 2016 to 30% in 2020, though a majority of companies still include TSR in their LTI plan on some basis. Many companies have recently reevaluated how effectively TSR has worked for their situation and how much incentive weight to assign it. The use of relative TSR as a modifier to a financial or operating metric outcome is becoming more prevalent.

Over 90% of companies used two or three vehicles to deliver long-term incentives; only 35% of companies used stock options. Additionally, like last year, the vast majority of companies used either one or two performance metrics in their long-term performance plans.

Finally, for those companies that made regular LTI grants in 2020, prior to COVID-19, the majority made grants with a similar or larger targeted value as in 2019.

The vast majority of calendar-year companies made annual LTI grants just prior to the pandemic, so much of this “current” data remains relevant. The question going forward concerns how the “next” annual LTI grants may differ as a result of recent (and potentially long-lasting) events.

During COVID-19

The COVID-19 outbreak has significantly depressed economies worldwide, which has generally rendered business financial projections for 2020 and beyond obsolete in many industries. With respect to outstanding LTI grants, many companies in highly-distressed industries (e.g., hospitality, air carriers, retailers) are faced with depressed stock prices since the original grant date; while companies across many industries are finding that their performance plans may produce no, or substantially below target, payouts.

Many companies are in the early stages of discussions about potential modifications of outstanding PSU plans tied to multi-year goals, with specific attention given to the accounting and disclosure implications of any such adjustments. However, rather than dwelling on the past, we expect that many companies may ultimately decide to leave existing equity arrangements in place and begin thinking in earnest about how the design of their LTI program may need to change for 2021 and beyond.

It is important to consider that the design of a company’s LTI grants will result in different sets of expected outcomes depending on the vehicle. For instance:

1) Stock Options: While recent options may be underwater, they have upwards of 7-10 years to recover. If a company plans to continue using this vehicle (and can afford the potentially larger share usage), stock options can become a strong wealth accumulator aligned with shareholders in next year’s cycle, depending on the timing and strike price of the next grant.

2) Time-Vested Restricted Stock/Units: With stock price volatility, these vehicles continue to maintain value and provide some retention benefits for executives and participants.

3) Performance-Plans Utilizing Relative Metrics (e.g., TSR): Depending on the peer group/index, many of these plans continue to provide a significant possibility of hitting performance goals that will at least partially pay out. Even for those that use a broader index and may be struggling due to their own industry dynamics, next year may position the company for significant upside if they are starting from a lower point on the next multi-year cycle.

4) Performance-Plans Utilizing Financial Metrics: This is perhaps the most challenging vehicle of all. Depending on plan design, COVID-19 could conceivably render three outstanding plan cycles unachievable. Additionally, it could be a few years until there is a payout from this type of vehicle. Future goal-setting may well present more challenges due to uncertainty and volatility.

For those companies that have one-year goals with associated “banking concepts,” multi-year averaging, or enduring growth standards, the design may diminish the impact of the pandemic and provide for some upside in future cycles/years of the plan.

Finally, share prices will likely be impacted differently depending on the industry. Some industries have experienced a severe decline in prices that may be accompanied by a slower/longer recovery (e.g., travel, oil and gas, specialty retail, etc.). Other sectors experienced a sharp decline but have already seen a recovery in share prices in recent weeks (even in some cases to pre-COVID-19 levels). There are yet others that are trading at or well-above pre-COVID-19 levels (e.g., technology). Therefore, the industry and expected recovery time will play an important role on the current evaluation of outstanding equity grants. In addition, a potential “2nd wave” of COVID-19 may introduce added complexity.

After COVID-19

Industries will inevitably rebound at different speeds. Organizations will face the same issues impacting their ability to re-engage key executives and properly motivate desired behaviors in the months and years ahead, regardless of what the specific recovery timeline looks like.

All companies have the opportunity to utilize future incentives as a powerful tool by evaluating the following:

Business Questions

■ What will our industry look like post-COVID-19?

■ How does our organization need to adapt and change to be successful in this new paradigm?

■ What results and behaviors do we want to encourage to position our organization for success?

Incentive Design Questions

■ What should be the vehicle mix for the next round(s) of LTI grants (e.g., increased emphasis on time- based equity, renewed interest in granting stock options, reduced emphasis on performance-based equity, increased reliance on relative performance, use of one-time awards, etc.)?

■ What performance metrics should be used to drive performance in the new business paradigm and how should the incentive curve be set?

■ What is the appropriate range of performance given expected volatility? How will this impact both goal- setting and the range for thresholds/maximums?

■ What vesting and/or performance period is appropriate (e.g., 3-year, 2-year, 1-year goals with 3-year vesting, etc.) given uncertainty in financial forecasting?

■ Were any “gaps” created as a result of many long-term PSUs plans being less likely to pay out as a result of COVID-19 and should this influence our grant decisions?

■ Should grants be smaller to protect against high burn rates and share pool depletion, or larger to address engagement and/or lost value?

In considering these questions, companies will need to give careful thought to not only internal reactions by recipients, but also external perceptions of investors, proxy advisors, employees, media and other stakeholders. Articles already focus on changes at some companies, implying that companies may be taking unfair advantage of current market conditions. In addition, some of the more creative solutions may have accounting and disclosure implications that should be thoroughly vetted as part of the discussion process.

Proactively Considering Long-Term Incentives

Companies that take the time to strategize LTI program designs over the coming months will likely be far better positioned to effectively drive desired performance and engage key talent during a time of tough business conditions. Proactive leadership includes:

■ Identifying and staying close to critical talent;

■ Understanding the impact of recent events on senior management;

■ Assessing the effectiveness of existing LTI programs and making adjustments to the mix, design and size of future grants as appropriate;

■ Communicating a strategy to key leaders early in the process to reestablish expectations; and

■ Using compensation as a tool to encourage key talent to continue making the right choices that will better position your company coming out of this pandemic.

We expect Boards to assess the financial and non-financial challenges that have been created by recent business and economic uncertainty, and evaluate the smartest approach to adjusting long-term incentives going forward to ensure strong engagement as the world recovers. Compensation committees should be given regular updates on management’s thinking and market trends, and discuss these topics over multiple meeting cycles.

There are countless questions with unknown answers but companies that are proactive, thoughtful and strategic with respect to LTI now will undoubtedly fare better than those that simply continue to “wait and see.”

* * * * *

The Client Update is prepared by Meridian Compensation Partners Governance and Regulatory Team led by Don Kalfen. Questions regarding this Client Update may be directed to Jared Berman at jberman@meridiancp.com, Adam Hearn at ahearn@meridiancp.com or Don Kalfen at dkalfen@meridiancp.com.

This report is a publication of Meridian Compensation Partners, LLC, provides general information for reference purposes only, and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.

www.meridiancp.com