Jonathan Szabo

Jonathan Szabo

Ryan McDonough

Ryan McDonough

Energy companies, along with the broader public company marketplace, commonly maintain severance protections for executives in the event of termination of employment following a change-in-control, either through an executive severance plan or individual employment agreements. The purpose is to keep executives neutral when evaluating and negotiating a potential deal that might result in the loss of their own employment but is otherwise in the best interest of shareholders. The severance benefits provided under these plans and agreements are quite consistent across energy companies and with the general industry.

Meridian reviewed the CIC severance benefits actually provided to Named Executive Officers (“NEOs”) during M&A events that occurred over the most recent E&P industry consolidation period (affecting approximately 24 upstream companies acquired since 2019) and compared them to the disclosed provisions going into the deal negotiation. We observe that many companies applied minor deviations to their cash severance benefits or treatment of outstanding equity awards during the merger negotiation process.

Companies may make adjustments to pre-established provisions for a few reasons:

• Incentivize getting the deal done – In certain cases, existing severance provisions may not be enough of an incentive to make executives neutral to losing the opportunity to turn performance around or generate additional value as a stand-alone entity. Enhancements to the programs, particularly to outstanding incentive cycles, may help address those concerns and encourage consolidation.

• Address one-off situations – CIC protections and the 280G tax rules that apply to them can be complex with a lot of variables that impact individual situations. At the time of an actual deal, companies have more visibility into the impact on each individual’s situation, so adjustments may be prudent to address unique or unintended outcomes.

While changes made to CIC plans are generally minor, companies typically make adjustments to one of more of the following four areas: Termination-Year Bonus, Cash Severance and/or Outstanding Equity Awards.

Treatment of Termination-Year Bonus

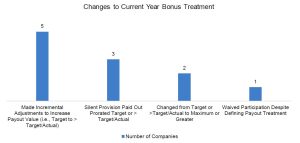

Among cash compensation components, the most prevalent changes were applied to the current-year bonus payout treatment. Eleven companies (46% of the sample) made subtle changes to this benefit. The chart below summarizes the frequency of changes made to the termination-year bonus payout. The magnitude of change varies across companies. Two companies decided to pay bonuses at maximum levels in the year of termination while others made more moderate adjustments such as giving credit for actual performance if it exceeded target.

• Made Incremental Adjustments to Increase Payout Value: Indicates that the company made incremental adjustments to their current year bonus payout, such changing the payout term from target to the greater of target or actual.

• Silent Provision Paid Out Prorated Target or > Target/Actual: Indicates that the company did not disclose treatment of current year bonuses but ended up providing a payout that was equal to target or the greater of target or actual.

• Changed from Target or >Target/Actual to Maximum or Greater: Indicates that the company changed their bonus payout treatment from target to a value equal to maximum or greater.

• Waived Participation Despite Defining Payout Treatment: Indicates that the company forewent receiving their current year bonus payout, despite defining payout terms, in favor of receiving other cash benefits.

Meridian Observation: While providing for a prorated bonus payout for the year of termination is highly prevalent among the general industry, fewer E&P companies have this provision hardwired in their pre-established plan or agreement. Given that this was among the most common deviations included in merger agreement negotiations, companies that do not currently provide for a partial payout may wish to consider adjusting their plans to provide for a partial payout and alleviate the need to haggle over this topic in the midst of deal negotiations.

Cash Severance

Cash severance multiples were largely left alone; however, two companies changed the definitions applied to severance multiples.

• One company changed from defining bonus as “target” to the “greater of target or 3-year average actual.”

• The other company changed from practices that varied among NEOs (including 2-year average actual, target, or highest in last 3 years) to a single practice of the greater of current year or previous year actual.

Meridian Observation: Negotiating adjustments to cash severance definitions or multiples is likely more offensive to the merger partner than other potential changes. Given that severance definitions and multiples are largely consistent across public companies for officer-level roles, there is also little basis for arguing for a more lucrative provision and would also be difficult to sell to shareholders in a “Say on Golden Parachute” proposal.

Treatment of Outstanding Equity Awards

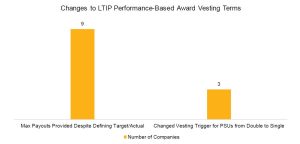

Among long-term incentive components, 12 (50%) of companies applied changes to the performance-based award vesting provisions.

Note that for those that changed PSU vesting trigger from double (CIC event followed by termination of employment) to single (CIC event only), time-based RSUs continued to be subject to double-trigger vesting.

Meridian Observation: Given that there is often a limited number of participants that receive performance-based equity, the incremental shares needed to pay at max are likely not significant or material to the economic terms of a deal and can help reward executives for negotiating a good deal for shareholders. However, hardwiring a max payout for a CIC-related termination in the original award agreements would likely draw external criticism from proxy advisors and shareholders as this somewhat softens the incentive to negotiate the best deal for the shareholder if there is already an understanding that the executive will receive max PSU payout (and it may be viewed as an incentive to simply “get a deal done”).

Excise Tax Gross-Ups

Only one company provided excise tax gross-ups to all NEOs (only one NEO was originally eligible in this observation). All other companies maintained their “best net” after tax provision providing for whichever benefit was better for the recipient on an after-tax basis (i.e., the full formulaic severance and benefits amount or an amount cut-back to avoid a tax imposition).

Meridian Observation: Excise tax gross-ups completely evaporated from CIC-severance plans and employment agreements over a decade ago under the pressure of proxy advisors and shareholders, and are now viewed as an “egregious” pay practice by proxy advisors leading to an automatic “against” Say on Pay vote recommendation (other than in legacy arrangements, which will still garner a negative comment). Adopting excise tax gross-ups in a merger agreement can be a polarizing topic. There may be situations where it makes sense for the company being acquired (e.g., a brand-new CEO or several NEOs hired externally whose severance benefits would otherwise be subject to heavy excise tax due to limited W-2 income history with the Company in their CEO or NEO roles). Providing excise tax gross-ups would also likely negatively impact the Say on Golden Parachute vote outcome.

Key Takeaway

It is better that a company ensures that executive CIC-related severance benefits are market competitive and appropriate for its unique situation before it finds itself in the throes of a merger negotiation. This will help ensure that the executive team is retained through the transaction, focused on negotiating the best possible terms for shareholders without being distracted by their own potential loss of employment and income. However, there may be situations where adjustments are appropriate at the time of a deal to address unique or individual circumstances or perceived fairness by those being terminated, as discussed above.