Christina Medland

Christina Medland

The significant increase in shareholder activism has many companies and compensation committees playing defense. While the specter of activist interest is generally viewed with concern, looking at your executive compensation programs from the perspective of an activist investor can focus compensation committees on three critical areas:

- Performance of the company relative to competitors for business and shareholder capital

- Executive compensation relative to peers, compared to performance relative to peers

- Stretch in incentive plan target setting and rigor in the evaluation of performance.

Activists tend to focus on companies where they see opportunities to quickly create and unlock shareholder value. Understanding how the company is positioned in these three areas can provide an early warning of potential activist interest, or comfort that activists are not likely to see the company as an ideal target.

1. Performance Relative to Competitors

The first step to understanding whether there is a solid relationship between pay and performance is to understand who the company’s competitors are for business and shareholder investment. The compensation committee should receive information from the investor relations team and senior executives to develop one or two groups of companies that reflect these constituencies. In some circumstances, an index, rather than a custom comparator group may be a better yardstick for assessing relative performance.

Performance should then be assessed relative to the peers, not just based on total shareholder return, but on metrics which are critical to the business and correlated with the creation of long term shareholder value—e.g., EBITDA, revenue, return on capital employed, free cash flow etc., depending on industry and strategy. The use of multiple metrics should ensure that performance is being measured on a basis that supports the longer term growth and health of the business. Performance should also be measured over one, three and five year time periods.

These assessments provide the compensation committee with a robust sense of how the company is performing which provides a foundation for making informed pay decisions. This analysis can also highlight areas of vulnerability to an activist attack (activists are clearly doing this type of analysis in choosing their targets). With an understanding of areas of under (or over) performance, the company can consider its strategy and whether the incentive programs need to be changed to drive performance. The analysis can also inform proxy circular disclosure. Several Canadian companies are now disclosing their pay for performance alignment analysis in various forms.

2. Executive Compensation Relative to Peers and to Peer Performance

When setting compensation levels and looking at pay structures, it is important to compare target pay levels at the company to target pay levels at peers. In assessing pay for performance, it is important to compare actual pay at the company to actual pay at peers. This type of pay comparison should:

- Compare both pay and performance, on a relative basis

- Use realizable pay which reflects actual annual incentive awards, changes in share price from the date of award and the level of performance vesting achieved. Realized/realizable pay should correlate more closely with performance than the grant date fair values required to be disclosed in the summary compensation table

