Many of the public company boards and corporate executives (very notably, 181 CEOs signing the Business Roundtable Statement avowing Stakeholder primacy1) that are eager to demonstrate this responsiveness cite compensation as an existing, meaningful and highly visible tool that is increasingly being used to reward or penalize executives for ESG performance.

The reality, however, is that most companies that have incorporated ESG into their respective executive compensation programs have done so on a mostly symbolic basis (e.g., ≈ 5% impact). While we do not believe ESG will or should completely replace traditional performance metrics, those companies that want to make more than just a symbolic gesture should consider taking the following fundamental steps.

Select a measure that is right for you: While there is pressure to demonstrate awareness and action on ESG dimensions, keep focused on which ESG measures support the long-term business strategy. Be wary of a checklist approach that diverts focus from your relevant ESG measures or are difficult to support with a rationale for paying for this performance in the Compensation Discussion and Analysis (CD&A). Luckily there are already some groups producing frameworks for ESG measurement2. When an ESG measure(s) is selected, consider the optimal incentive vehicle for recognizing performance (that is, in short-term, mid-term or long-term incentives, as each potential ESG measure likely has its own appropriate measurement timeframe).

Depending on the measure selected, absolute or relative measurement may be appropriate and available for your objectives. For example, certain measures such as gender representation on the board may require absolute goals considering the currently low relative representation in the Russell 3000 vis-à-vis some institutional investors’ expectations. Other measures, like safety, have strong, historical data sets specific to jobs and industries that support relative performance measurement. The decision between absolute or relative measurement should consider both business needs and stakeholder requirements, as well as the available measurement and data alternatives.

Consider how much impact ESG should have: Another fundamental step is determining how “important” the ESG measure is in terms of impacting the payout result. If a performance measure is weighted below 10% it may be appropriate to question its importance and impact on the business. Perhaps the appropriate ESG metric could be measured in other larger / roll-up performance indicators. For example, rather than piecemeal measurement of individual ESG dimensions, such as diversity, inclusion or pay equity, consider a workforce strategy scorecard that as a whole is a significant part of the overall business strategy.

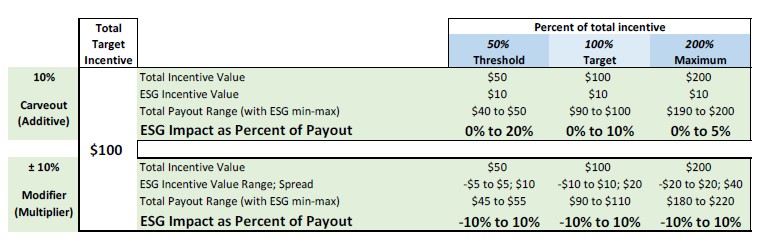

Consider using a ± modifier so it has more impact than a symbolic carve-out: A common model currently employed is to have a simple carve-out (percent of the total incentive value) that is deemed to be earned or not if a criteria or rating level is met. This is generally a symbolic (e.g., 5%) and fixed percentage allocated to ESG criteria.

Alternatively, a modifier (or multiplier) approach leverages the results from traditional measures up or down based on the selected criteria. Philosophically, this approach says that if you perform well in traditional ways AND perform well on ESG, you will get more and if you do not perform well on ESG you’ll get less. The absolute increase and decrease will depend on overall performance – so

you can’t make- up for poor performance in traditional metrics with ESG performance. At the same time, you can lose a significant amount in a traditionally defined “good” year or even target year if ESG performance was poor due to the plus and minus modification range (that is, +10 to -10% will mean up to a 20% swing). This also helps deter cutting corners to max out performance (e.g., safety, etc.). The graphic below shows how the modifier approach is always dependent on overall business performance and has a greater impact at higher levels of incentive payouts.

Consider using discretion: Given the nascent state of many ESG measures and definitions, performance evaluation might need to be somewhat subjective as to what is a “good” outcome versus a “poor” outcome. The reality is that the strategy may be simply to begin moving in the right direction on ESG when timeframes for desired measurable outcomes remain uncertain. Discretion to set appropriate targets and ultimately evaluate progress is a prudent overlay to a plan with ESG objectives, as the evolution of metrics continues and the scope of issues covered under the ESG umbrella grows. Stakeholders as well as participants will also likely welcome the Compensation Committee’s ability to either exercise common sense restraint (like “Guard Rails,” that only affect payouts when performance is either clearly exceeding or failing) or to take action in unforeseen circumstances.

Disclosure and communication: When implementing ESG measures into your incentive plans, internal and external communications are also key. Firmly understanding the purpose and impact of ES&G measure(s) within the business strategy is critical3. If the business rationale is clear and supportable, communication to both incentive plan participants and other stakeholders should easily follow. Outreach efforts with your large institutional shareholders should also regularly include key ESG objectives and progress towards important goals (e.g., sustainability).

* * *

Though still in the developing stages, many companies have made ESG issues a meaningful part of their overall business strategy. In the first steps of using ESG measures in incentive plans, companies may wish to use a performance modifier approach that allows for, but does not force, meaningful recognition of ESG progress. This approach provides the Board an effective tool to use now (or not) while they continue the significant work on honing the measures and determining the appropriate uses and impacts on incentives at their company.

1An Economy That Serves All Americans’, August 19, 2019

2For example, We Mean Business Coalition, Principles for Responsible Investing (PRI) and Sustainability Accounting Standards Board (SSAB) have rating and reporting criteria used by companies and investors.

3For example, Blackrock’s position detailed in Larry Fink’s 2019 Letter to CEOs: Profit and Purpose