Donald Kalfen

Donald Kalfen

Institutional Shareholder Services (ISS) recently issued its 2022 Policy Survey Questionnaire, which generally previews potential changes in ISS’s proxy voting policies.

Through its annual policy survey, ISS seeks feedback from institutional investors, public companies, corporate directors and the consulting and legal communities on emerging trends in corporate governance, executive compensation and other matters as part of its policy formulation process. The policy survey often provides an early read on ISS’s emerging views on a particular issue.

The Survey also includes questions on other governance topics such as virtual-only meetings and Special Purpose Acquisition Corporation (SPAC) transactions. ISS also issued a separate Policy Survey that includes questions related to climate change.

The Policy Survey will be open for participation until Friday, August 27. The Survey can be completed online by going to the following webpage: https://www.surveymonkey.com/r/ISS_2021_Primary_Benchmark_Survey.

The results of the Policy Survey are expected to be published in September. To provide ISS with a corporate perspective, we recommend that public companies complete and submit the Survey, and consider gathering input from Board members, as appropriate. Meridian will be submitting a response as well.

Non-Financial ESG Performance Metrics in Executive Compensation

Currently, ISS does not have a policy on whether a company should include non-financial ESG metrics in their incentive programs for executive officers. ISS notes in the Survey “the upward trend of companies incorporating non-financial ESG-related metrics into compensation programs” and cites rationales in favor and against the inclusion of ESG metrics in incentive programs. Specifically, ISS notes that critics and sceptics are concerned that “many ESG outcomes may be hard to quantify and that the more widespread use of such performance metrics could reward executives for vague and poorly-defined outcomes that should already be considered part of the executive’s job.”

The Survey asks respondents to identify whether incorporating non-financial ESG metrics into executive compensation programs is an appropriate way to incentivize executives by choosing among the following responses:

- No, non-financial ESG performance metrics are not usually relevant or effective as compensation program measures. Compensation programs should only use traditional financial performance measures, for transparency and to maintain alignment with shareholders’ financial interests.

- Yes, but such metrics should only be used in compensation programs if the metrics selected are specific and measurable, and their associated targets are communicated to the market transparently

- Yes, when chosen well, even ESG-related metrics that are not financially measurable can be an effective way to incentivize positive outcomes that may be important for a company

- Other

The Survey also asks respondents to identify the pay components that are most appropriate for inclusion of non-financial ESG metrics if a company decides to use them by choosing among the following responses:

- Short-term incentives

- Long-term incentives

- Both short-term and long-term incentives – either can be appropriate depending on the circumstances

- Other

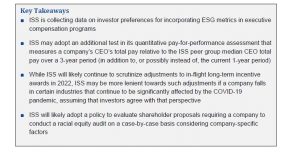

Meridian comment. While ISS appears to be collecting feedback on investor preferences regarding the recent trend of including ESG metrics in annual incentive plans, we do not expect ISS to adopt a prescriptive policy in this area at this time.

ISS Quantitative Pay-for-Performance Methodology (U.S. and Canada)

Currently, ISS’s pay-for-performance evaluation for Russell 3000 companies includes a three part quantitative analysis¹ of CEO pay and company performance. A company that receives a “medium” or “high” overall concern level under the quantitative tests is subject to a more in-depth qualitative pay-for-performance assessment. Based on the outcome of its pay-for-performance evaluation, ISS could issue a negative vote recommendation on a company’s say on pay proposal, which can significantly affect vote outcomes.

A component of ISS’s quantitative analysis is the Multiple of Median (MoM) analysis, which measures a CEO’s 1-year total pay relative to the ISS peer group median CEO total pay. Starting in 2020, ISS now includes in its proxy research reports a 3-year MoM of CEO pay solely for informational purposes. The 3- year MoM is a measure of long-term pay on a relative basis.