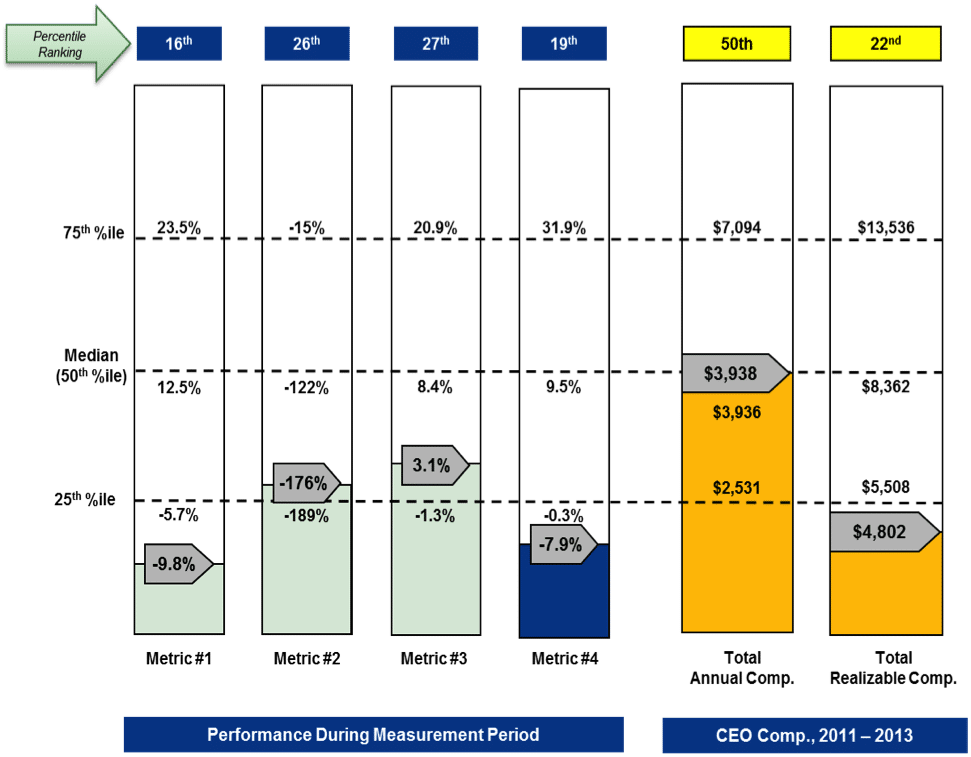

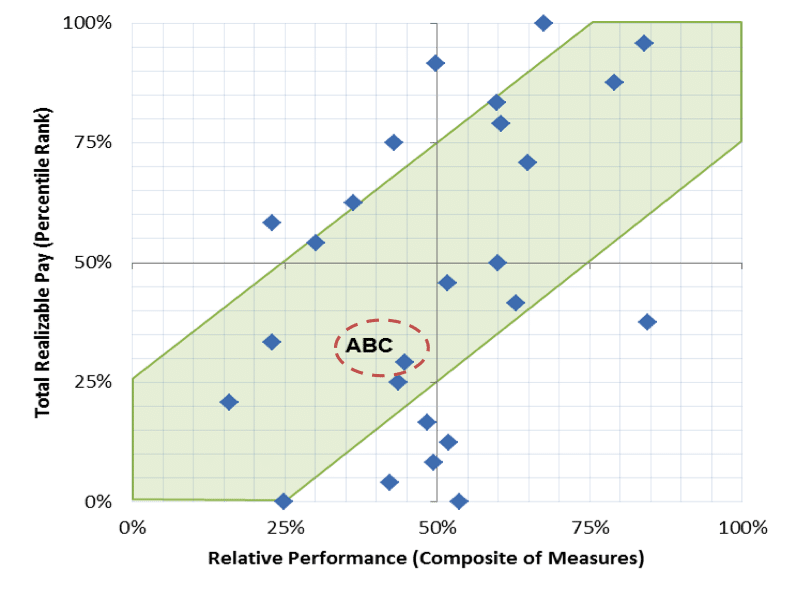

The charts below show the pay and performance at ABC Co relative to its peers. The first chart shows a breakdown of performance on a number of key metrics, the second chart shows the information aggregated to create a “zone of alignment”.

Pay for Performance Measurement

Pay for Performance Measurement

Armed with this analysis, the compensation committee is in a position to identify and address pay for performance disconnects which draw negative attention from shareholders and may give an activist investor a foothold to bring a hostile proxy solicitation.

3. Assessing Stretch in Targets and Robust Performance Evaluation

The key to ensuring that pay is aligned with performance is for the compensation committee and management to ensure that incentive targets are set with sufficient stretch. This is discussed in detail in the Meridian Update titled “Setting Annual Incentive Targets – Increasing Alignment with Performance”.

Equally critical is a robust evaluation of performance against targets. While this may seem straightforward, the two areas that can be challenging are:

- Adjustments made in assessing performance relative to financial statement based targets. Generally adjustments should be for unexpected events that management is not expected to manage—e.g., changes in foreign exchange rates could be adjusted for a mining company, but not for a financial institution, or for “one off” events, such as a significant acquisition or divestiture that was not contemplated as part of the target setting process, or changes in accounting treatment of a material item

- The exercise by the compensation committee of discretion to adjust payouts that would otherwise be driven by the quantitative measures. Generally discretion should be exercised in circumstances where the compensation committee has a compelling rationale to disclose to shareholders.

Thinking like an activist and critically assessing performance and pay for performance can provide:

- An early warning that identifies potential vulnerability to an activist shareholder

- Insights into whether the incentive programs effectively link pay and performance

- A basis for pro-active disclosure to shareholders.

* * * * *

Questions regarding this Client Update or executive compensation issues may be directed to:

- Christina Medland at 416-646-0195 or cmedland@meridiancp.com

- Andrew McElheran at 416-646-5307 or amcelheran@meridiancp.com

- Andrew Stancel at 647-478-3052 or astancel@meridiancp.com

- John Anderson at 847-235-3601 or janderson@meridiancp.com

This report is a publication of Meridian Compensation Partners Inc. It provides general information for reference purposes only and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.