Bob Romanchek

Bob Romanchek

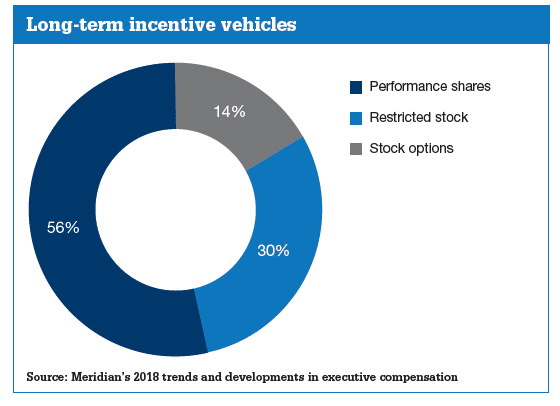

For well over 50 years, there has been the same three general design categories of long-term incentives for US-based CEOs. These have been full-value share grants, which vest over time and focus on retention; stock appreciation vehicles, such as stock options and stock appreciation rights, which focus on driving share price over the long term; and performance-based vehicles, like performance shares or units, which involve the achievement of specific absolute financial measures, or stock performance relative to that of a set of peers, over an intermediate term of three or four years. Most organizations use simultaneous combinations to focus on multiple strategic objectives.

This business strategy, and resulting executive pay philosophy, is the place to start in designing an appropriate long-term incentive program. Attraction and retention, shareholder alignment and focus on clear financial goals are universal strategic design points. And it is possible to combine aspects of the three LTI vehicle categories so that most goals can be effectively addressed with the use of just two vehicles.

In addition to alignment with the current business strategy, additional important considerations include the weighting between vehicles, vesting and employment termination provisions, grant size and resulting share usage and dilution. Technical issues also come into play, including the tax and accounting implications, and the governmental securities filings and required public disclosures.

This leads to the important issue of the reaction of all major constituents – large shareholders, proxy advisory firms, the media, all employees and, of course, the executive participants.

Tools of engagement

However, the most critically important design issue is the type of performance goals and related requirements built into the long-term incentive program. To achieve long-term pay-for-performance, the goals need to be set at levels that require some stretch, yet do not disengage participants by being impossible to achieve.

Although earnings and return-related goals have been perpetually popular, the use of relative total shareholder return (TSR) – stock price appreciation plus dividends – has been the majority LTI performance measure of choice for the past few years. Use of relative TSR has actually levelled off and even ticked downward a bit in recent memory, as some companies have experienced unexpected and misaligned results by having their largest executive pay component determined based entirely upon their stock price performance compared to that of 20 or so unrelated entities. Periods of high stock market volatility only make this worse.

Value for money

So, coupling an absolute company financial goal, such as earnings growth or return on invested capital, with a relative TSR measure is becoming the norm. Also, a noticeable trend exists of using TSR as a modifier of earnings growth results, of maybe ±20%, instead of a baseline measure. This modifier approach can connect the achievement of an important internal financial strategic goal with the actual external stock price growth results, while eliminating the risk that unrelated peer group stock performance dictates the entire payout.

On the fringes, some companies are starting to once again consider operating or free-cash flow goals, to coordinate with measures now proposed by certain proxy advisory firms to enhance or replace purely TSR-based quantitative tests. However, due in part to the complexity in understanding and communicating these cash flow based goals, the prevalence of such incentives has historically remained in the low single digits.

It is also worth noting that a small but increasing number of companies have moved entirely to 100% full-share grants with longer-term vesting – which provides shareholder alignment and perspective, as well as a focus on creating long-term shareholder value.

The bottom line is that designing the long-term incentive program for top executives can be a complex task involving many variables, constituencies and considerations – and requires constant attention to ensure strategic alignment continues.