The Survey asks respondents to identify whether ISS’s quantitative pay-for-performance assessment should include a longer-term perspective (e.g., a 3-year assessment) of CEO pay amounts by choosing among the following responses:

- Yes, a longer-term perspective is relevant and would be helpful

- No, the most recent year’s CEO pay is the relevant measure for the quantitative model

- Other

Meridian Comment. ISS appears to be considering whether to adopt a 3-year MoM analysis as an additional test in its quantitative pay-for-performance assessment.

Adjustments to In-Flight Long-Term Incentive Awards

Currently, under ISS’s latest policy guidance related to the COVID-19 pandemic, ISS will generally view negatively any changes to in-flight long-term incentive (LTI) awards, particularly for companies that exhibit a quantitative pay-for-performance misalignment. ISS believes that long-term incentives should cover performance over multiple years and “should be designed to smooth performance over a long-term period and not be altered after the beginning of the cycle based on a short-term market shock.”

In its Policy Survey, ISS notes that some industries continue to incur severe negative economic impacts since the onset of the pandemic more than a year ago. The Survey asks respondents to identify their view on adjustments to in-flight long-term incentive awards for companies incurring long-term negative impacts of the COVID-19 pandemic by choosing among the following responses:

- Mid-cycle changes to long-term incentive programs should continue to be viewed as a problematic response to the pandemic

- Mid-cycle changes to long-term incentive programs may be reasonable for companies that have incurred long-term negative impacts from the pandemic

- Other

Meridian comment. We expect ISS to continue to scrutinize adjustments to in-flight long-term incentive awards in 2022. However, ISS appears to be considering whether to be more lenient towards such adjustments if a company continues to be significantly affected by the COVID-19 pandemic.

Shareholder Proposals Seeking to Implement Racial Equity Audits

Starting in 2021, certain activist shareholders brought shareholder proposals requesting companies to implement third-party racial equity audits.

Currently, ISS does not have a policy on such shareholder proposals. However, ISS has adopted policies on analogous issues. For example, ISS will evaluate, on a case-by-case basis, shareholder proposals requesting that a company report on: (i) pay data by gender, race or ethnicity, or (ii) policies and goals to reduce any gender, race or ethnical pay gap.

The Survey asks respondents to identify their view on third-party racial equity audits by choosing among the following responses:

- Where permissible, most companies would benefit from an independent racial equity audit, whether or not the company has adequate corporate programs addressing racial equity or company-specific racial equity controversies

- Whether a company would benefit from an independent racial equity audit depends on company- specific factors including outcomes and programs

- Most companies would not benefit from an independent racial equity audit

The Survey also asks the respondent to identify which of the following company-specific factors are relevant in indicating that a company would benefit from an independent racial equity audit:

- The company is involved in significant racial and/or ethnic diversity-related controversies

- The company does not provide detailed workforce diversity statistics, such as EEO-1 type data

- The company does not disclose an adequate internal framework/process for addressing implicit or systemic bias throughout the organization

- The company has not undertaken initiatives/efforts aimed at enhancing workforce diversity and inclusion, such as trainings or pay disclosure

- The company has not undertaken initiatives/efforts aimed at offering products/services and/or made charitable donations with a specific focus on helping create opportunity for people and communities of color

- Other

Meridian comment. We expect ISS will adopt a policy to evaluate racial equity audit proposals on a case-by-case basis considering company-specific factors, including workforce diversity and pay outcomes and company initiatives to promote racial equity.

¹ These tests include the Relative Degree of Alignment (RDA) analysis, measuring the degree of alignment between total shareholder return (TSR) and CEO total pay over 3 years compared to ISS-determined peers; the Pay-TSR Alignment analysis, measuring the 5-year historical trend in CEO pay and company TSR; and the Multiple of Median (MoM) analysis, measuring a CEO’s 1-year total pay relative to the ISS peer group median CEO total pay.

* * * * *

The Client Update is prepared by Meridian Compensation Partners’ Governance and Regulatory Team led by Donald Kalfen. Questions regarding this Client Update or executive compensation technical issues may be directed to Donald Kalfen at 847-235- 3605 or dkalfen@meridiancp.com.

This report is a publication of Meridian Compensation Partners, LLC, provides general information for reference purposes only, and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.

www.meridiancp.com