Carrie Guenther

Carrie Guenther

The Survey covers key board governance practices, compensation-related proxy disclosures, and annual and long-term incentive design practices. This information allows companies to benchmark their board governance practices, proxy disclosures and compensation program design against market practices.

Highlights of Meridian’s 2020 Corporate Governance & Incentive Design Survey

■ Governance Practices

― Corporate Responsibility. 64% of the Meridian 200 disclose internal tracking of long-term sustainability or climate change goals. Additionally, 76% of the Meridian 200 reference a Corporate Responsibility Report in their most recent proxy.

― Board Diversity. Fully 94% of Meridian 200 companies directly address current board member diversity (i.e., ethnicity or gender) in their proxy filing, up from 87% in 2019. All Meridian 200 companies have at least one female board member, with just over one-half (51%) disclosing more than 30% female board members representation. Details on ethnicity and other diversity representation on boards are just starting to appear in some public filings.

― Skill Matrix. 70% of the Meridian 200 companies include a skill matrix in their proxy statement detailing outside directors’ key areas of expertise.

― Mandatory Retirement Age. 70% of Meridian 200 companies disclose a mandatory age policy for board members. Since 2015, the mandatory retirement age of 75 has increased in prevalence from 25% to 38%, while the mandatory retirement age of 72 has decreased in prevalence from 57% to 45%.

― Independent Board Chair. 53% of the Meridian 200 companies separate the Board Chair (CoB) and CEO role. Of those companies that separate the roles, a strong majority (73%) elect an independent director as CoB, but a recent trend toward Executive Chairs has also emerged.

■ Proxy Disclosures

― COVID-19 Disclosure. The majority of Meridian 200 companies filed their proxies prior to or during the early stages of the COVID-19 outbreak and therefore, did not disclose any significant compensation actions taken in response to the pandemic. However, 14% of companies (primarily later filers) discussed COVID-19 in the context of executive and/or director compensation. The most prevalent disclosed action taken was to reduce base salary of one or more NEOs (41%).

― Compensation-Related Shareholder Proposals. Only 9% of Meridian 200 companies’ 2020 proxies included one or more compensation-related shareholder proposals. Of these proposals, the most prevalent related to gender pay gap (22%) and employee diversity/pay or human capital policies (22%).

― Shareholder Outreach. 85% of Meridian 200 companies disclosed shareholder outreach efforts, with almost one-half (42%) providing specific detail on feedback received, number of major institutional investors that were contacted and/or actions taken.

■ Annual Incentive Plan Design Practices

― The most prevalent performance metrics continue to be Operating Income, Revenue, Cash Flow and Earnings per Share (EPS).

― Use of EVA continues to be a small minority practice (2%).

- In 2020, ISS replaced GAAP financial metrics with EVA to determine the quantitative test “modifier” (i.e., Financial Performance Assessment). Meridian has not observed an increase in the use of EVA in executive incentive plans because of the ISS change.

― 17% of the Meridian 200 include ESG metrics as a weighted corporate performance metric in their annual incentive plans, and we expect that number to grow.

- For purposes of this survey, ESG includes safety, environmental and diversity & inclusion metrics but does not include other operational metrics such as customer satisfaction.

― As economic uncertainty continues, we are likely to see some companies consider changes to 2021 annual incentives, including the addition of non-financial measures and incorporating the use of informed discretion.

■ Long-Term Incentive Plan Design and Vehicle Mix Practices

― 97% of Meridian 200 companies grant performance-based vehicles as part of their long-term incentive plans (most often Performance Share Units or PSUs), with cumulative performance measurement (typically 3 years) continuing to be the most prevalent (88%).

― The 2020 average mix of LTI awards for CEOs changed little from 2019, with the majority of LTI mix comprised of performance-based full value shares/units (61%) and the remainder of the LTI mix comprised of service-vesting full value shares (21%) and stock options (18%).

― Relative Total Shareholder Return (rTSR) continues to be the most prevalent (70%) metric in performance-based LTI plans with a trend toward increased use as a payout modifier (27% prevalence) versus a weighted component (75% prevalence).

- In light of ongoing economic uncertainty caused by COVID-19, rTSR (and other relative metrics) may have a more prominent role in 2021 PSU designs as companies become frustrated with the effectiveness of multi-year financial goals. We may also see temporary shifts in equity award mix (with decreasing emphasis on performance-based awards) as well as alternative structures with shorter performance periods as companies face heightened goal setting challenges.

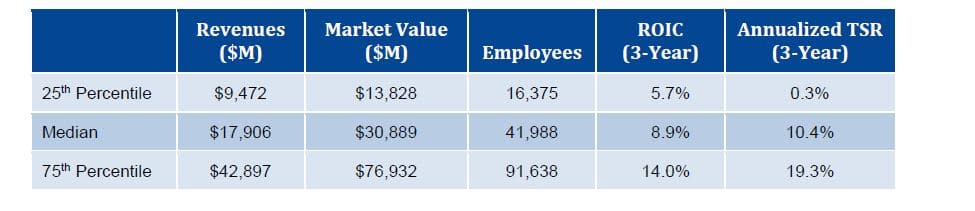

The table below shows key statistics of the Meridian 200 companies. All figures shown are as of the end of fiscal year 2019.

Full survey results can be downloaded from Meridian’s website, www.meridiancp.com. This Survey was authored by Carrie Guenther and other consultants of Meridian Compensation Partners, LLC. Questions and comments on the Survey should be directed to Ms. Guenther at cguenther@meridiancp.com or (847) 235-3622.

* * * * *

The Client Update is prepared by Meridian Compensation Partners’ Technical Team led by Donald Kalfen. Questions regarding this Client Update or executive compensation technical issues may be directed to Donald Kalfen at 847-235-3605 or dkalfen@meridiancp.com.

This report is a publication of Meridian Compensation Partners, LLC, provides general information for reference purposes only, and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.

www.meridiancp.com