Ryan Harvey

Ryan Harvey

Ron Rosenthal

Ron Rosenthal

To state the obvious, 2020 has been an unprecedented year. The impact of the COVID-19 pandemic and the resulting economic shock has led many compensation committees to wrestle with the treatment of 2020 annual incentives, given the dramatic change in business conditions since the first quarter of the year. Depending on the industry and unique circumstances of the company, we are likely to see a wide spectrum of approaches adopted— from companies that leave 2020 incentives unchanged to companies that modify incentive plan goals to reflect the new business conditions.

As companies prepare for 2021, developing appropriate incentive compensation arrangements and performance goals becomes the next major challenge. Even in an ordinary year, establishing incentive plan goals is often challenging. However, 2021 could be one of the more challenging years in recent memory for setting performance targets given the uncertain economic and political environment. Companies must continue to balance the motivation and competitiveness of incentives with setting appropriate goals that align with investor expectations and hold executives accountable for performance. In the balance of this article, we will explore alternative approaches to annual and long-term incentive (LTI) plan design and goal setting that companies can explore to address this increased uncertainty in 2021.

Annual Incentive Considerations

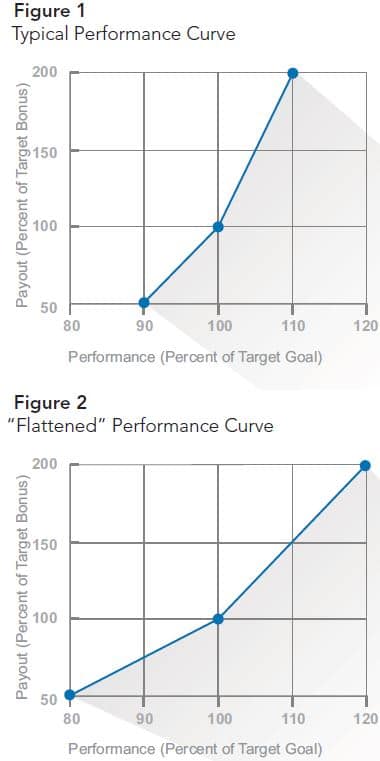

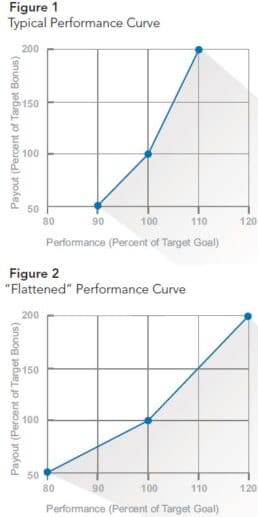

When addressing the difficulty of goal setting in an uncertain environment, the first strategy to consider is adjusting the slope of the “performance curve.” The performance curve is simply the relationship between the performance goals and the corresponding incentive payout.

By flattening the performance curve, a company can reduce the sensitivity of incentive payouts to business performance. This should generally apply to both the “upside” (achievement above target) and the “downside” (performance below target). A flatter performance curve reduces the likelihood of being “out of the money” and, similarly, reduces the likelihood of a maximum payout if conditions improve quicker than expected. Additionally, the incremental change in payouts for performance above/below target will be reduced due to the flatter slope of the performance curve. This approach was commonly used in the Great Recession in 2009 and may be a helpful approach if there is limited confidence in 2021 target setting. (See Figures 1 and 2.)

While a 12-month performance period has long been the standard approach for most annual incentive plans, if uncertainty is particularly high in 2021, companies could also consider the use of two semi-annual or four quarterly performance periods. Under this approach, the target bonus opportunity is allocated amongst each performance period. Goals are established at the beginning of each period, and the payout earned is determined following the end of each period (and either paid currently or “banked” and paid following the end of the full year). The compensation committee would have an opportunity to consider changes in the economic environment and business expectations when setting targets for subsequent performance periods, allowing for a more dynamic goal-setting process.

Dividing an annual incentive into shorter performance periods adds some complexity to the plan design, increases the need for frequent participant communication and no longer ties the annual incentive to achievement of the annual budget/operating plan. However, in a highly volatile economic environment, this approach can help avoid setting performance goals that the board and management later find to be regrettable based on changing business conditions.

Companies could also review the type and weighting of performance metrics for 2021. While financial metrics such as earnings growth, revenue and cash flow typically receive substantial weighting in annual incentives to drive achievement of key financial objectives, companies could consider moderately decreasing the weighting of such metrics for 2021 to lower the risk of setting financial targets in a period of limited visibility. Instead, companies could consider increasing the weighting of (or including) strategic, operational and/or ESG metrics to drive achievement of key initiatives and increase the weighting on measures that are likely to be more within management’s control in 2021.

Long-term Incentive Considerations

For the last decade, the majority of senior executives’ LTI opportunity at many companies was granted in the form of performance shares or similar arrangements, in response to investors’ preference for strong alignment of pay and performance. However, for companies with significant business uncertainty in 2021 that have traditionally tied vesting of performance shares to attainment of financial targets, the first question that needs to be considered is whether performance shares should be awarded in 2021. Most performance share arrangements have a three-year performance period, which only further exacerbates the goal-setting difficulties. While in most cases the performance/alignment benefits of continuing to grant performance shares will outweigh the goal-setting challenges, some companies may consider reducing the weighting of, or eliminating, performance shares for 2021 annual grants and re-allocating the target opportunity to either time-vested stock options and/or restricted share units.

For the majority of companies that choose to maintain the use of performance shares in 2021, some of the same considerations discussed previously for annual incentive plans will apply to performance share goal setting. For example, companies could consider flattening the performance curve to address uncertainty.

Additionally, a company might consider the use of relative metrics, where appropriate. Measuring performance relative to other companies eliminates the challenge of setting an absolute goal. However, incorporating a relative metric requires the availability of comparable peer companies with similar business dynamics. It also requires companies to identify a metric that is easily comparable across companies without adjustments. Total shareholder return (TSR) is the most widely used relative metric, and we may see increased use of TSR as a metric in 2021. Where appropriate, we may also see an increase in the prevalence of market share metrics or even relative financial metrics, if companies are willing to use unadjusted GAAP results.

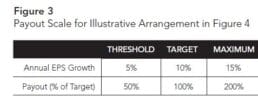

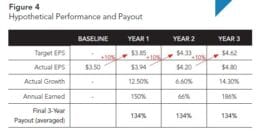

Most performance share arrangements measure performance over three years. Measuring performance over a multi-year period will continue to be the ideal. However, another approach that can address uncertainty is to use three one-year performance periods. A goal-setting approach for such a design that can be particularly effective is to set three annual growth goals with each year’s growth calculated based on the prior year’s actual performance. All three annual growth targets are set at the beginning of the three-year period. However, each year’s performance is measured independently based on its growth over the prior year. This allows for some opportunity to earn an incentive even if performance for one of the years is well below expectations. Likewise, if a single year is well above expected performance, the following year’s growth is measured from that strong year, thereby increasing the required performance in the following year (See Figures 3 and 4.)

2020 has truly been an “unprecedented” year, and 2021 is shaping up to be nearly as challenging for establishing reasonable performance targets. Companies’ approach to incentive compensation arrangements may require some unconventional thinking in 2021, but should also remain true to strong governance and performance principles that have guided past design, whenever possible.