The Holy Grail in executive compensation is to achieve strong alignment between pay and performance. In the quest to achieve this alignment, management teams and board members strive to design the perfect incentive structures, using the most appropriate performance measures for their industry and individual company circumstances. However, even the most effectively designed incentive can’t overcome inappropriate goals and payout curves.

In today’s economy, there are many headwinds to setting motivating, yet stretch performance goals. The pace of change in many industries has been growing dramatically. Companies face growing economic uncertainty on a global basis. M&A has been an increasing component of many corporate strategies. Add these to the traditional challenges around cyclicality, as well as foreign exchange or commodity price fluctuations, and you have a perfect storm of uncertainty.

Let’s face it, directors will never know as much as management about potential performance when trying to set goals for annual incentive plans or long-term incentive plans (including performance shares and long-term cash plans). However, there are steps directors can take to level the playing field somewhat. And, when faced with increasing uncertainty (either systemic or episodic), there are tools to keep incentive plans motivational, without giving away the store.

Covering the Basics

Before reviewing and approving incentive plan goals, directors should arm themselves with the following information:

- Historical company performance. Look back across 5-10 years at several relevant performance measures. Even look at measures not formally used for incentive purposes. For those measures used in incentives, how often did the company pay above target? Below target? At maximum? How often (if at all) did the company pay no incentive?

- Peer group performance. For the same time period as above, how did the company perform against peers? Did the top bonus years coincide with peer group outperformance? In general, did payouts line up with relative performance? (Note: Don’t expect perfect alignment every year; no one has a crystal ball. But rather, look for overall trends.)

- Long-range plan. Have a deep understanding of the company’s long-range business plan. Have a firm understanding not only of where the company wants to be in 3, 5, or even 10 years, but also understand what interim steps are necessary to get there.

- Analyst and shareholder expectations. While they will never have the same level of inside knowledge that management or the board has, they have analyzed what you’ve told them and they know what’s going on in your industry. Therefore, their conclusions are worth noting. At a minimum, management should be able to explain any significant discrepancies between goals and street expectations.

- Impact on value. Once management puts forward suggested goals and payout ranges, be sure to understand the impact of those payouts on earnings and shareholder value. Understand the “sharing ratio” between shareholders and management. Does it feel appropriate and fair?

With this solid foundation, directors will be better equipped to review the appropriateness of management’s recommendations on incentive plan goals and payout curves.

Addressing Uncertainty

There are a number of tools companies can use to adjust incentives in the face of heightened uncertainty.

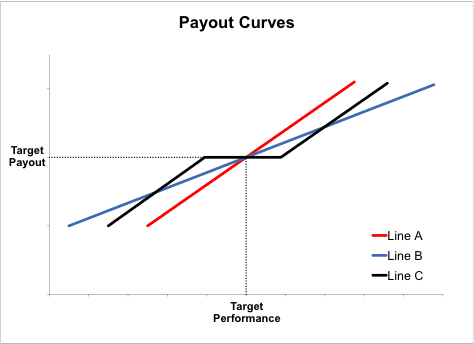

Change the Payout Curve

For both annual and long-term plans, most companies adhere to a traditional payout curve, with a threshold set at 80% or 90% of target, and maximum set at 110% or 120% of target. (See line “A” below) In times of uncertainty, these ranges can be widened to accommodate increased volatility. (See line “B” below) The range can be widened by either lowering the threshold, or increasing the maximum, or both. It’s not necessary to be symmetrical. In deciding how far to move the ends of the range, discuss probabilities with management, using the following guidelines:

- Threshold: There should be a 90% probability of achievement. You want to make sure participants have an opportunity to receive some level of incentive in most situations.

- Target: Targets are generally sent with a slightly better than even chance of achievement – i.e., 50% – 60%.

- Maximum: There should be only a 10% to 20% probability of achieving maximum performance levels.

If expected volatility is mainly around the target, rather than the potential swings at either end of the range, you can also flatten out the curve in the middle, creating a flat range around target. The payout curve does not need to be linear from top to bottom. (See line “C” below) These adjustments work well in either annual or long-term plans.

Apply Discretion

While considered a “dirty word” among proxy advisory firms, there are many situations in which directors can and should use discretion. Its use can be particularly useful in times of uncertainty. There are several ways for the Compensation Committee to exercise discretion:

- Pool Funding: Under this approach, a certain percentage of earnings, or a pool created based on other measures, is funded. From this pool, individual bonuses are determined based on a review of the year’s performance against established goals, but without using a rigid formula. Relative performance against the year’s headwinds (or tailwinds!) can be factored into this assessment.

- Discretionary Ranges: This approach adds a bit more structure by establishing performance ranges. If performance falls within a pre-established range, payouts may range from 80% to 120% of target, for example, based on the Committee’s discretionary assessment. Performance below that range, results in payouts of less than 80%, and performance above results in payouts above 120%.

- Discretionary Override: If additional structure is desired, a formula can be established, with a formal threshold, target, and maximum. However, the Committee reserves judgment to adjust final awards based on a variety of factors (e.g., quality of earnings). These factors should be established when goals are set at the beginning of the year so expectations can be appropriately managed.

Discretion is most commonly used in annual incentives, as allowing significant discretion in long-term plans can create accounting and tax-deductibility issues. It’s also important to understand that any use of discretion by the Committee can be judged harshly by proxy advisory firms. However, clear disclosure on the rationale, explanation of the special need for discretion based on industry, company, or economic factors, and drawing the linkage to actual performance can often convince shareholders that you’ve acted in their best interest.

Go Strategic

When a company is seeking to “reboot”, or make a fundamental shift in strategy (e.g., major capital investment in new product line), setting formulaic performance goals can be especially problematic. During these times a company may want to reduce or eliminate its reliance on annual formula driven measures and focus on strategic goals or milestones. Under this approach, it’s critical to have a common understanding between management and the board on how target, threshold, and maximum are defined. That definition may change as circumstances change, making ongoing communication throughout the year crucial. This approach is almost exclusively applied to annual incentives, versus long-term incentives.

Diversify

A similar approach to going strategic for annual incentives would be to diversify the measures, decreasing reliance on any one formulaic measure. Companies can create a scorecard, dashboard, or combination of formulaic and strategic goals to help mitigate the impact of uncertainty.

Use Relative Performance

The use of relative performance (relative to either peer companies or an index) is a great way to mitigate uncertainty in certain situations. To take advantage of this approach, it’s crucial that a company have peer companies facing the same source of uncertainty, or an index that addresses the source (such as for commodity pricing).

Relative performance often works best in long-term incentive plans. However, it can be used effectively in short-term plans, particularly when used as one of the discretionary factors applied by the Committee.

In Summary

Regardless of the source of uncertainly, there are several approaches that directors can take advantage of to ensure incentives remain motivating and continue to drive desired results. While these approaches may require a departure from traditional formulaic incentives, their use can help enhance motivation, while maintaining the integrity of your incentive structure and alignment with shareholder interests.

Annette Leckie is a Partner in Meridian’s Boston office. Additional information about Meridian can be found at www.meridiancp.com.